3. Funding and Financing Infrastructure: Indonesia and Australia

© C. F. Duffield, R. Duffield, and S. Wilson, CC BY 4.0 https://doi.org/10.11647/OBP.0189.03

3.0 Introduction

Funding and financing remain a major hurdle for delivering planned infrastructure projects in Indonesia. While the Government of Indonesia has increased their spending, significant amounts of foreign investment will be required to fill the financing gap. Countries like Australia also face continuing challenges to fund their infrastructure ambitions. However, for the right project, they appear to be able to attract international finance.

As mentioned earlier in Chapter 1, growth centres and infrastructure development are considered the main building blocks of the proposed Indonesian economic corridors. As such, ICT and transport infrastructure improvements in roads, seaports, airports, water, energy, power and social needs are critical. The Indonesian Government has estimated that it will only be able to provide approximately 35% of funds required and that local and international finance is being sought to participate in infrastructure investments via the use of Public Private Partnerships (PPPs) as alternative sources of development financing.

This chapter seeks to establish the current mechanisms adopted for infrastructure finance in Indonesia and Australia, and to establish the likely success of the more commonly available financing mechanisms for any given situation. More specifically, the research seeks to identify which investment strategies and options facilitate project initiation that attracts international engagement. It draws on recent international literature, the outcomes from a major survey, focus group meetings, interviews of key professionals in Indonesia and Australia, and specific case study examples from both countries. The qualitative investigation concentrates on the needs and reflections for port developments in both countries and uses the Port sector to draw examples to amplify the financing mechanisms under discussion.

The chapter is structured as follows: first, it critiques a range of scenarios for private investment; second, it identifies the actual investment mechanisms being used in both countries; and, finally, it explores the strengths and weaknesses of the alternatives for specific projects.

3.1 Potential Sources of Infrastructure Financing

Emerging nations appear to have more options for funding and financing projects than exist for developed nations. This is due to potential investment from foreign aid, as well as the desire of economically strong countries to expand their influence into emerging economies and thus gain a strategic commercial footing for future growth. The range of financing scenarios considered are:

- Direct financing out of government budget. Direct financing comes from the investors’ corporate internal budget if internal procedures permit. It may include debt financing, but such loans are secured at an organisational level rather than at project level.

- Direct company facilitation — potentially with expanded business model that incorporates supply chain integration, e.g. industrial zone adjoining port facilities.

- Foreign Direct Investment, inter‐country grants or loans e.g. World Bank, Asian Development Bank (ADB), Japan International Cooperation Agency (JICA).

- Public Private Partnerships (PPPs) in a variety of broad categories: (a) user charge like toll roads; (b) availability PPP payments (these PPP are generally facilitated through transactional processes, but they are also sometimes developed by a direct approach from the private sector).

- Special Economic Zones or preferential concessional loans.

- Asset recycling — leasing. Asset recycling is a technique where capital tied up in long-term assets can be freed up for new investment by releasing the contract of an asset, for a period of time, for payment. In so doing the revenue generated from the asset is foregone for the term in lieu of an upfront payment.

- Privatisations are mentioned but due to their unpopularity in both countries they are not considered in detail in this chapter.

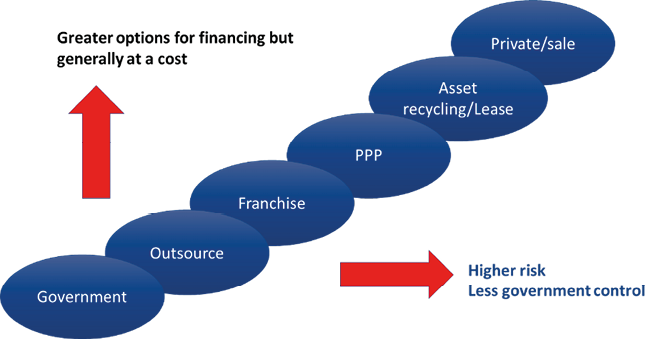

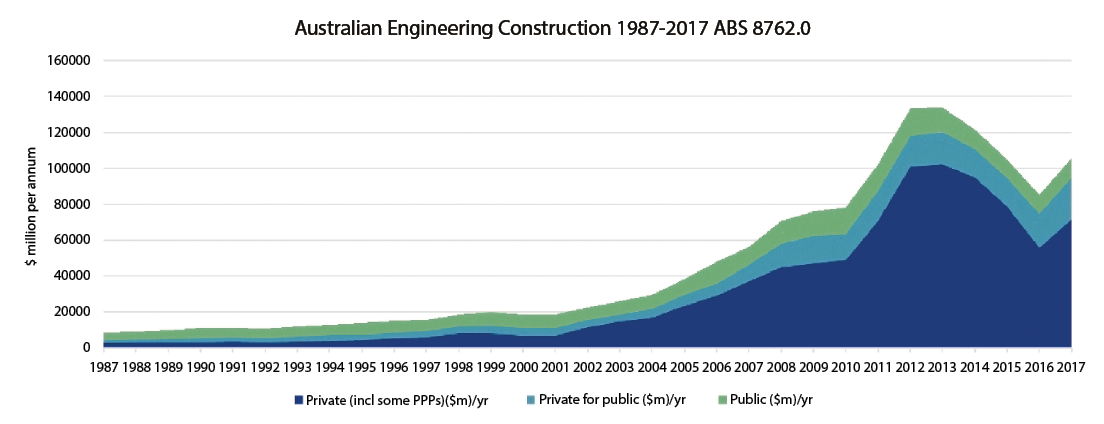

Each financing option carries a greater or lesser opportunity for private sector involvement. Direct government investment — whether by internal investment, the use of special economic zones or via engagement with other countries — places control within government, which also brings the responsibility to facilitate solutions. If government ownership is relaxed, a range of options emerge that may attract international finance (refer to Fig. 3.1), although these options bring differing levels of control, costs and risk profiles. It is worth noting that over the last thirty years in Australia, the balance of publicly controlled infrastructure construction compared with private investment has swung considerably to the private sector. This is due to mining expansions, asset sales and the use of Public Private Partnerships (Fig. 3.2).

Fig. 3.1 Increased opportunity for private sector finance (Figure by the authors)

Fig. 3.2 Private versus public engineering construction in Australia (Figure by the authors)

Specific sources of finance differ depending on the facilitation mechanism adopted. Preferred mechanisms for raising finance in Indonesia and Australia are discussed later in this chapter. Firstly, however, some specific consideration of the financing scenarios focused on are considered.

3.2 Discussion of the Specific Financing Scenarios

3.2.1 Direct Governmental Financing

As mentioned previously, all countries have infrastructure plans that exceed their budgetary capacity. This has necessitated a range of alternative approaches and it is in the broader approaches that divergence between individual countries becomes evident.

