8. Revealing Indonesian Port Competitiveness

Challenge and Performance

© S. Wahyuni, A. Azadi Taufik, and F. K. P. Hui, CC BY 4.0 https://doi.org/10.11647/OBP.0189.08

8.0 Introduction

Port competitiveness is an important aspect that can boost national competitiveness. According to Merk (2013), ports are beneficial not only as trade facilitators, but also as providers of value-added activities. They boost port employment, and become places of innovation, research and development. Dwarakish and Salim (2015, p. 299) analysed various reports from ports around the world and concluded that “the growth and development of ports leads to greater trade activity, increased supply, greater foreign reserves, and reduced prices for commodities as a whole”, and that the development of ports serves as “a good reflection of a country’s economy.”

Although Indonesia is a maritime country, its ports have not performed as expected by Joko Widodo, current President of Indonesia, who would like to establish a sea toll, and see Indonesia become a world class maritime player. Compared to the neighbouring countries in East Asia and the Pacific, Indonesia ranks 7th in container port traffic (Dappe and Suárez-Alemán 2016), while Malaysia and Singapore rank 4th and 2nd, respectively. According to the Global Competitiveness Report 2017–2018, Indonesia ranks 5th in the Association of Southeast Asian Nations (ASEAN) in overall infrastructure quality, below Singapore, Malaysia, Brunei Darussalam, and Thailand. In ASEAN, Indonesia’s port infrastructure quality ranks 4th, below Singapore, Malaysia, and Thailand. In terms of the Logistics Performance Index in 2016, Indonesia ranks 4th again below Singapore, Malaysia, and Thailand, with infrastructure and international shipments receiving low scores (Table 8.1). Land and port bottlenecks in Indonesia’s economic corridors result in logistical costs estimated to be 24–26% of the GDP (Carruthers 2016). In order to strengthen Indonesian port competitiveness, smart and strategic positioning, marketing and implementation need to be undertaken.

Indonesia is an archipelago, where efficient sea transportation between islands can potentially create a more efficient supply chain (Wiranta 2003) that would address the high costs of shipping within Indonesia (Sandee 2011). The emergence of the ASEAN Economic Community will also increase trade within the region and accelerate the need for Indonesian port competitiveness (van Dijk, van de Mheen, and Bloem 2015).

Table 8.1 Rank of ASEAN Logistics Performance Index

|

Country |

ASEAN Rank |

Global Rank |

Total Score |

Customs |

Infra-structure |

International Shipments |

Logistics Competence |

Tracking and Tracing |

Timeliness |

|

Singapore |

1 |

5 |

4.14 |

4.18 |

4.20 |

3.96 |

4.09 |

4.05 |

4.40 |

|

Malaysia |

2 |

32 |

3.43 |

3.17 |

3.45 |

3.48 |

3.34 |

3.46 |

3.65 |

|

Thailand |

3 |

45 |

3.26 |

3.11 |

3.12 |

3.37 |

3.14 |

3.20 |

3.56 |

|

Indonesia |

4 |

63 |

2.98 |

2.69 |

2.65 |

2.90 |

3.00 |

3.19 |

3.46 |

|

Viet Nam |

5 |

64 |

2.98 |

2.75 |

2.70 |

3.12 |

2.88 |

2.84 |

3.50 |

|

Brunei |

6 |

70 |

2.87 |

2.78 |

2.75 |

3.00 |

2.57 |

2.91 |

3.19 |

|

Philippines |

7 |

71 |

2.86 |

2.61 |

2.55 |

3.01 |

2.70 |

2.86 |

3.35 |

|

Cambodia |

8 |

73 |

2.80 |

2.62 |

2.36 |

3.11 |

2.60 |

2.70 |

3.30 |

|

Myanmar |

9 |

113 |

2.46 |

2.43 |

2.33 |

2.23 |

2.36 |

2.57 |

2.85 |

|

Laos |

10 |

152 |

2.33 |

1.85 |

1.76 |

2.18 |

2.10 |

1.76 |

2.68 |

Research into Indonesian port competitiveness is limited. A search through the Scopus database (Elsevier) — which provides a searchable database of scientific journals, books, and conference proceedings — identifies only four articles about Indonesia from a total of 455 articles and reviews with titles, abstracts, or keywords consisting of either “competitiveness” or “selection” or “choice” or “performance” combined with the term “port” since 1980 to the present. That represents 0.9% of all articles compared to 10% of articles about China, 9% of articles about South Korea, and 8.8% of articles about the USA. This suggests that there are substantial gaps in the research into Indonesian port competitiveness.

The research reported in this chapter tries to fill this gap by identifying the position of Indonesian ports relative to other Asian ports, and by engaging with the challenges faced by Indonesian ports. Findings from this study hopefully can help policy makers in crafting their strategy to boost Indonesian port performance through improved financing decisions for seaport projects. This chapter contributes to research and management practice by identifying important aspects of port competitiveness and encouraging investor interest by overcoming inefficiencies in government bureaucracy, customs clearance, and strategic decision making, energy infrastructure and road rail connectivity.

8.1 Literature Review

Currently, Indonesia has more than 2,000 ports and terminals (Ministry of Transportation, 2013), with 111 commercial ports, 1,129 non-commercial ports, and more than 800 special terminals for mining, oil, gas, and chemical industries.

