3. Public Investment in Germany: The Need for a Big Push

© Chapter authors, CC BY 4.0 https://doi.org/10.11647/OBP.0222.03

Introduction

For a number of years, Germany has been at the centre of the European debate about increasing public investment. With record-large current account surpluses, increasing public investment in Germany has often been seen as a possible remedy to imbalances in the euro area (OECD 2016; IMF 2018). Within Germany, the debate has focused on insufficiencies of the public capital stock and especially public infrastructure and has intensified over time (Expertenkommission 2015; Bardt et al. 2019), with the federation of German trade unions (DGB) and the federation of German industries (BDI) jointly endorsing a big, debt-financed, ten-year investment programme in November 2019.

This chapter takes a closer look at public investment in Germany. It first describes the development of German public investment and the German public capital stock over the past decades (section 3.1.), then defines quantitatively and qualitatively needs for public investment (section 3.2.) and gives a first model-based evaluation on the economic effects of a debt-financed, ten-year €450 bn public investment programme (section 3.3.) both on the German economy and on other euro area countries.

3.1. The German Public Capital Stock

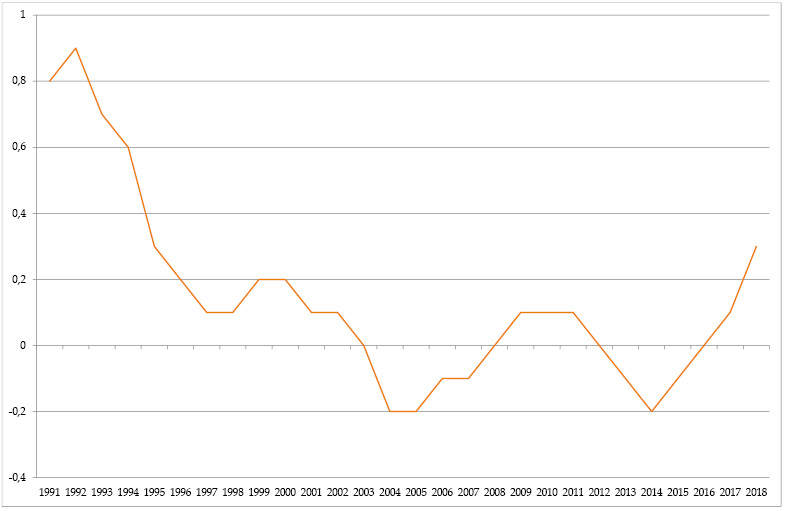

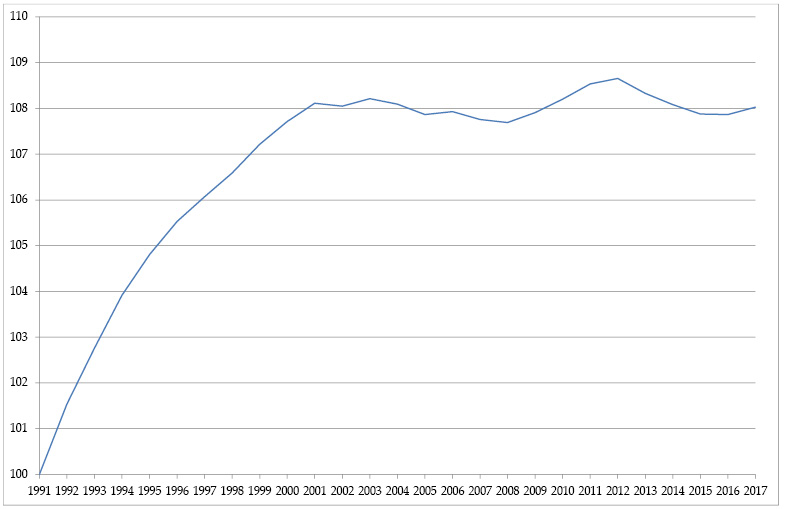

After the unification boom at the beginning of the 1990s, public investment in Germany has steadily declined. Net public investment (gross public investment minus depreciations) dropped from almost 1% of GDP in the early 1990s to around 0.2% of GDP towards the end of the decade and turned negative in 2004. Since then, it has been hovering around zero (Figure 1). As a consequence, while Germany’s population and GDP have still been growing, its public capital stock net of depreciation has been stagnating for the past two decades (Figure 2), resulting in a falling ratio of public capital stock to GDP. Lately, increases in public investment spending have led to a slight increase in the net investment-to-GDP ratio, but the increase has been too small to stop the declining trend in the public capital stock to GDP.4

The stagnation of the public capital stock has become a problem for the economy at large. While the large bulk of overall investment takes place in the private sector, government investment plays a decisive role. Government investment provides important public goods and is often complementary in private production and investment. State-owned infrastructure, such as transport networks and energy grids, is a crucial factor affecting potential output and productivity growth (Baxter and King 1993; Clemens, Goerge and Michelsen 2019).5 It is hence plausible that the weakness in private sector fixed capital formation in Germany is at least partly a consequence of insufficient public investment.