As a Federation of States, Australian governments attract revenue from a variety of sources. At a federal level, taxation from individuals and entities is the primary source of revenue, whereas specific states generate revenue as duties, fees and royalties and receive distributions from the Federal government, and, from time to time, specific grants and/or co-funding for major infrastructure projects. States and Territories in the main have primary responsibility for the direct provision of infrastructure with the Federal government retaining responsibility for matters of national importance. The Australian Government and State and Territory Governments commit to infrastructure investments via their budgetary processes and much attention has been placed on developing detailed business cases to assist in prioritising projects for investment. Long-term strategic infrastructure planning is undertaken both within government departments and agencies, and by so called ‘I’ bodies like Infrastructure Australia and Infrastructure New South Wales.

The choice of ownership model and arranging specific project finance is in the control of the delivering government. The financial markets in Australia are mature, with regulation regarding foreign investment, consumer protection and banking regulations being managed at the federal level. While it is hard to specifically quote the need for infrastructure, based on Infrastructure Australia’s 2018 priority list of projects, there is an immediate need for development of ninety-six projects at an estimated cost of some AUD 55 billion. This call for funds far outstrips the approximate AUD 13 billion available capital for projects per annum.

Like Australia, Indonesia has three levels of government, all with specific responsibility for the provision of infrastructure. However, control of procurement of infrastructure and investment decisions tend to be driven top down from the Indonesian Government. This system has the advantage of consistency but often faces the burden of a long and protracted democratic process to gain support for major investment decisions. Being an emerging economy, the revenue base in Indonesia is smaller than for Australia. Nonetheless, long-term planning of infrastructure is managed by its planning agency Bappenas and complemented from time to time by direct intervention from the President via agencies such as KPPIP who assist in developing and accelerating a plan of priority infrastructure projects.

Bappenas details its infrastructure forecasts in the ‘Blue book’. In the 2017 Blue Book there was a forecast requirement of some USD 35 billion over the four-year projection, this is again well in excess of the available budget of approximately USD 9 billion over the same period.

Several funds and financial entities have been established by the Indonesian government and their Ministry of Finance (MoF) to facilitate financial support for infrastructure projects. These are outlined below.

3.2.1.1 Indonesia Infrastructure Guarantee Fund (IIGF)

The IIGF, also known as PT PII, was established by the Government of Indonesia as a State-Owned Enterprise (SOE) under the Ministry of Finance (MoF) in December 2009.

The IIGF provides guarantees for the financial obligations of the Government Contracting Agency (GCA) under a Contracting Agency, Ministry, Regional government, State Owned Enterprises or Public Private Partnership (PPP) contract to mitigate contractual risks stemming from the government’s actions and inactions. These include breach of contract by the GCA, delays in obtaining permits/licenses, changes in the law, and so forth.

The entity provides government guarantees or credit enhancements only to PPP projects that are financially feasible. Providing guarantees will leverage private investments in infrastructure projects. As the fund’s capital is still limited, the guarantees are backed up by co-guarantors, including the World Bank (WB) (supporting since September 2012), as well as by the MoF when necessary. An objective of the IIGF is to improve transparency and governance on guarantee provisions (Indonesia infrastructure guarantee fund 2017).

3.2.1.2 PT Sarana Multi Infrastruktur (Persero) (PT SMI)

PT SMI was originally set up as a non-bank financial institution (infrastructure financing institution) established by the Government of Indonesia in February 2009 and wholly owned by the Ministry of Finance (MoF). The institution provides alternative sources of project financing by working with stakeholders to obtain appropriate financing solutions for infrastructure projects.

PT SMI promotes PPPs in financing infrastructure projects in Indonesia. It acts as facilitator and catalyst for infrastructure development in Indonesia, including the promotion of the Public Private Partnership scheme and funding activities in various infrastructure-related sectors in the form of debt, equity and mezzanine financing.

For PPP projects, PT SMI has mainly acted in an advisory role at the project preparation stage (PT Sarana Multi Infrastruktur (Persero) 2017).

3.2.1.3 Indonesia Infrastructure Finance (PT IIF)

PT IIF was established by the MoF through PT SMI in 2010. It is an infrastructure financing company, majority privately owned. It is funded through equity participation by PT SMI, the Asian Development Bank (ADB), the International Finance Corporation (IFC), the Deutsche Investitions-und Entwicklungsgesellschaft mbH (DEG) and Sumitomo Mitsui Banking Corporation (SMBC), and subordinated loans from World Bank and the Asian Development Bank (PT Indonesia Infrastructure Finance 2019; KPMG Indonesia 2015).

PT IIF focuses on commercially viable infrastructure projects and offers fund-based products (e.g. long-term financing in IDR), non-fund-based products (e.g. guarantees), and fee based services (e.g. syndication) (PT Indonesia Infrastructure Finance 2019).

3.2.1.4 Viability Gap Fund (VGF)

The VGF was recently established on the basis of MoF Regulation no. 223 of 2012 and contributes a part of the construction cost of well-prepared PPP projects in the form of cash to enhance the project’s financial viability (ERIA 2014 March; Ministry of Finance Republic of Indonesia 2016).

3.2.1.5 Land Funds

The Government of Indonesia has several forms of land funds for land acquisition or clearance. For instance:

- Land capping fund — provides compensation for toll road investors against a significant increase in land prices.

- Land Revolving Fund — temporarily covers land acquisition costs for toll road projects, to be reimbursed by the project’s investors

- Centre for Government Investment (PIP) — under the Ministry of Finance — prepares Pre-financing for land acquisition.

It is concluded that, regardless of the sound initiatives implemented by either Australia or Indonesia, there remains a gap between the available funds for infrastructure investment and the critical needs identified.

3.2.2 Direct Company Facilitation

Direct investment by companies is an excellent solution where control and regulation of the investment decision is dictated by the market and a company’s view on the risk — return trade off. Exhibit 3.1 provides an example of direct company facilitation in Indonesia. Attraction of company facilitation of infrastructure development becomes a Business to Business transaction and such arrangements are best arranged using standard international commercial principles. These principles and business practices provide companies with a mechanism where they can balance their strategy with forecast current and future returns on their investments. Confidence in such transactions transcends specific in-country requirements, provided that companies have confidence that sovereign risks will not emerge, that a specific country has a stable and peaceful economy and that business is conducted using sound governance practices.