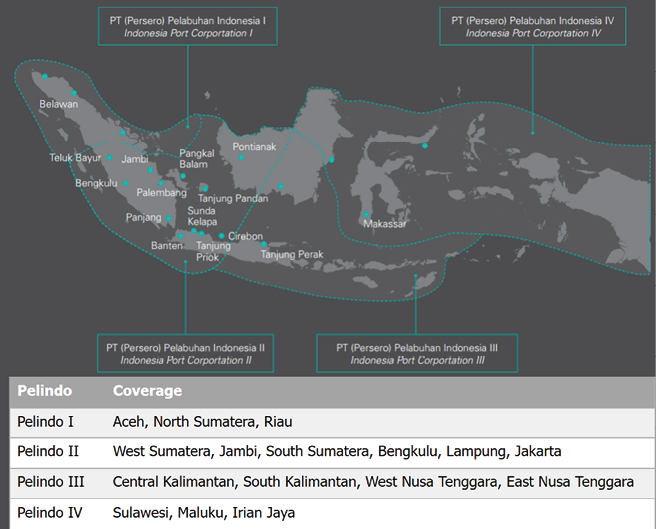

There are four state-owned port companies that are major players in the Indonesian port industry. Known as PT Pelabuhan Indonesia (Pelindo) I, II, III and IV, the companies operate public ports within geographical regions as depicted in Figure 8.1. The four port corporations generated USD 130 million in 2017 (Maulana 2018), which accounts for 0.21% of Indonesia’s GDP.

According to OECD (2012), although each Pelindo was designed as a limited liability, profit-making company, the government of Indonesia controls port tariffs at a national level to allow cross-subsidisation amongst them. With the Shipping Law of 2008, Pelindo’s role has been limited to port operators and port service providers, and is no longer a port authority, allowing in theory for competition and greater participation of other operators from the private sector.

Lee, Song and Ducruet (2008) state that there is a common trend amongst Western port cities to shift port facilities towards outer areas of their metropolitan regions, whereas Asian ports have been shifting land-use activities towards creating Global Hub Cities, thereby responding to the demand for an integrated global logistical system to handle cargo import and export in Asia.

Fig. 8.1 Coverage of Pelindo I, II, III, and IV. Source: adapted from Sheng (2015).

Merk (2013) states that large port-cities have gateway ports which serve port traffic to metropolitan areas and its hinterland. Hinterland proximity refers to the geographical proximity between industrial zones and ports. Hinterland connectivity refers to the transportation systems and links between industrial zones and ports, such as roads, railways, and the transport cost and travel times. Kim (2014) found that amongst service-oriented, cost-saving oriented, task-achiever oriented, and infrastructure-oriented actors, inter-modal links and land transport systems are important elements of port choice behaviour. Tang, Low and Lam (2011), state that availability of inter-modal transport facilities allows for easier handling of containers being imported or exported. Walter and Poist (2003) reinforce the point that inter-modal transport facilities allow for easier local and regional deliveries.

Port infrastructure and facilities are also an important factor in the determination of port competitiveness (Lin and Tseng 2007). Based on the work of De Martino and Morvillo (2008), infrastructure can be categorised into hard and soft components. Hard components include infrastructure, supra-structures, equipment, geographical location, and inland logistics platforms whilst soft components include supplied services, interfirm ties, ICT systems, and safety and security. Other researchers focused on measurable port facilities instead of physical objects, such as handling efficiency (Lirn, Thanopoulou, Beynon and Beresford 2004; Cullinane, Fei and Cullinane 2004), and reliability of facilities, and storage capacity (Grosso and Monteiro 2009; Yuen, Zhang and Chueng 2012).

Operational efficiency and port service quality are important factors in port competitiveness. Operational efficiency is the ability of the port to use its resources to deliver high operational performance efficiently (Parola, Risitano, Ferretti and Panetti 2016). This can be measured in numerous ways, including: throughput; ship turnover time; cargo handling productivity; capacity utilisation; and other measurements used to indicate operational performance and resource utilization (Steven and Corsi, 2012).

Yen, Zhang and Chueng (2012) outline how customs procedures and government regulator administrative procedures are also important factors that determine port competitiveness. De Langen (2004) includes governance alongside maritime accessibility and hinterland infrastructure, as important determinants of the seaport performance.