Fig. 1 Net public investment in Germany, in percentage of GDP, 1991–2018

Source of data: Destatis 2019. Figure created by the authors.

Fig. 2 Net capital stock in Germany from 1991–2018, in constant prices (index, 1991 = 100)

Source of data: Destatis 2018. Figure created by the authors.

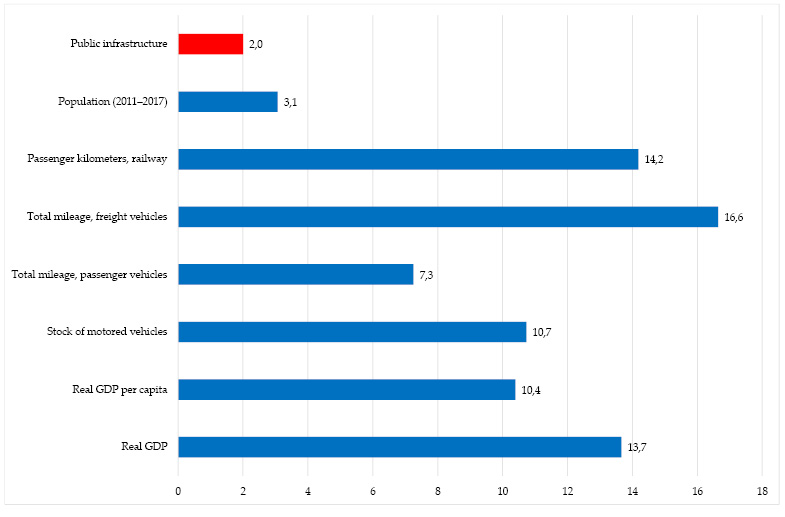

In particular, transport infrastructure is a fundamental factor for economic growth. Insufficiently maintained and expanded, it can lead to delays in passenger and goods transport. In the case of Germany, while the gross stock of publicly owned structures (a large part of which is transport infrastructure) has only marginally grown since the beginning of the decade, passenger as well as freight vehicle and railway traffic expanded considerably, both in absolute and per-capita terms (Figure 3). For example, the overall freight mileage on German roads increased by 16.6% between 2010 and 2017, while the economy grew by only 13.7%.6 Moreover, this data probably even underestimates the degree of underinvestment, as the gross capital stock concept ignores the wear and tear of the roads and bridges.

For evaluating the quality of German infrastructure, it is important to keep in mind that vast parts of it were built during the major construction programs in the 1970’s in the West and in the 1990’s in the East. For example, almost half of all motorway bridges (measured by surface area) were built between 1965 and 1975 (Bundesministerium für Verkehr und digitale Infrastruktur 2016, p. 2). Those bridges were not designed to carry today’s heavy traffic and would require a complete overhaul even if they had been properly maintained over the last decades (which often has not been the case).

All in all, expanding traffic volumes are pushed through an outdated transport infrastructure of deficient quality. This is also felt by the German business sector: in a recent survey, two thirds of German companies stated that their business was regularly hindered by deficiencies in the public infrastructure, especially by unsatisfactory traffic conditions (Grömling and Puls 2018).

Fig. 3 Development of various economic indicators in Germany, percentage change 2010–2017

Source of data: Dullien and Rietzler (2019). Figure created by the authors.

The poor development of the German public investment of the last decades can be traced back to several, partly interlinked causes (Bardt et al. 2019).

First, from a politician’s point of view, cutting infrastructure investment has the advantage that citizens usually only become aware of the infrastructure deterioration with a delay. So, especially when confronted with the need of cutting public deficits, investment cutbacks can become a preferred choice and might therefore be implemented before taxes are raised or other government expenditure is cut.