The strong private investment in infrastructure experienced in Australia, refer to Fig. 3.2, has been underpinned by substantial private sector business investment.

|

Exhibit 3.1 Example of Direct Company Facilitation for Port Development in Indonesia PT Terminal Teluk Lamong, a subsidiary of PT Pelabuhan Indonesia III (Persero), was built as a development from Tanjung Perak Port. Equipped with ecofriendly and semi-automatic equipment, PT Terminal Teluk Lamong serves as the best solution to reduce density and accelerate the process of distributing goods flows especially from and to the Eastern Indonesia region. PT Terminal Teluk Lamong serves loading and unloading container and dry bulk services. Through the availability of modern equipment, Terminal Teluk Lamong is able to drive and boost the economy in Indonesia. |

3.2.3 Foreign Direct Investment (FDI)

Emerging nations generally enjoy support from wealthier countries by way of foreign aid, grants and preferential loan schemes that are granted on humanitarian grounds, foreign trade support and from time to time to seek alignment of a country for specific purposes such as resolutions within the United Nations. The schemes of arrangement vary from donations, “trade for aid” arrangements, and aid for commercial support of the donating country, to long-term loans that are provided with an expectation that the loans will be repaid in the future. Current commitments to Indonesia under such schemes add to some USD 12 billion which is inclusive of funds provided by the World Bank, ADB,4 JICA,5 IFAD,6 Exim Bank and aid from countries such as: Korea, Germany, Hungary, Spain, Australia, and the UK. This foreign support, whilst welcomed, nonetheless does not bridge the funding gap for infrastructure. In the context of specific Indonesian investment, in ports, the following exhibits 3.2 and 3.3 provide a range of typical styles of support provided.

|

Exhibit 3.2 Examples of Foreign Direct Investments Available for Port Development in Indonesia World Bank In May 2015, the President of the World Bank, Jim Yong Kim, announced that the institution would support Indonesia’s maritime development plans by providing both advice and funding. The World Bank plans to work with public and private stakeholders while contributing up to USD 12 billion over the next three to four years towards projects which will improve maritime logistics and connectivity, such as upgrades to seaports and access roads (The World Bank 2015). |

|

ASEAN Infrastructure Fund (AIF) and Asian Development Bank (ADB) In order to address the infrastructure investment needs of the ASEAN region, member countries of ASEAN together with the Asian Development Bank (ADB) established the ASEAN Infrastructure Fund (AIF) in 2011. Supported by 10 shareholder nations and the ADB (Asian Development Bank 2016a), the AIF is expected to provide up to USD 300 million in loans per year for regional projects involving the development of roads, railways, power, clean water supply and other critical fund power upgrades in Indonesia (Asian Development Bank 2013, December) and since then at least three other projects in Indonesia have been approved to receive joint funding from the AIF and ADB (Asian Development Bank 2016b). |

|

Asian Infrastructure Investment Bank (AIIB) Established by China in October 2014, the Asian Infrastructure Investment Bank (AIIB) is an alternative to the World Bank and Asian Development Bank aimed at improving regional cooperation and connectivity through infrastructure development. In June 2015, Indonesia joined the twenty other nations who are part of the USD 50 billion bank, providing opportunity for investment in its infrastructure (Meharg et al. 2015). |

|

Silk Road Infrastructure Fund In November 2014, the President of China, Xi Jinping, announced that China would contribute USD 40 billion to establish the Silk Road Fund as a part of its Silk Road Economic Belt and 21st Century Maritime Silk Road Initiatives. This funding source was refined to the ‘Belts and Road’ initiative announced in 2016. The fund is supported by investors such as the China Development Bank, the Export-import Bank of China and China Investment Corporation (Silk Road Fund 2016) and has already invested in its first project (Jia 2015). Implications of the Maritime Silk Road for Indonesia are discussed above and Xi Jinping has pledged to sponsor Indonesian maritime projects through both the Silk Road Fund and the AIIB (Tiezzi 2015). |

|

Exhibit 3.3 Examples of Specific Country Support for Port Development in Indonesia Japan Due to rising labour costs in China and tension over territorial disputes, Japan is increasingly shifting its investment to the ASEAN region (Piesse 2015). In 2014, President Widodo called upon Japan to invest in infrastructure in Indonesia, and Kishida, the then Minister for Foreign Affairs of Japan, agreed to provide support for Indonesia’s maritime development plans (Purnamasari 2014). A report into Indonesia’s development and Japan’s cooperation noted that “eight out of a total of 28 gateway ports in Indonesia, 12 non-commercial ports in eastern Indonesia, and 10 ferry ports across the country were developed” (JICA 2018). |

|

China With their complementary development plans, Indonesia and China have agreed to develop a “maritime partnership”. China has promised to encourage Chinese firms to invest in Indonesian infrastructure and the government also intends to provide funding to Indonesian projects through the AIIB and Silk Road Fund (Tiezzi 2015). |

|

Australia Commercial, trade and political ties are strengthening between Australia and Indonesia. As a part of Indonesia Australia Business Week in December 2015, the then Australian Minister for Trade and Investment, Andrew Robb, led a program involving 360 Australian business people aimed at encouraging increased investment, trade and business links with Indonesia (Robb 2015). The Indonesia-Australia Comprehensive Economic Partnership Agreement currently under negotiation is also likely to deepen the Australian Indonesian relationship and enhance bilateral trade and investment). As stated by Andrew Robb, “when you deepen trade and commercial ties, new investment inevitably follows”, and Australia has expertise to offer Indonesia in the field of infrastructure (Robb 2015). |

3.2.4 Public Private Partnerships

In the broadest definition Public Private Partnerships (PPPs) are arrangements that involve the private sector in the delivery of service outcomes expected of public infrastructure. Such arrangements generally involve the construction of major infrastructure. The capital required for this investment is at least partially provided by private finance through the facilitation of debt and equity arrangements.

In Australia, PPPs have enabled the acceleration of both economic and social infrastructure projects over the last twenty-five years. Considering the most populated states of New South Wales (NSW) and Victoria, in excess of seventy-five large projects have been undertaken as PPPs to a value in excess of AUD 85 billion. These projects have always been arranged as hard money, high risk transfer commercial contracts with long-term concessions deeds ranging from seven years to over thirty years in duration. These PPPs account for approximately one third of the major project investments undertaken over the period, and the services provided have helped establish best practice in the industries where the model is used. Typically, economic infrastructure such as road and water treatment facilities have been structured on a user charge mechanism, whilst social infrastructure projects such as hospitals and schools have used a term payment mechanism provided by the government, known as an availability payment.

Attempts to use similar commercial contract-based PPPs have been less successful in Indonesia. Some excellent outcomes have been achieved by the Independent Power providers in the provision of power stations and there were early examples of toll roads. The toll roads have been criticised for their commercial structuring, and it has been difficult to arrange long-term private finance for other transactions brought to the market. Schemes such as the West Semarang Drinking Water supply project have relied heavily on viability gap funding and infrastructure guarantees to facilitate a bankable transaction. The Umbulan Springs Water Supply project is another PPP project in Indonesia that has recently been contracted after considerable support from government and foreign assistance to overcome funding gaps and concerns regarding the proposed risk transfer and governance arrangements.