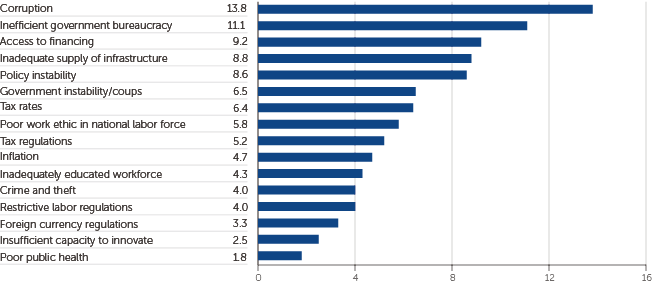

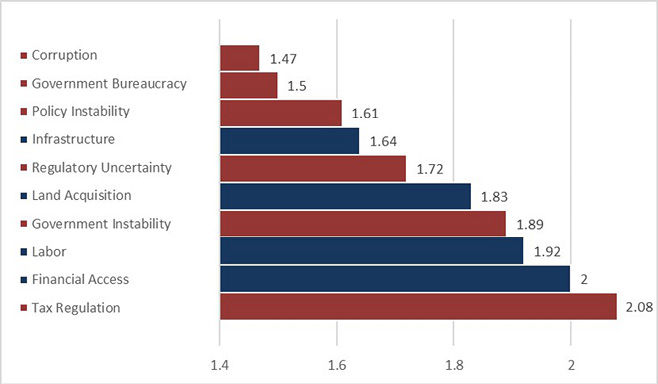

Other research focuses on the competitiveness of major ports in Southeast Asia (Kutin, Nguyen and Vallée 2017; Dang and Yeo 2017; Cheong and Suthiwartnarueput 2015). There are several possible reasons for the lack of port development in Indonesia. An internal analysis conducted by Bank Mandiri (Nirwan 2017) concluded that the general obstacles for project development in Indonesia also occur in port infrastructure development, namely land acquisition, construction issues, financing issues, planning and preparation issues, and permit issues. Figure 8.2 shows that corruption, inefficient government bureaucracy, lack of access to financing, inadequate supply of supporting infrastructure, and policy instability are the most problematic factors of doing business in Indonesia.

Fig. 8.2 Most Problematic Factors of Doing Business in Indonesia. Source: Schwab (2017).

Improving Indonesian port competitiveness is crucial for the national economic development of the country. The government claims that improving the seaport transportation in Indonesia can help overcome disparity in local economic development in the western and eastern regions of the vast archipelago nation (Ministry of National Development Planning, 2014). The Ministry of Transportation is even more ambitious, viewing the development of seaport transportation in Indonesia as having the potential to transform Indonesia into a global maritime power in an increasingly Asian-centric global economy (Ministry of Transportation, 2015). Leinbach (1995) argues that transportation infrastructure is particularly critical for development in developing countries. This argument is supported by Kamaluddin (2003) who conducted a study on the importance of transportation infrastructure to Indonesia’s development. As an archipelago, Wiranta (2003) suggests that the development of sea transportation between islands in Indonesia can create a more efficient supply chain that solves what Sandee (2011) — a World Bank trade specialist — reports as the high costs of shipping: it is currently more expensive to ship from Padang to Jakarta than from Jakarta to Singapore. In the near future, the importance of port competitiveness will continue to increase with the emergence of the ASEAN Economic Community, where trade is expected to intensify (van Dijk, van de Mheen and Bloem 2015).

Responding to the need to improve Indonesian port competitiveness, the Indonesian government is in the midst of planning and implementing broad policies and strategies concerning maritime and port development. President Widodo envisions Indonesia as a Global Maritime Nexus, involving 34 ministries and 425 policies which range from maritime diplomacy, maritime connectivity, marine industry, maritime security, and nautical cultural. The National Development Plan and the Ministry of Transportation Strategic Planning for 2015–2019 outline the ways in which policies and strategies for the port sector focus on increasing private investment for port services, and on the development of twenty-four strategic ports to create a maritime highway (dubbed Indonesia’s Sea Toll Project) that would act as a transportation network amongst all regions of Indonesia. Other policies include a reform package to improve logistics in the country through transportation insurance, logistics cost reduction, strengthening the Indonesian National Single Window, and reducing the number of prohibited goods. Whether these policies have or will increase port competitiveness is yet to be evaluated.

8.2 Methodology

The study reported in this chapter is part of a research project into the Efficient Facilitation of Major Infrastructure Projects with a focus on ports, where an online survey, focus group discussions (FGD), and in-depth interviews were conducted with key port stakeholders in Indonesia and Australia in 2017/18. The research is a collaboration between The University of Melbourne in Australia and the Universitas Indonesia, Universitas Gadjah Mada and Institut Teknologi Sepuluh Nopember in Indonesia as part of research funded by the Australia-Indonesia Centre Infrastructure Cluster Research Group. The methodology associated with the Efficient Facilitation of Major Infrastructure Projects study is described in full in Appendix 1. This chapter focuses exclusively on the results from the online port survey, FGD, and in-depth interviews from Indonesia.

The online survey into port planning and development explored investment decisions, port/city performance, barriers to doing business, funding and financing decisions, port sustainability, procurement and capacity building. The online survey targeted port authorities, policy-makers related to ports, and other port actors in Indonesia. The key port stakeholders were also approached to take part in the FGD and in the in-depth interviews.

The online port survey included a question asking participants to indicate from a list of twenty-nine factors provided, how problematic these factors are to doing business in Indonesia. Respondents were required to indicate how problematic the factors are on a scale of 1 to 5, where 1 is the most problematic, and 5 the least problematic. The list comprised the sixteen factors that the World Economic Forum (WEF) uses in their Executive Opinion Survey, the ten indicators used by the World Bank for their ‘Doing Business’ rankings (WB), and three additional factors that were identified as issues in Indonesia: affordable energy availability, land acquisition and regulatory uncertainty.

8.2.1 Focus Group Discussions and In-Depth Interviews

On the 25 September 2017, FGD were held at the Ministry of Transportation office in Jakarta with port experts and authorities to obtain a deeper understanding of Indonesian port planning, development, and financing. The FGD were structured into two sessions: the first session focused on Indonesian port planning and development, while the second session focused on Indonesian ports financing. Each session began with a presentation from invited speakers, followed by a panel discussion. The FGD session was attended by more than thirty-six high-ranking officials and representatives of the government, major corporations in logistics and development, banks, associations, universities, and other experts.

