Appendix 2: Advanced or Postponed Wage Payments?

© Ernesto Screpanti, CC BY 4.0 https://doi.org/10.11647/OBP.0182.08

Marx normally defines the profit rate as r=S/(C+V), which implies wages are paid in advance. Then, the matrix equation for prices is:

p1 = (1 + r)wl + (1 + r)p1A(A4)

On the other hand, he declares unequivocally that

in every country in which the capitalist mode of production reigns, it is the custom not to pay for labour power before it has been exercised for the period fixed by the contract, as for example, the end of the week. In all cases, therefore, the use value of the labour power is advanced to the capitalist: the labourer allows the buyer to consume it before he receives payment of the price; he everywhere gives credit to the capitalist (Marx 1996, 184).

In several occasions, Marx insists on the observation that “the labourer is not paid until after he has expended his labour power” (567) and that, despite the common view that “the capitalist, using the jargon of political economy, advances the capital laid down in wages, […] as a matter of fact the reverse takes place. It is the labourer who advances his labour to the capitalist” (1997, 219).

When wages are postponed, they are not capitalised, and the correct equation for price determination is the following:

p2 = wl + (1 + r)p2A(A5)

Marx also thinks that a distorted point of view lurks behind equation (A4): “since [the capitalist] pays after the labour has lasted for days, weeks, or months, instead of buying it and paying for the time which it is to last, the whole thing amounts to a capitalist quid pro quo, and the advance which the labourer gives to the capitalist in labour is turned into an advance of money given to the labourer by the capitalist” (219). The “jargon of political economy” is based on such a quid pro quo: a blunder or misunderstanding resulting from turning one notion (advanced payment) into another (postponed payment).

Marx puts forward this criticism because he thinks the opinion that wages are advanced is an ideological deformation of reality, aimed at mystifying the social conditions of capitalist exploitation. It makes the payment of wages appear as the buying of a produced commodity, whilst, in reality, it is payment for the worker’s relinquishment of his freedom and his labour capacity to the capitalist.

What the capitalist buys is the temporary right to dispose of labour capacity, he only pays for it when this labour capacity has taken effect, objectified itself in a product. Here, as in all cases where money functions as means of payment, purchase and sale precede the real handing over of the money by the buyer. But the labour belongs to the capitalist after the transaction, which has been completed before the actual process of production begins. The commodity which emerges as product from this process belongs entirely to him. He has produced it with means of production belonging to him and with labour he has bought and which therefore belongs to him, even though it has not yet been paid for […]. The gain that the capitalist makes, the surplus value which he realises, springs precisely from the fact that the labourer has sold to him not labour realised in a commodity, but his labour capacity itself as a commodity. If he had confronted the capitalist in the first form, as a possessor of commodities,1 the capitalist would not have been able to make any gain, to realise any surplus labour, since according to the law of value exchange is between equivalents, an equal quantity of labour for an equal quantity of labour. The capitalist’s surplus arises precisely from the fact that he buys from the labourer not a commodity but his labour capacity itself, and this has less value than the product of this labour capacity, or, what is the same thing, realises itself in more objectified labour than is realised in itself. But now, in order to justify profits, its very source is covered up, and the whole transaction from which it springs is repudiated […]. We are now told that the labourer has sold his share in the product to the capitalist before it has been converted into money (1989a, 212–3).

Nonetheless, in most of his analyses, Marx defines the rate of profit as r=S/(C+V). He states that, “for a clear comprehension of the relation of the parties”, he “provisionally” (1996, 185) assumes the wage is advanced; and admits that, by doing so, he proceeds “according to the usual way of reckoning” (227), thus complying with “the jargon of political economy”. In reality, this assumption is not so provisional.

What are the reasons for the “usual way of reckoning”? One might be that equation (A4) represents the common practice of price fixing followed by firms; normal prices are determined by applying a gross mark-up to direct costs, C+V. Then, as I argued in chapter 5, equation (A4) holds independently of whether wages are advanced or postponed, but simply because it corresponds to the procedure by which firms fix prices. Price fixing, however, implies that markets are not perfectly competitive. When competition is assumed–as done by Marx, following Smith and Ricardo–market prices are not fixed by firms, but are determined by the forces of demand and supply. If the market process is stable and wages are postponed, market prices must gravitate around the production prices represented by equation (A5), not equation (A4).

Another reason for the “usual way of reckoning” could be that in many sectors (e. g. agriculture), the length of the production process (one year) is longer than the length of the sub-period for wage payment (a day, a week or a month). Therefore, even if paid at the end of the day, the week or the month, wages are advanced by capitalists during the production process and thence must be capitalised at the end of the year. This observation, however, does not justify equation (A4).

In fact, suppose the annual wage, w, is post-paid in T sub-period instalments during the production process, the length of the wage payment sub-period being 1/T of the length of the production process. The sub-period wage is w/T. The annual factor of profit is 1+r=(1+i)T, where i is the sub-period rate of interest. As shown by Steedman (1977, 103–4), prices are determined as:

Since ,

it is

(A6)

which is equal to (A5) when T=1. Now, a real economy involves production processes of different lengths. Some of them are longer than the wage payment period, while others are shorter. In abstract theory, this difficulty is overcome by assuming that all production processes, as well as the wage payment period, have the same length. Then, the question is whether (A4) or (A5) is more plausible in this idealised economy. The answer is: the most plausible is the one that better approximates equation (A6).

Steedman (1977, 105) proves that (A5) gives a good approximation for low profit rates. The degree of approximation weakens when r rises. Steedman’s result can be generalised. It can be proved that equation (A5) always provides a better approximation than (A4).

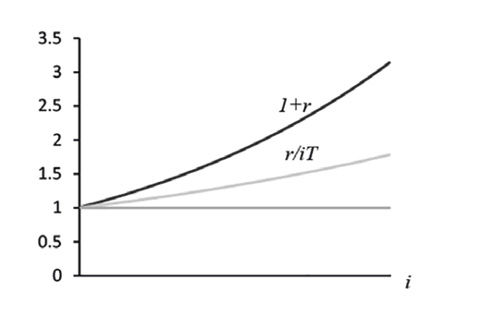

Figure 2 shows the behaviour of 1+r and r/iT for T=12 and i∈[0.001, 0.1]. It is evident that (1+r)–r/iT>r/iT–1, which is the condition under which the full wage post-payment equation yields a better approximation than the full wage pre-payment equation.

Figure 2

More generally, Lonzi, Riccarelli and Screpanti (2017) prove that

Whatever the period of wage payments and whatever the interest rates, the equation with postponed wages approximates (A6) better than the equation with advanced wages.

1 According to an ideology I recalled in note 1 of the Conclusions, these commodities could be conceived as a series of labour services.