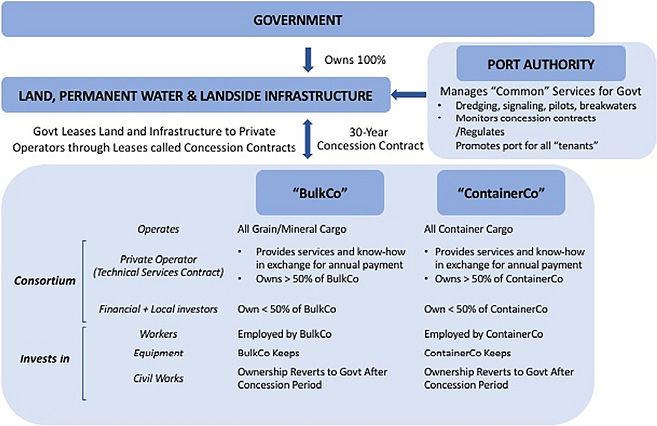

In the context of Ports, Indonesia has successfully used the Landlord PPP model (Fig. 3.3) described by the World Bank7 at Tanjung Priok in Jakarta. This landlord PPP model has facilitated the joint venturing of Hutchinson Ports and Pelindo II (a government agency) to reform the operations and efficiency of the Jakarta International Container Terminal at Tanjung Priok. The ownership control remains with government while gaining operational excellence from a private operator.

Fig. 3.3 Landlord Port Model (Figure by the authors based on the World Bank resource, https://ppp.worldbank.org/public-private-partnership/library/landlord-port-structure-graph-pdf)

3.2.5 Special Economic Zones or Preferential Concessional Loans

The concept of governments attracting foreign investment through the provision of zones with special, investor-friendly regulatory and tax concessions is not new, yet such approaches do not always achieve their strategic objective. In 2017, Indonesia announced a major strategy to attract foreign investment using special economic zones (SEZs) with specific industrial foci. Their locations are detailed in Fig. 3.4. Of these SEZs, the first three proposed zones are Mandalika, Maloy Batuta Trans Kalimantan, and Palu.

Fig. 3.4 Proposed new Indonesian Special Economic Zones. Source: Indonesia Investments 2017, https://www.indonesia-investments.com/business/business-columns/indonesia-seeks-to-develop-more-special-economic-zones/item7962?

One of the first SEZs developed in Indonesia was Batam. The strategy adopted for this investment was based primarily on its proximity to Singapore rather than its inherent strategic advantage. The new SEZ locations are far more strategically located, although the findings from a 2013 comparison of SEZs in Indonesia, Malaysia, Thailand and China by Wahyuni (2013) concluded that there is no universal ‘cookie-cutter’ approach to tackle development problems, since experiences, situations and practices differ dependent on the local context.

This message equally holds true for Australia’s Northern Australian Infrastructure Facility established in 2016.8 The objective of this facility was to attract business to the north of Australia through the provision of concessional loans. Mandatory criteria for the proposed project to be eligible for financial assistance are as follows:9 the project must involve the construction or enhancement of Northern Australia economic infrastructure; it must be of public benefit; it must be located in, or have a significant benefit for, Northern Australia; the loan provided must be repaid or refinanced; and there must be an Indigenous engagement strategy. Unfortunately, the uptake of the concessional loan arrangement was very slow, necessitating a revamp of arrangements in 2018. On discussing the viability of these concessional arrangements with industry it became evident that, first and foremost, companies make their investment decisions based on the risk return equation over the long-term. Concessional arrangements were secondary considerations.

3.2.6 Asset Recycling

In the 2014–2015 Australian budget a policy to stimulate asset recycling was launched. Asset recycling is a mechanism to forward sell the revenue stream of an asset, generally under the terms of a long-term lease, thus releasing the long-term capital locked in the value of an asset to working capital that can be used to invest in new initiatives. The asset recycling transaction resembles a sale whereby the government values its asset and the time discounted value of the revenue stream and commits to enter a long-term lease of the facility should the private sector offer a price and terms deemed to enhance the government’s position should it retain the asset. The Australian policy sought to stimulate more asset recycling initiatives by states and territories by incentivising successful asset recycling arrangements with a 15% bonus of the price received to further stimulate investment in infrastructure. The scheme closed in 2016.

Major facilities for which the management and stewardship of the assets changed as a result of the asset recycling program are detailed in Table 3.1.

Table 3.1 Major Australian asset recycling transactions (Table compiled by authors from various publicly available websties and data sources relating to the facilities)

|

Facility |

Term of the agreement |

Consideration (AUD) |

|

Port of Melbourne (Vic) |

50 years (transaction 1 Nov 2016) |

9.7 billion |

|

Poles and wires — electrical network (NSW) |

99 years |

34.1 billion |

|

Port Botany and Port Kembla |

99 year (31 May 2013) |

5.0 billion10 |

|

City Renewal Precinct sites (ACT) |

Sale |

60 million |

|

Darwin Port (NT) |

99 year (Nov 2016)11 |

506 million12 |

|

Port of Newcastle |

98 year |

1.71 billion13 |

|

Port of Brisbane |

99 year |

2.3 billion14 |

The release of the assets detailed in Exhibit 3.3 raised community discussions regarding the sale of strategic public facilities. The direct investment of the proceeds of these sales has underpinned major economic stimulation in the participating jurisdictions, particularly NSW and Victoria. There is strong emerging evidence15 that Customer Focused private sector involvement in public infrastructure enhances outcomes rather than detracting from the services received. Further, it also appears that the involvement of large investment houses has focused port investments on the wider supply chain rather than simply port management.

Asset recycling has not been adopted in Indonesia.

3.2.7 Discussion

When the six investment strategies (presented above) are considered, it is evident that no one solution is appropriate in every situation.

Direct government sponsorship is ideal, but there are insufficient resources for those projects deemed urgent.

Direct company facilitation is effective, although risk aversion by many companies (and their bankers) often means that sound projects cannot raise the necessary finance in a timely manner.

Direct Foreign Investment frequently provides a lifeline in emerging economies yet long-term reliance on arrangements from other countries is not sustainable.

Public Private Partnerships appear to be most successful when executed effectively, but there are many examples where the projects do not attract the required finance, or are questioned for the value they bring.

Special Economic Zones and preferential concessional loans bring much optimism that the arrangements will create a quantum market shift, yet the examples of failure or under performance appear far too common.

Asset recycling provides a mechanism to unlock capital from existing assets, but the approach raises many questions regarding the long-term stewardship of assets and the need for intergenerational equity.

A detailed survey and a series of workshops with industry leaders was undertaken in order to understand how both countries may overcome the lack of finance for infrastructure projects, and how best to prioritise the investment of scarce resources in the port sector. The next section details the collective wisdom regarding financing port infrastructure projects.