In-depth interviews were also conducted to uncover specific expert insights into Indonesian port competitiveness. To find information about the strategic direction of Indonesian port development we interviewed senior representatives from Pelindo II’s Strategic Bureau. For information on the operational performance we interviewed the executive team members from Pelindo II’s Operations and Information System Division. Finally, we interviewed the managers at the Jakarta International Container Terminal to obtain details on competitiveness regarding one of Indonesia’s growing and highest potential terminals.

8.3 Results and Discussion

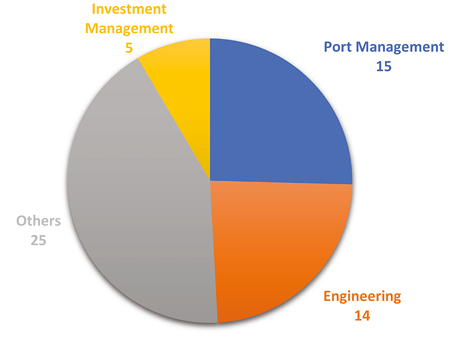

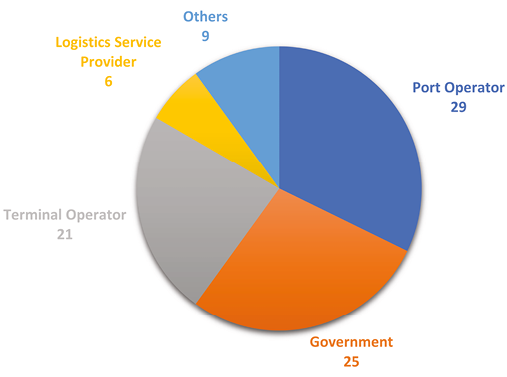

There were fifty-nine respondents to the online Indonesian port survey in total. The specialisation of our respondents varies, with a total of twenty different specialisations (see Figure 8.3). Most of them specialise in port management (n = 15, 25%), engineering (n = 14, 24%), and investment management (n = 5, 8%). This specialisation indicates enough knowledge on port operations and business-related activities such as financing, operations, etc. Lastly, 49% of our respondents work for or with port operators (n = 29), 42% work for or with government departments (n = 25), 36%, work for or with terminal operators (n = 21), 10% work for or with logistics service providers (n = 6), and 15% in other areas (n = 9). These are all important aspects of port operations.

Fig. 8.3 Respondent Data: (Top) Respondent’s Specialisation and number of respondents, (Bottom) Respondents’ association/working for or with, in the ports and number of respondents (Figure by the authors)

Due to the dominant role of the state-owned corporations Pelindo I, II, III, and IV, this discussion further investigates the leadership and decision making of the Indonesian government, and its impact/influence on port competitiveness. We explore the role of the government and State Owned Enterprises (SOEs) by analysing the administration, bureaucracy, policy, and regulations taken by the government that influence the performance of infrastructure sectors, such as ports. Since many of the investment decisions for ports are still controlled by the government, the level of investment facilitation accommodated by the government will be a good determinant to evaluate port competitiveness. Lastly, evaluating the usefulness of past reform packages — and the level of approval towards investment facilitation for port performance — will also indicate the success of the government in improving Indonesian port competitiveness.

A summary of the Indonesia port problems identified from the research conducted is shown in Figure 8.4.

Fig. 8.4 Summary of Indonesian port problem (Figure by authors)

Results from this study show that there are ten most problematic factors for doing business in Indonesia, from the perspective of the survey respondents as shown in Figure 8.5. Corruption, followed by government bureaucracy, are the most problematic.

Fig. 8.5 The Most Problematic Factors for Doing Port Business in Indonesia. (Figure by authors). Red (Government Related Variables), Blue (Business Related Variables) 1 (Most Problematic-Major Effect), 3 (Neutral), 5 (Least Problematic-Minimal/No Effect)

Figure 8.5 highlights the severity of corruption as a problematic factor. In terms of infrastructure projects, many respondents claim that “there are many stakeholders that try to obtain profit illegally which result in the value of the project being marked-up” or that there are “too many interest[ed] parties wanting a slice of the action”. These stakeholders are called “legal premans within the government process” by another respondent. “Preman” is a derogatory word to describe hooligans or delinquents. The problem of corruption is not only a government problem: one respondent claimed that “development funds must be ensuring that all process is honest and that [corporations] fulfil Good Corporate Governance”. One respondent boldly includes port operators as one of the actors involved in political interference and corruption, and identified lack of policy as the main obstacle in advancing infrastructure projects.