Second, economists and officials for a long time assumed an imminent decline in Germany’s working population and potential GDP growth rate, which did not materialize. A smaller economy would have needed a smaller capital stock, and debt dynamics would have been more toxic under more pessimistic growth assumptions. As a consequence, third, the so-called debt brake (“Schuldenbremse”) was written into the German constitution which limits structural public sector deficits to 0.35% of GDP, replacing the former Golden Rule of public finance which allowed the government to borrow for investment purposes.

Fourth, welfare reforms shifted the fiscal burden of unemployment towards the municipalities. As in Germany, the municipal level is in charge of maintaining a large part of road infrastructure, public transport, schools and other local infrastructure, this further squeezed out public investment. This trend has been aggravated by the fact that the Länder (the federal states) had to move towards balanced budgets under the debt brake and have hence cut their respective transfers to the municipalities’ budgets.

In a nutshell, due to fiscal consolidation pressure, investment in public infrastructure has been greatly neglected in Germany in recent decades. This has resulted in the deterioration and depletion of Germany’s public capital stock that does not anymore meet the requirements of a modern economy.

3.2. Quantifying Investment Needs

In addition to the gradual closing of the accumulated infrastructure gap, imminent challenges for the German economy require massive additional investments. Decarbonization in accordance with the Climate Action Plan 2050 will need additional spending on the expansion of renewables, modernization of the energy and transport networks, as well as making existing residential buildings more energy-efficient. To cushion demographic change, it is necessary to invest more in early childhood education and care. Early childhood education increases people’s chances of a productive participation in the economy later in life, while childcare makes it possible to boost the current labour force participation by enabling both parents to work.

In what follows, we outline the rough estimation of the magnitude of the required public investment in Germany in the upcoming decade, adopted from Bardt et al. (2019). The term “investment” is used here in a broad sense, so that it also includes government measures to promote private investment (such as subsidies for energy-efficient building refurbishment) or spending on human capital development, which is not accounted for as public investment in the national accounts. The concept of public investment is thus defined as government expenditures capable of increasing the production potential of the German economy in the future or of generating long-term net returns to the economy as a whole. As the counterfactual scenario, we assume a price-adjusted continuation of the investment positions listed in the government budget 2019.

Indeed, every attempt of such a comprehensive calculation is vulnerable to critique. For example, one can argue that suggested figures in specific areas are too high or too low. However, our estimations are based on well-founded studies of individual sectors and, most important, the goal of this exercise is only to deliver a convincing first idea of the rough monetary size of the overall economic challenge to be addressed.

For a ten-year horizon, our estimate of the investment requirements in Germany (based on Bardt et al. 2019) includes:

- Repair and modernization of public infrastructure: the municipal panel of the public KfW bank states an investment need of €138.4 bn (Kreditanstalt für Wiederaufbau 2019). For this paper, it is assumed that the infrastructure gap should be closed within ten years.

- Significant expansion of early childhood education and full-day schooling is desirable and economically efficient from a demographic point of view. Over ten years, the necessary investment adds up to €50 bn for the improvement of early childhood education, as well as €9 bn for the construction and €25.5 bn for the operation of full-day schools (Krebs and Scheffel 2019).

- Expansion of the local public transport is necessary to enable decarbonization. Currently, infrastructure projects of around €8.2 bn have been registered or accepted for financing via the Municipal Transport Financing Act (Gemeindeverkehrsfinanzierungsgesetz — GVFG). If investment were to be financed from existing funds provided under the GVFG, it would take twenty-four years to complete these projects. In order to ensure their finalization within the next decade, larger funds are required. According to surveys among providers of local public transport, €15 bn are needed here (Verband Deutscher Verkehrsunternehmen 2017). All in all, investment needs sum up to approximately €20 bn in this sector.

- The long-distance and freight services of the German railway (Deutsche Bahn) also require a massive modernization and capacity expansions. The necessary investment adds up to €60 bn. In addition, an expenditure of approximately €20 bn is needed for the maintenance and refurbishment of German highways.

- In comparison to other rich countries, Germany lags behind in both financing of universities and promotion of research and development. Overall, additional expenditure of €2.5 bn per year should be budgeted to modernize universities and strengthen research funding.

- There is currently a housing shortage in many large German cities. Yet, estimates for the demand for residential dwellings in the coming years differ. Ralph Henger and Michael Voigtländer (2019) expect that, due to the current construction activity, the housing market will gradually relax. However, Till Baldenius, Sebastian Kohl and Moritz Schularick (2019) conclude that the lack of housing will continue until 2030, especially in metropolitan areas. Either way, at least €1.5 bn per year are needed as additional public incentive for housing construction.