3.3 The Market’s View of How Best to Finance Port Infrastructure Projects: Indonesia and Australia

3.3.1 Introduction

To gain an understanding of the actual financing approaches being successfully implemented in Australian and Indonesian ports, a comprehensive sequence of surveys, interviews and workshops were conducted during 2017/18. The detailed method adopted for collection of this data is provided in Appendix 1. Of specific relevance to the funding and financing issues were questions broadly relating to:

- Is there sufficient finance to meet the development demand in a timely manner?

- What are the priority areas requiring investment?

- What are the barriers to doing business in Indonesia or Australia?

- What financing mechanisms have proven popular and successful?

The analysis adopted in this section relies on statistical analysis of the results where Means, standard deviation, ANOVA analyses and F tests for significance have been considered. The results are presented primarily for those findings deemed to be statistically significant.

3.3.2 Do the Current Government Policies Support and Facilitate Investment?

Survey participants in Indonesia and Australia were asked whether the current government policies in their respective countries are supporting and facilitating investment. Interestingly, in Indonesia 82% of respondents (n=45) indicated ‘yes’ — that the government policies in their country support and facilitate investment — whilst 11% indicated they do not and 7% did not know. In Australia only 47% of respondents (n=43) indicated that the government policies in their country support and facilitate investment while 40% said they do not and a further 14% did not know.

3.3.3 Is There Sufficient Finance to Meet the Development Demand in a Timely Manner?

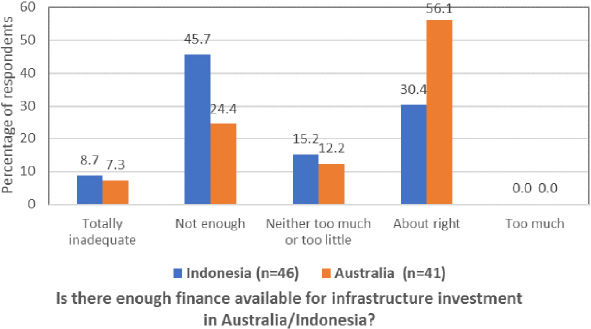

Two fundamental starting questions were: (a) Is there sufficient finance? And (b) Is your port attracting sufficient finance? The results are summarised in Figures 3.5 and 3.6. Unsurprisingly, as seen in Fig. 3.5, nobody thinks there is too much finance available for infrastructure investment, while few people think that too much is being spent on their port (Fig. 3.6). More interesting is the confirmation that Indonesia generally considers there to be a lack of finance, while, in Australia, respondents consider finance is available and adequate (combined (‘neither too much or too little’ and ‘about right’) 68% of respondents Fig. 3.5).

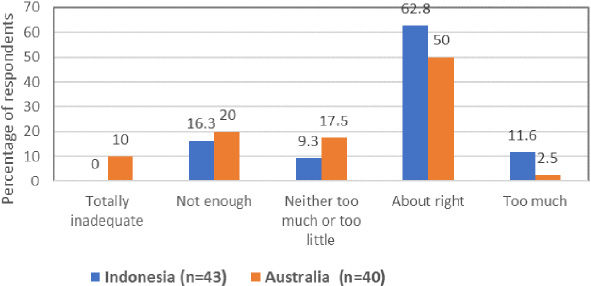

Indonesian respondents tended to consider that their ports were attracting enough finance for infrastructure development (63%) whereas a smaller proportion of Australian respondents shared this view for their ports (50%, Fig. 3.6).

Fig. 3.5 Availability of finance (Figure by the authors)

Fig. 3.6 Port is attracting enough finance (Figure by the authors)

A higher proportion of respondents from Australia felt that the level of administration/control associated with the decision making process for infrastructure projects in their country was ‘too much’ (22.5%, n=40) compared with respondents from Indonesia (4.7%, n=43) whereas more Indonesian respondents felt it was ‘about right’ in their country.

In summary it is concluded that:

- Current government policies are perceived to be supporting and facilitating direct government investment in Indonesia, more so than in Australia where investment is dominated by the private sector.

- Australia seems to have access to finance whereas Indonesia would like more.

- Ports appear to get more attention in Indonesia than in Australia. This is not surprising as the Indonesian President has made port enhancements a priority for the country.

- Some think Australia has excessive administration/control mechanisms.

3.3.4 Priority Areas Requiring Investment

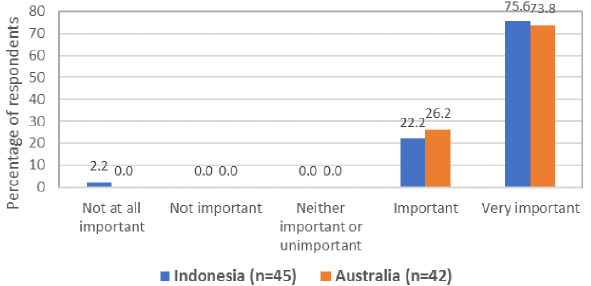

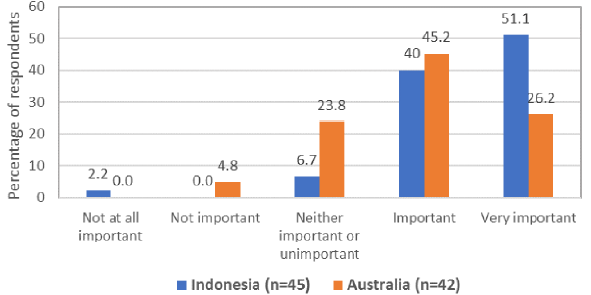

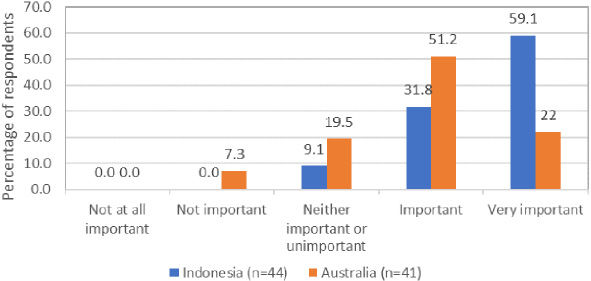

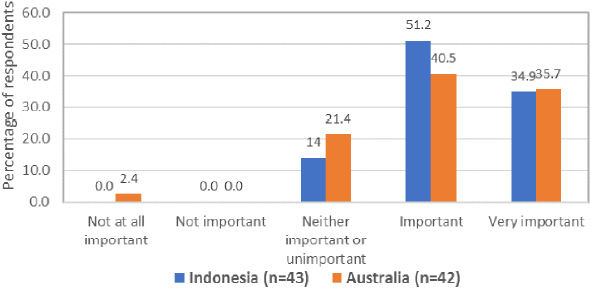

Survey participants were asked to indicate how important it is to make investment decisions in water infrastructure, transport, energy and materials handling to improve ports and the level of importance of developing these areas (Figs. 3.7–3.10). All respondents to the online surveys in Indonesia and Australia agreed that transport improvements are required (Fig. 3.7). Water and energy appear to require specific attention in Indonesia (Figs. 3.8 and 3.9 respectively).