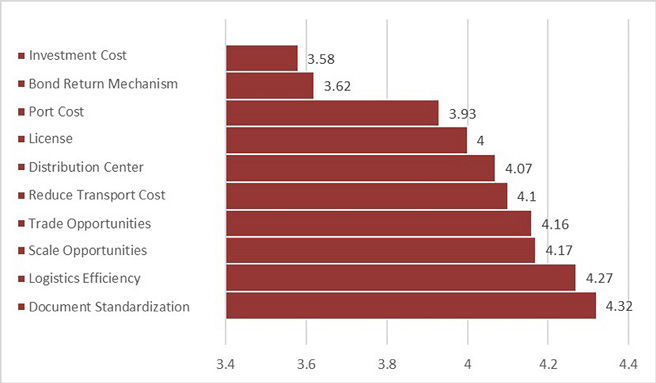

Of course, there is no implication that all government policies are futile. Recently, the Joko Widodo administration has provided a reform package intended to reduce the high logistics and high freight costs to improve the supply chain. The previous President, Susilo Bambang Yudhoyono, enacted a reform program consisting of the 2008 Shipping Law which opened competition of port operations between Pelindo I, II, III, and IV with private sectors, and the Indonesia National Single Window (INSW). As the former policy received resistance from Pelindo I–IV, Widodo’s administration further relaxed restrictions on logistics service providers, including freight forwarders, storage providers, distribution providers, transport providers, and cargo handlers. The INSW was strengthened through increased integration between the Ministry of Transport, Ministry of Trade, and the Ministry of Finance. In addition, the 15th Economic Reform Package in June 2017 enacted the following policies: to enhance transportation insurance; to reduce costs for logistics service providers by decreasing transportation operating costs; to eliminate requirements for cargo transportation permit; to decrease port investment cost; to standardize documents; to develop regional distribution centres; to ease procurements, reducing the number of restricted goods; and to strengthen the Indonesia National Single Window (Figure 8.6).

Fig. 8.6 Government Reform Package Usefulness Score (mean) (Figure by the authors). 1 (Very Unhelpful), 3 (Neither Unhelpful or Useful), 5 (Very Helpful)

Document standardisation was perceived by respondents to be one of the most useful initiatives within the reform packages, receiving a score of 4.32 (Fig. 8.6). One of the interviewees, a senior port executive indicated that the flow of documents used to be a problem that contributed to long dwell times in Indonesian ports, as it still required human interaction to receive and approve documents. A recent E-Service technology has also been implemented in Tanjung Priok, which provides electronic features for booking, tracking and tracing, billing, payment, delivery, and loading cancel. These electronic features increase procedural clarity for customers.

The World Bank Representative Head for Indonesia explains that the reform package is expected to overcome Indonesia’s logistics bottleneck, resulting in a more efficient economy. The Indonesia National Shipowners’ Association (INSA) says that the package will increase the role of national shipping lines, thereby encouraging the shipping competitiveness towards the global market. The Indonesian Logistics Association (ALI) asserts that the package will smooth the flow of cargoes and cut logistics cost. The reform addresses a logistical problem outlined by a leader in Pelindo II, who reports that most of the costs incurred by customers are from external logistic players:

The internal analysis that we conducted found that only 20% to 30% of cost that is incurred by port customers are from the port itself, the rest are incurred by external logistic players outside the port. (Stakeholder in Pelindo II)

We proceed now in analysing the business-related factors that impact on Indonesian port competitiveness. As shown previously, the results of our survey indicate that the three most problematic business factors are an inadequate supply of infrastructure, land acquisition, and poor work ethics in the national workforce. In terms of infrastructure, one respondent stated that “in Jokowi’s Presidency with the tagline ‘Indonesia as a World Maritime Fulcrum’, is actually very great. But it needs more support with real actionable programs, in terms of infrastructural improvements, accessibility, and connectivity of ports in Indonesia”. Many other respondents agree that infrastructure is highly important to develop ports in Indonesia, saying that “ports are not able to operate in solo and will require all supporting infrastructure to ensure the sustainability of port operations”.

The condition of infrastructure that supports ports is currently very poor. As one respondent said: “hard accessibility to ports makes [the ports] worthless. For so long, Indonesia has had problems of accessibility, either be it by sea or by land”. Another respondent, echoing the conditions outlined in our introduction, stated that “the development of transportation and energy in Indonesia is far behind our neighbouring countries, both in South East Asia and the world.”

The forms of infrastructure that our respondents are referring to are transportation infrastructure and energy infrastructure. Questions about operational efficiency are relevant here, with the survey showing that road connectivity, transport, and energy require operational improvements, scoring 1.11, 1.31, and 1.5 respectively. Indonesia’s transportation infrastructure is underperforming. According to our resource person in Pelindo II,

The government’s road connectivity masterplan for Indonesia constantly changes and doesn’t focus on integrated urban mass transportation. (Stakeholder in Pelindo II)

There were many comments made by survey respondents which concerned Indonesia’s transportation infrastructure, and questioned why transportation infrastructure in Indonesia is still causing logistical problems. One survey respondent said that “transportation infrastructure and roads hold an important role in goods and service distribution. The delay of distribution paths has caused economic losses from other sectors”. The inefficient flow of goods between Indonesian hinterlands and the ports constitutes the major loss felt by the port sector as a result of poor transportation infrastructure. Resource persons expressed that Indonesia’s transportation infrastructure is well behind other Southeast Asian countries. Another respondent indicated that transportation is one of the reasons for the high price in many Indonesian regions, stating that “the delay in the distribution path can result in economic loss” since the inefficient distribution of goods causes losses in other economic sectors. The concern is that transportation is especially important to enhance economic equality and growth in other regions of Indonesia. Integration of ports with industrial parks, production centres, and distribution centres was noted as a prerequisite for improvement because, irrespective of how great ports are implemented, it becomes less useful if access to those ports is difficult.

Many respondents to the survey noted the importance of an integrated intermodal transportation system as a way of improving Indonesia’s adequate transportation infrastructure. One individual wrote that “the existence of ports and terminals must be supported with good integrated intermodal [transportation]. Access to the port from the sea and from land must be good for trucking and large ships. Then, intermodal integration, such as trains, must be a main alternative.” However, the solution to Indonesia’s transportation infrastructure is not that simple. Other respondents countered arguments that Indonesian ports require the further development of railways. Interestingly, the Indonesian condition is an anomaly compared to other international ports, where trains have become cost effective for delivery to and from ports. A leader of the Indonesian Railway Company explained that Indonesian ports cannot rely on railways because they are not a cost-effective mode of transporting freight:

Railway is usually used in Java mostly; Nevertheless, in Indonesia railways cannot compete with trucking. Railway transport cost is almost three times more than trucking. Because we have to pay maintenance fee for trains, while this does not occur in trucking. Government policy needs to help this situation. (Stakeholder of Indonesian Railway Company)

One of the current plans to improve the competitiveness of Tanjung Priok port is through intermodal connectiveness with the construction of a Cikarang-Bekasi waterway canal. This waterway canal cuts through the problem of Jakarta’s infamous congested roads and the high cost of using railways to transport goods. The government hopes to connect the Cikarang industrial zones with port terminals in Jakarta directly, increasing the effective proximity of Jakarta with its industrial hinterlands.

In terms of energy, one respondent described that “there is unequal distribution of electricity and water to support port activities”. This is especially prevalent in less developed regions of Indonesia, where electricity supply is uncertain and there are many power shortages.

The problem of inadequate access to infrastructure may stem from the ways in which Indonesia plans its infrastructural projects. As explained by a leader in the National Development Planning Body,

In terms of infrastructure in general, Indonesia is different from other countries. Other countries do feasibility studies before deciding on the financing scheme. In Indonesia the process is reversed. In Indonesia we determine the financing scheme, either assigning it to SOE, finance through PPP, or through loan, before any feasibility study is conducted. (Stakeholder in the National Development Planning Body)

Respondents claim that “the government needs to improve its analysis on infrastructure development so that it is suitable with the level of development in the economic area”. One respondent went to the extent of explaining that the main obstacle for obtaining a project infrastructure permit is “uncertainty that a project is feasible from a commercial side or whether it drives social and economic improvement”. The primary suggestion for the government to overcome this problem is to establish a “development bureau and masterplan in each city to prevent late development. This biro (bureau) has to use a creative process and innovation in each area should be given to a professional team”.

After infrastructure, land acquisition is the next most problematic business-related variable for port competitiveness. During the FGD sessions, we found that land acquisition conducted by the government still requires an unacceptably long period of time. This creates a problem whereby foreign investors become more hesitant to be part of port infrastructure developments due to the long time required to start construction. We discovered from managers at Jakarta International Container Terminal that the construction of the New Priok Container Terminal One (NPCT1) — a brand-new PPP funded terminal in Tanjung Priok Port off the coastline of the Jakarta Bay — faced a land-acquisition issue with residents. The residents refused to have their houses compulsorily acquired for the construction of a new terminal road. Due to this refusal, the road construction project was forced to change route and be re-designed, to account for the land that it was unable to obtain because of the residents’ refusal to sell.

Where the port workforce is concerned, problematic factors include national work ethic, and lack of education. Interviews indicate that there is a lack of professionalism amongst port staff. Port operator employees are often ill equipped and inexperienced to interact with foreign players due to lack of training provided by the corporation for communication and interaction with foreigners. This lack of experience to interact with foreign players was described in terms of language barriers, feelings of inferiority towards foreigners, and a lack of understanding of foreign work standards such as timeliness and punctuality. Many employees and managers display a lack of trustworthiness and integrity, especially in dealings with foreign players. This adverse attitude to the involvement of foreign players is justified as being a disturbance to local uniqueness.

Interviewees indicated that, within Pelindo I, II, III and IV, many employees were not “forward-looking”. Many of them had been habituated to feel comfortable with the corporation’s current standings and already feel they are accomplished within domestic markets. This mindset leads to unwillingness to involve foreign investors or experts. Along with that, many employees have a pessimistic view towards the vision of new programs, calling them “only dreams” instead of discussing necessary actions to achieve new visions. This is perpetuated by a system of seniority and rigid chain of command amongst the corporation’s organisational structure. This also inhibits the promotion of younger-generation staff into important positions of responsibility, even when those individuals are more open, adaptive, and tech-savvy.

Management inefficiencies still exist. Many of the basic port technologies that we would expect of large ports have only recently been implemented in Tanjung Priok. It is a good sign that representatives in Pelindo recognize the problem of management inefficiency and are implementing technologies such as VTS (Vessel Traffic Service) — the equivalent of Air Traffic Control for ships — MOS (Marine Operating Systems), which allows for port ship communication and planning, TOS (Terminal Operating Systems), which follows terminal cargo, and Container Freight Service Center, which allows customers to electronically track containers. E-Services and Gate Systems have been implemented only since 2015. This shows a lack of capacity to integrate technology into port management systems. Interviews indicate that the two factors preventing early implementation of technologies are the cost of innovations, and the unwillingness of corporate employees to adopt such innovations. Extensive change management is required to introduce and habituate corporate employees, and other stakeholders, to system improvements such as introducing state-of-the-art technologies.