Fig. 3.7 The importance of making investment decisions in transport to improve ports (Figure by the authors)

Fig. 3.8 The importance of making investment decisions in water infrastructure to improve ports (Figure by the authors)

Fig. 3.9 The importance of making investment decisions in energy to improve ports (Figure by the authors)

Fig. 3.10 The importance of making investment decisions in materials handling to improve ports (Figure by the authors)

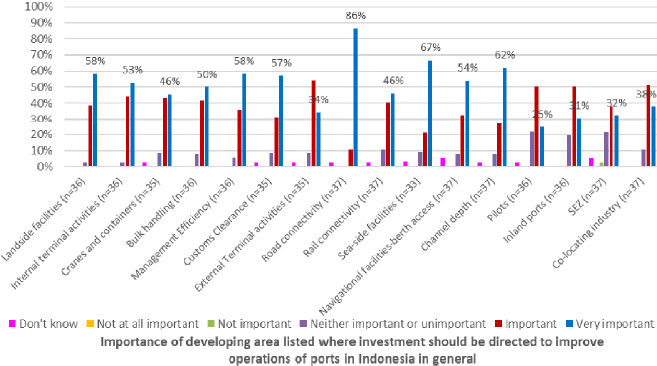

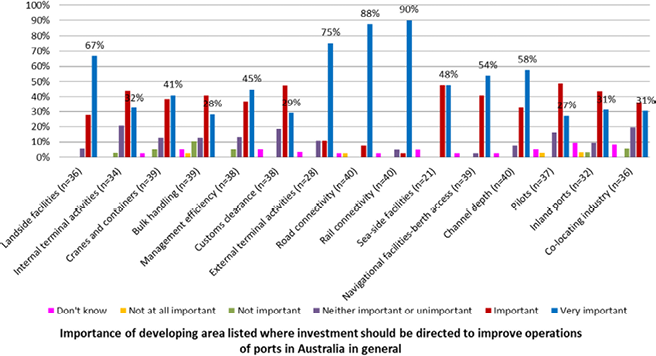

The online port surveys also took into consideration ports in general and the importance of developing various areas listed where investment should be directed to improve port operations for Indonesia (Fig. 3.11) and for Australia (Fig. 3.12). Road connectivity features highly for both countries.

The Indonesian port survey responses showed that road connectivity was most important (‘very important’) followed by seaside facilities, and then channel depth (Fig. 3.11).

Fig. 3.11 Level of importance of developing areas listed where investment should be directed to improve operations of PORTS in general in Indonesia. (Figure by the authors)

In the Australian port survey, responses to this question showed that road and rail connectivity were the most important (‘very important’) areas to be developed to improve port operations in general (Fig. 3.12).

Fig. 3.12 Level of importance of developing areas listed where investment should be directed to improve operations of PORTS in general in Australia. (Figure by the authors)

3.3.5 Research Relevance to Funding and Finance

The relative effectiveness of twenty-nine financing mechanisms was explored for Indonesia and Australia in the online surveys (Tables 3.2 and 3.3). The tables combine the responses to ‘not at all effective’ and ‘ineffective’ and combine those for ‘effective’ and ‘highly effective’. The tables do not include the responses from respondents who indicated they ‘don’t know’.

There are some differences in financing mechanisms that are available in the two countries. For Indonesia these are: Indonesian bank finance, World Bank, Asian Development Bank, Asset Sale, Incentive SEZ.

For Australia the unique financing mechanisms are: Australian bank finance, International financing, Outright asset sale, Arrangement of special tax zone, and Arrangement of incentives to attract investment e.g. special taxation arrangements.

Table 3.2 Relative effectiveness of various funding mechanisms — Indonesia (Table by the authors)

|

INDONESIA |

Neither effective or ineffective |

n |

||

|

Direct government finance (from budget/bonds) |

6.3% |

40.6% |

53.1% |

32 |

|

Government agency finance |

9.4% |

34.4% |

56.3% |

32 |

|

Indonesian bank finance |

3.1% |

21.9% |

75% |

32 |

|

International bank finance |

10% |

43.3% |

46.6% |

30 |

|

Foreign government / International government finance |

17.2% |

34.5% |

48.3% |

29 |

|

Direct inter-country grants or loans |

17.2% |

27.6% |

55.1% |

29 |

|

World bank |

6.5% |

32.3% |

61.3% |

31 |

|

Asian Development bank |

6.5% |

38.7% |

54.9% |

31 |

|

Private port operator finance |

0% |

38.7% |

61.3% |

31 |

|

Third party logistics operator finance |

6.5% |

38.7% |

54.8% |

31 |

|

Direct company facilitation |

6.3% |

31.3% |

62.5% |

32 |

|

Asset recycling: leasing or sale |

13.8% |

48.3% |

37.9% |

29 |

|

Asset sale |

29.1% |

45.2% |

25.8% |

31 |

|

Franchise |

27.5% |

34.5% |

37.9% |

29 |

|

Lease |

29.1% |

29% |

42% |

31 |

|

Public private partnerships (PPP) |

3.3% |

26.7% |

70% |

30 |

|

PPP Government guaranteed |

0% |

26.7% |

73.3% |

30 |

|

Viability gap funding (funding provided to meet shortfall/deficiency of funds for infrastructure project funding) |

3.3% |

36.7% |

60% |

30 |

|

Availability funding |

6.3% |

25% |

68.7% |

32 |

|

PPP with ‘in kind’ — construction support |

3.2% |

29% |

67.8% |

31 |

|

Fully demand risk transfer (full risk of traffic volume is transferred to the private sector) |

25% |

35.7% |

39.3% |

28 |

|

PPP Capital contribution |

0% |

55.2% |

44.8% |

29 |

|

PPP Availability payments |

0% |

46.4% |

53.6% |

28 |

|

PPP Availability payments with capital contribution |

0% |

42.9% |

57.1% |

28 |

|

Asset roll over (sell and then reinvest) |

12.5% |

46.9% |

40.7% |

32 |

|

Market led proposals |

10% |

30% |

60% |

30 |

|

Arrangement of incentives to attract investment e.g. SEZ |

3.3% |

26.7% |

70% |

30 |

|

Direct foreign investment |

18.8% |

28.1% |

53.2% |

32 |

|

A combination of the above, please list below and indicate relative effectiveness here* |

8.7% |

34.8% |

56.5% |

23 |

n=number of respondents (NB: does not include ‘don’t know’ responses)

*Options listed by respondents include:

- ‘Funding assistance from any party with a grant nature to soft loan over a selective program’.

- ’Government Budget and International financial institutions’.