One other point raised by a respondent was that there is “too much bureaucracy in the port, starting for quarantines, customs, and managing permits in government institutions cause the long dwelling time in Indonesia”. Other responses to the survey question concerning operational improvement indicate that improvements are needed in customs clearance.

The last factor that determines Indonesian port competitiveness is business support (Figure 8.4). As a developing country with multiple economic, financial, and technological constraints, business support is an important determinant in deciding the level of accommodation required in Indonesia’s current business-related climate to support port competitiveness. The business-support factors include general macroeconomic factors and infrastructure, and technology that influences business performance and investor willingness. The finance factor includes access to finance and protection, while the business-activities factor includes aspects related to the ease of doing port business.

8.4 Conclusions

The results from this research have identified that the factors influencing Indonesian port competitiveness are numerous. The three distinct factors identified are government support, business support, and operational performance. Both operational performance and business support have been extensively researched and reported on as important factors in existing literature. Government support was developed as another factor that impacts port competitiveness, wherein the government and Pelindo I–IV play an active and dominant role in shaping Indonesia’s port industry.

We found that, even though there is general support towards the government policies in facilitating port investment, there seems to be a substantial gap between policy expectation and policy realisation. This gap is caused by inefficient government bureaucracy, especially in customs clearance and the strategic decision making of dominant port actors such as Pelindo I, II, III and IV. Investors and developers are also deterred by the inconsistent application of policies and the lack of commitment from the government, which causes policy instability and uncertainty. Slow and uncertain land acquisition remains a prevalent problem.

Despite the lack of connectivity, a transparent and a quick process of investment apparently becomes the main agenda of port reformation. Hopefully this self-reflection could help policy makers and port stakeholders in designing a grounded strategy that can boost Indonesian port competitiveness. All these factors work together to impede investor willingness to participate in infrastructure projects.

References

Arvis, J, Saslavsky, D, Ojala, L, Shepherd, B, Busch, C, Raj, A, and Naula, T 2016. Connecting to compete 2016: Trade logistics in the global economy: The Logistics Performance Index and its indicators, Washington D.C., USA: The World Bank, wb-lpi-media.s3.amazonaws.com/LPI_Report_2016.pdf

Carruthers, AM 2016. Developing Indonesia’s maritime infrastructure: The view from Makassar, ISEAS Yusok Ishak Institute, 49, www.iseas.edu.sg/images/pdf/ISEAS_Perspective_2016_49.pdf>

Cheong, I and Suthiwartnarueput, K 2015. ‘ASEAN’s initiatives for regional economic integration and the implications for maritime logistics reforms’, The International Journal of Logistics Management, 26:3, pp. 479–93, https://doi.org/10.1108/IJLM-08-2013-0092

Cullinane, K, Fei, WT and Cullinane, S 2004. ‘Container terminal development in Mainland China and its impact on the competitiveness of the port of Hong Kong’, Transport Reviews,24:1, pp. 33–56, https://doi.org/10.1080/0144164032000122334

Dang, VL and Yeo, GT 2017. ‘A competitive strategic position analysis of major container ports in Southeast Asia’, The Asian Journal of Shipping and Logistics, 33:1, pp. 19–25, https://doi.org/10.1016/j.ajsl.2017.03.003

Dappe, MH and Suárez-Alemán, A 2016. Competitiveness of South Asia’s container ports: A comprehensive assessment of performance, drivers, and costs, Washington D.C., USA: The World Bank, www.worldbank.org/en/news/press-release/2017/04/27/port-performance-south-asia-better-still-expensive-slow-report

De Martino, M and Morvillo, A 2008. ‘Activities, resources and inter-organizational relationships: Key factors in port competitiveness’, Maritime Policy and Management, 35:6, pp. 571–89, https://doi.org/10.1080/03088830802469477

De Langen, P 2004. ‘Governance in Seaport Clusters’, Maritime Economics and Logistics, 6:2, pp. 141–56, https://doi.org/10.1057/palgrave.mel.9100100>

Dwarakish, GS and Salim, AM 2015. ‘Review on the role of ports in the development of a nation’, Aquatic Procedia, 4, pp. 295–301, https://doi.org/10.1016/j.aqpro.2015.02.040

Grosso, M and Monteiro, F 2009. ‘Relevant strategic criteria when choosing a container port — The case of the port of Genoa’, European Transport Conference, 3:4, pp. 299–306.

Kamaluddin, R 2003. Ekonomi transportasi: Karakteristik, teori, dan kebijakan, Jakarta, Indonesia: Ghalia Indonesia.

Kim, JY 2014. ‘Port user typology and representations of port choice behavior: A Q-methodological study’, Maritime Economics and Logistics, 16:2, pp. 165–87, https://doi.org/10.1057/mel.2013.26

Kutin, N, Nguyen, TT and Vallée, T 2017. ‘Relative efficiencies of ASEAN container ports based on data envelopment analysis’, The ASIAN Journal of Shipping and Logistics, 33:2, pp. 67–77, https://doi.org/10.1016/j.ajsl.2017.06.004

Lee, S, Song, D and Ducruet, C 2008. ‘A Tale of Asia’s world ports: The spatial evolution in global hub port cities’, Geoforum, 39:1, pp. 372–85, https://doi.org/10.1016/j.geoforum.2007.07.010

Leinbach, TR 1995. ‘Transport and Third World development: review, issues, and prescription’, Transportation Research Part A: Policy and Practice, 29:5, pp. 337–44, https://doi.org/10.1016/0965-8564(94)00035-9