- ‘This question is based on opinion alone or according to existing conditions? The existing ones right now are almost all not effective, only funding with Government Budget is running, even then is not effective. While the PPP scheme should be the solution of funding, the private companies are given the restrictions in the share, causing also not effective, because it is not possible to become a major fund provider but may only have a share that is not major. It should be the question in this case, How Important is your opinion, if the question is effective or not, nothing is effective’.

- ‘Reduce Pelindo dominance’.

- ‘The Port ‘owner’ must have a very heavy level of control. All of the above must lead to non-government and city interference’.

- ‘Domestic bank loan mixed with international loan’.

Table 3.3 Relative effectiveness of various funding mechanisms — Australia (Table by the authors)

|

AUSTRALIA |

Not at all effective / ineffective |

Neither effective or ineffective |

Effective /highly effective |

n |

|

Direct government finance (from budget/bonds) |

9.7% |

19.4% |

70.9% |

31 |

|

Government agency finance |

12.6% |

25% |

62.5% |

32 |

|

Australian bank finance |

6.1% |

9.1% |

84.8% |

33 |

|

International bank finance |

0% |

16.7% |

83.3% |

30 |

|

Foreign government / International government finance |

24.1% |

41.4% |

34.5% |

19 |

|

Direct inter-country grants or loans |

34.6% |

38.5% |

26.9% |

26 |

|

International financing |

13.3% |

20% |

66.7% |

30 |

|

Private port operator finance |

11.8% |

8.8% |

79.4% |

34 |

|

Third party logistics operator finance |

6.5% |

32.3% |

61.3% |

31 |

|

Direct company facilitation |

3.4% |

34.5% |

62.1% |

29 |

|

Asset recycling: leasing or sale |

13.3% |

20% |

66.6% |

15 |

|

Outright asset sale |

21.3% |

24.2% |

54.5% |

33 |

|

Franchise |

22.2% |

37% |

40.7% |

27 |

|

Lease |

15.1 |

15.2% |

69.7% |

33 |

|

Public private partnerships (PPP) |

14.3% |

28.6% |

57.1% |

14 |

|

PPP Government guaranteed |

17.2% |

17.2% |

65.5% |

29 |

|

Viability gap funding (funding provided to meet shortfall/deficiency of funds for infrastructure project funding) |

22.2% |

22.2% |

55.5% |

27 |

|

Availability funding |

27.3% |

27.3% |

45.4% |

22 |

|

PPP with ‘in kind’ — construction support |

26.9% |

19.2% |

53.8% |

26 |

|

Fully demand risk transfer (full risk of traffic volume is transferred to the private sector) |

19.2% |

34.6% |

46.2% |

26 |

|

PPP Capital contribution |

16.7% |

12.5% |

70.8% |

24 |

|

PPP Availability payments |

19% |

28.6% |

52.4% |

21 |

|

PPP Availability payments with capital contribution |

23.8% |

23.8% |

52.4% |

21 |

|

Asset roll over (sell and then reinvest) |

32.1% |

17.9% |

50% |

28 |

|

Market led proposals |

7.4% |

14.8% |

77.7% |

27 |

|

Arrangement of special tax zone |

28.6% |

19% |

52.4% |

21 |

|

Arrangement of incentives to attract investment e.g. special taxation arrangements |

25.9% |

11.1% |

62.9% |

27 |

|

Direct foreign investment |

25.8% |

12.9% |

61.3% |

31 |

|

A combination of the above, please list below and indicate relative effectiveness here* |

23.1% |

38.5% |

38.5% |

13 |

n=number of respondents (NB: does not include ‘don’t know’ responses)

*Only two respondents indicated the relative effectiveness of a combination of the finance vehicles listed and one listed that vehicle and its relative effectiveness:

- ‘Government guaranteed funding of port infrastructure and private funding of terminal operations and logistics’.

- ‘Port context + government policy would more than likely dictate the allowable funding strategies; in SW WA ports privately funded infrastructure is the most acceptable method for in-port works (marine) whereas the government seems prepared to fund lanside (landside) works (rail loop; road over rail bridge)’; (relative effectiveness: highly effective).

NB. For some forms of financing the response numbers were low.

Indonesian bank finance followed by government guaranteed PPP were perceived to be most effective by Indonesian survey respondents.

Australian bank finance and international bank finance were perceived to be most effective by Australian survey respondents.

3.4 Concluding Remarks

In this chapter the international research team conducted both qualitative and quantitative research employing online surveys, focus group discussions and in-depth interviews to identify projects and initiatives that are critical to the funding and financing of infrastructure projects associated with ports in Australia and Indonesia.

There are various findings in our research:

- There are never sufficient funds to meet the expectations associated with the large capital expenditure required for infrastructure development. Developed countries like Australia can readily raise the finance for such investments provided the investment is underwritten by a AAA credit rated government. Nonetheless, balancing the level of debt with the ongoing cost of finance remains a challenge.

- For an emerging nation such as Indonesia there are additional challenges in raising finance due to sovereign risk, perceptions of governance and the depth of their in-country financial market. The options available to decision makers are important. Among the various options, some, particularly PPPs, look very viable.

- The asset recycling model as a financing mechanism for infrastructure projects has been successful in Australia.

- Enabling and directing investments toward landside connectivity constitute the critical issues pertaining to Indonesian and Australian port infrastructure decisions.

- Infrastructure projects are usually nationally significant investments that provide much needed social and economic benefits. Decision makers are often faced with challenging tasks of prioritising and allocating scarce financial resources. In the case of significant infrastructure investments such as port projects, specific guidance on the critical issues will help with decision making to ensure that value is delivered.

- Through our study in the Australian ports, it was observed that the asset sale model is an effective financing mechanism for port infrastructure development, with the asset lease being the most agreeable among other asset sale options.

- Our research in Australia also found that the enabling effects of directing investment to landside transport as a means of improving port operations is crucial. Investment funds should be directed towards transportation facilities as a priority area. Reduction of traffic bottlenecks in road and rail infrastructure near the ports are also areas identified that need to be addressed. Investment in rail and road connectivity is a significant means of improving port operations. However, it is recognized that it is a challenge to implement rail networks as the main mode of freight transportation to and from ports as currently rail networks prioritise passenger trains as opposed to freight trains, which may lead to increased dwell times and increased costs due to resulting disruption to the whole supply chain. A possible solution to these challenges is the development of inland hubs co-located with industrial and warehouse areas.

- The Indonesian study shows support for government policies for investment facilitation. Future research can develop more comprehensive solutions to increase port competitiveness in Indonesia through the problems identified in our study.

- Financing options that are available for infrastructure projects in Indonesia would differ from those in Australia. The study gained insights from the Indonesian seaport stakeholders into the issues, barriers, and improvement of port infrastructure financing and the most effective financing vehicle for port infrastructure projects. The survey finds that Indonesian domestic banks syndication and Public Private Partnership (PPP) schemes with government fiscal support are two most awaited financing vehicles. In reality, however, the domestic banks have limited capacity and the PPP schemes are still ineffective as shown by our researchers.