Lin, LC and Tseng, CC 2007. ‘Operational performance evaluation of major container ports in the Asia-Pacific region’, Maritime Policy and Management, 34:6, pp. 535–51, https://doi.org/10.1080/03088830701695248

Lirn, TC, Thanopoulou, HA, Beynon, MJ and Beresford, AKC 2004. ‘An application of AHP on transhipment port selection: A global perspective’, Maritime Economics and Logistics, 6:1, pp. 70–91, https://doi.org/10.1057/palgrave.mel.9100093

Maulana, R 2018. ‘Pendapatan Pelindo I–IV Tahun Lalu Tembus Rp24 Triliun’, Bisnis Indonesia, industri.bisnis.com/read/20180122/98/729300/pendapatan-pelindo-i-iv-tahun-lalu-tembus-rp24-triliun

Merk, O 2013. ‘The competitiveness of global port-cities: Synthesis Report’, in OECD Regional Development Working Papers, no. 2013/13, Paris, France: OECD Publishing, https://doi.org/10.1787/5k40hdhp6t8s-en

Ministry of National Development Planning 2014. Rencana Pembangunan Jangka Menengah Nasional (RPJMN) 2015–2019: Buku I: Agenda Pembangunan Nasional, www.bappenas.go.id/id/data-dan-informasi-utama/dokumen-perencanaan-dan-pelaksanaan/dokumen-rencana-pembangunan-nasional/rpjp-2005-2025/rpjmn-2015-2019/

Ministry of Transportation 2013. ‘The future of Indonesia’s port system’, paper presented at the Port Development and Expansion Asia 2013 Conference, November, Jakarta, Indonesia, www.iqpc.com/media/1000519/29609.pdf

Ministry of Transportation Directorate General of Sea Transportation 2015. Keputusan Direktur Jenderal Perhubungan Laut Nomor UM.008/100/19/DJPL-15 Tentang Rencana Strategis (RENSTRA) Direktorat Jenderal Perhubungan Laut Tahun 2015-2019, hubla.dephub.go.id/kebijakan/Rencana%20Strategis/RENSTRA%20DJPL%202015%20-%202019.pdf

Nirwan, E 2017. Financing solution for port sector, unpublished paper, Jakarta, Indonesia: PT Bank Mandiri.

Parola, F, Risitano, M, Ferretti, M and Panetti, E 2016. ‘The drivers of port competitiveness: A critical review’, Transport Reviews, 37:1, pp. 116–38, https://doi.org/10.1080/01441647.2016.1231232

Sandee, H 2011. ‘Promoting regional development in Indonesia through better connectivity’, World Bank News, www.worldbank.org/en/news/opinion/2011/03/13/promoting-regional-development-indonesia-through-better-connectivity

Schwab, K 2017. The global competitiveness report 2017–2018, World Economic Forum Reports, www.weforum.org/reports/the-global-competitiveness-report-2017-2018

Sheng, LJ 2015. Indonesia’s new administration: Infrastructure and manufacturing opportunities, IE Insights, 21, www.iesingapore.gov.sg/-/media/IE-Singapore/Files/Publications/IE-Insights/Vol-21-Indonesia-New-Administration-Infrastructure-and-Manufacturing-Opportunities.ashx

Steven, AB and Corsi, TM 2012. ‘Choosing a port: An analysis of containerized imports into the US’, Transportation Research Part E: Logistics and Transportation Review, 48:4, pp. 881–95, https://doi.org/10.1016/j.tre.2012.02.003

Tang, LC, Low, JMW and Lam, SW 2008. ‘Understanding port choice behaviour — A network perspective’, Network and Spatial Economics, 11:1, pp. 65–82, https://doi.org/10.1007/s11067-008-9081-8

Van Dijk, C, van de Mheen, P and Bloem, M 2015. Indonesia maritime hotspot, Rotterdam, The Netherlands: Nederland Maritiem Land, www.maritiemland.nl/wp-content/uploads/2015/09/NML-serie-44-Indonesia-Maritime-Hotspot.pdf

Walter, CK and Poist, RF 2003. ‘Desired attributes of an inland port: Shipper vs. carrier perspectives’, Transportation Journal, 42:5, pp. 42–55, www.jstor.org/stable/20713548

Wiranta, S 2003. Pengembangan Jasa Transporatasi Laut dalam Rekonstruksi Ekonomi, Jakarta, Indonesia: Pusat Penelitian Ekonomi Lembaga Ilmu Pengetahuan Indonesia.

World Bank n.d. World development indicators, databank.worldbank.org/data/reports.aspx?source=2andseries=IS.SHP.GOOD.TUandcountry

Yuen, CA, Zhang, A and Cheung, W 2012. ‘Port competitiveness from the users’ perspective: An analysis of major container ports in China and its neighboring countries’, Research in Transportation Economics, 35:1, pp. 34–40, https://doi.org/10.1016/j.retrec.2011.11.005

1 Associate Professor, Dept. of Management, Faculty of Economics and Business, Universitas Indonesia.

2 Former student in Dept. of Management, Faculty of Economics and Business, Universitas Indonesia.

3 Senior Lecturer and Academic Specialist, Dept. of Infrastructure Engineering, School of Engineering, The University of Melbourne.