References

Asian Development Bank 2013. ‘Indonesia power project marks first loan of ASEAN Infrastructure Fund’, News Release, www.adb.org/news/indonesia-power-project-marks-first-loan-asean-infrastructure-fund

Asian Development Bank 2015. The ASEAN Infrastructure Fund (Infographic), www.adb.org/news/infographics/asean-infrastructure-fund

Asian Development Bank 2016a. ASEAN Infrastructure Fund Overview, www.adb.org/site/aif/overview

Asian Development Bank 2016b. ASEAN Infrastructure Fund projects, www.adb.org/site/aif/projects

ERIA 2014. PPP country profile. Indonesia, http://www.eria.org/projects/PPP_in_Indonesia_ERIAsummary_March_2014.pdf

Indonesia Infrastructure Guarantee Fund 2017. Business-guarantee overview, PT Penjaminan Infrastruktur Indonesia (Persero), www.iigf.co.id/en/business/overview

Infrastructure Australia 2017. Improving Public Transport: Customer Focused Franchising, https://www.infrastructureaustralia.gov.au/sites/default/files/2019-06/customer-focused-franchising.pdf

Jia, C 2015. ‘Silk Road Fund makes first investment’, China Daily USA, www.chinadaily.com.cn/cndy/2015-04/22/content_20502525.htm

Japan International Cooperation Agency (JICA) 2018. Indonesia’s development and Japan’s cooperation: Building the future based on trust, www.jica.go.jp/publication/pamph/region/ku57pq00002izqzn-att/indonesia_development_en.pdf

Kirkwood, I 2016. ‘Questions over ownership of Port of Newcastle shareholder Hastings Fund Man-agement’, Newcastle Herald, 23 March, https://www.newcastleherald.com.au/story/3809984/port-move/

KPMG Indonesia 2015. Investing in Indonesia, assets.kpmg/content/dam/kpmg/pdf/2016/07/id-ksa-investing-in-indonesia-2015.pdf

Meharg, S, Kirono, DGC, Butler, JRA, McEachern, S and Hajkowicz, S 2015. Australia-Indonesia Centre megatrends: Infrastructure, report prepared for the Australia-Indonesia Centre, Monash University, publications.csiro.au/rpr/download?pid=csiro:EP158505&dsid=DS2

Ministry of Finance Republic of Indonesia 2016. Public Private Partnership. Government support and facilities for PPP project in Indonesia.

NAIF Northern Australian Infrastructure Facility, http://www.naif.gov.au/about-us/naif-governance/

Northern Australia Infrastructure Facility Investment Mandate Direction 2018, https://www.legislation.gov.au/Details/F2018L00567

NSW Auditor-General 2013. Report: Financial Audit, Vol. 8: Focusing on Transport and Ports, https://www.audit.nsw.gov.au/sites/default/files/pdf-downloads/2013_Dec_Report_Volume_Eight_2013_focusing_on_Transport_and_Ports.pdf

O’Brien, C and Howells, M 2010. ‘Government leases Port of Brisbane for $2.3b’, ABC News, 11 November, https://www.abc.net.au/news/2010-11-10/government-leases-port-of-brisbane-for-23b/2331972

Piesse, M 2015. Strategic Analysis Paper: The Indonesian maritime doctrine: Realising the potential of the ocean, Future Directions International, futuredirections.org.au/wp-content/uploads/2015/01/FDI_Strategic_Analysis_Paper_-_The_Indonesian_Maritime_Doctrine.pdf

PT Indonesia Infrastructure Finance (PT IIF) 2019. Overview.

Port of Darwin 2017. Darwin Port Handbook, https://www.darwinport.com.au/sites/default/files/uploads/2017/Darwin%20Port%20Handbook%20June%202017_0.pdf

Purnamasari D, 2014. ‘Jokowi asks for Japan’s help on infrastructure projects’, The Jakarta Globe, 12 August.

Robb, A 2015. ‘After the IABW 2015: Growing Australia’s business with Indonesia’s middle class’, Australian Financial Review.

Silk Road Fund 2016. Silk Road Fund home page, www.silkroadfund.com.cn/enwap/27363/index.html

The World Bank 2015. ‘The tale of two ports in Indonesia’, The World Bank: News, www.worldbank.org/en/news/feature/2015/05/26/the-tale-of-two-ports-in-indonesia

Tiezzi, S 2015. ‘Indonesia, China seal “maritime partnership”’, The Diplomat, thediplomat.com/2015/03/indonesia-china-seal-maritime-partnership/

Wahyuni, S 2013. Competitiveness of special economic zone: Comparison between Indonesia, Malaysia, Thailand and China, Hak Cipta, Jakarta, Jakarta: Salemba Empat.

1 Professor of Engineering Project Management, Deputy Head of Department, Dept. of Infrastructure Engineering, The University of Melbourne.

2 Research Assistant, Dept. of Infrastructure Engineering, The University of Melbourne.

3 Research Fellow, Dept. of Infrastructure Engineering, The University of Melbourne.

4 Asian Development Bank.

5 Japan International Cooperation Agency.

6 The International Fund for Agricultural Development.

7 World Bank, World Bank Port Reform Tool Kit, Module 3: Alternative Port Management Structures and Ownership Models, https://ppiaf.org/sites/ppiaf.org/files/documents/toolkits/Portoolkit/Toolkit/module3/index.html

8 NAIF Northern Australian Infrastructure Facility, http://www.naif.gov.au/about-us/naif-governance/

9 Northern Australia Infrastructure Facility Investment Mandate Direction 2018, dated 24 April, https://www.legislation.gov.au/Details/F2018L00567

10 NSW Auditor-General’s Report: Financial Audit, Vol. 8: Focusing on Transport and Ports, 2013, https://www.audit.nsw.gov.au/sites/default/files/pdf-downloads/2013_Dec_Report_Volume_Eight_2013_focusing_on_Transport_and_Ports.pdf

11 Port of Darwin, Darwin Port Handbook, June 2017, https://www.darwinport.com.au/sites/default/files/uploads/2017/Darwin%20Port%20Handbook%20June%202017_0.pdf

12 Ian Kirkwood, ‘Questions over ownership of Port of Newcastle shareholder Hastings Fund Management’, Newcastle Herald, 23 March 2016, https://www.newcastleherald.com.au/story/3809984/port-move/

13 Ibid.

14 Chris O’Brien and Melinda Howells, ‘Government leases Port of Brisbane for $2.3b’, ABC News, 11 November 2010, https://www.abc.net.au/news/2010-11-10/government-leases-port-of-brisbane-for-23b/2331972

15 Infrastructure Australia, Improving Public Transport: Customer Focused Franchising, May 2017, https://www.infrastructureaustralia.gov.au/sites/default/files/2019-06/customer-focused-franchising.pdf