- In Germany, the telecommunication network coverage is poor by international standards, particularly outside big cities. A country-wide expansion of broadband internet would cost 60 to €100 bn (Expertenkommission 2015), a 5G network expansion some €60 bn more. Much of these expenses are likely to come from private telecom operators. Still, public funding is crucial to mend the patches in digital infrastructure. We assume that a government spending of €20 bn will be necessary in the coming ten years.

- The decarbonization of the German economy poses a particular challenge. Current studies show that, in sum, between €1700 bn (Dena 2018) and €2300 bn (Gerbert and others 2018) will be required to reduce the German economy’s carbon emissions by 95% until 2050. If one takes the lower limit of the estimated cost and distributes the total expenditure over the entire period up to 2050, further assuming that the state bears approximately 15% of the costs, then a public investment need of approximately €7.5 bn per year results.

Table 1 summarizes the above calculation. All in all, public investment needs sum up to a volume of at least €450 bn over the next ten years. The required financing is thus not excessively large in relation to the German economic output. Spread over the years, this would average an annual additional expenditure of around €45 bn, which corresponds to approximately to 1.3% of GDP.

There is no good economic reason why the type of investments listed above should be paid from the current year’s budget. On the contrary, as the investments benefit many generations to come, it is reasonable to spread also the cost over several generations. For example, decarbonization will lead to a massive reduction in Germany’s energy import bill. Today’s expenditure will thus be offset by saved costs in the future. Similarly, improvements in early childhood education today are expected to translate into higher employment, higher productivity and higher incomes in the future.

Moreover, current financing conditions for Germany are extremely favourable, such that long-term bond (with maturity of at least ten years) yields are negative. In other words, Germany would not have to pay back the full amount of debts taken on today. At the same time, the German government debt-to-GDP ratio has been steadily decreasing in the recent years and is about to fall below the 60% benchmark. Combined with the long-term productivity effects of the above described public investment, it is advisable to enable debt-financing of the investment program. It would be inefficient and unfair to burden the current generation with the entire cost of the restructuring of the economy. Much worse, it would be greatly dangerous to forgo current and future opportunities because of fear of an increase in public borrowing.

The actual fiscal policy framework — including the debt brake, the Stability and Growth Pact and the Fiscal Compact — should therefore be used (and, if necessary, modified) in a way that the financing of investment requirements becomes possible through new borrowing. From the economic point of view, it makes sense to follow a Golden Rule which exempts investment — at least up to a fixed amount — from the deficit limit, as in Truger (2016).

Table 1 Public investment requirements in Germany

|

|

Sum over 10 years, base year prices (bn €) |

|

Infrastructure investment on municipal level |

|

|

Updating of existing local infrastructure |

138 |

|

Public transport |

20 |

|

Education |

|

|

Early childhood education |

50 |

|

Development of full-day schooling |

9 |

|

Operation of full-day schooling |

25 |

|

Funding of universities and R&D |

25 |

|

Housing investment |

|

|

Public sector share |

15 |

|

Interregional infrastructure |

|

|

Broadband internet/5G |

20 |

|

Railway |

60 |

|

Highways |

20 |

|

Decarbonization |

|

|

Public sector share |

75 |

|

Total |

457 |

Source of data: Bardt et al. (2019).

There are two possibilities for the technical implementation of such a Golden Rule. Firstly, it would be conceivable to change the German constitution. Secondly, one could use the room for flexibility built in the debt brake so that debt financing of new investment becomes feasible. For example, a separate legal entity (fully owned by the federal government) could be established as a federal investment fund for development goals, responsible of precisely defined investment tasks. This entity could be allowed to borrow while its debt is not counted under the German debt brake. The local authorities could then lease the corresponding capital goods from this fund against payment of the financing costs and depreciation. In this way, an amendment of the constitution would not be necessary.

The European budget rules would count such an entity to the public sector, but since Germany’s public debt is expected to fall under the 60% benchmark, the usual fiscal rules will be relaxed, so that the limit for the medium-term structural deficit rises from 0.5% to 1% of GDP. Moreover, Germany could (and should) lobby at the European level for an exemption from new borrowing for certain types of growth enhancing green investment.

3.3. Macroeconomic Implications of a Public Investment Program in Germany

It is important to consider the potential macroeconomic effects of such a large investment program for Germany, and its spillover effects for the rest of the euro area. In this section, we use a modified version of the NiGEM model developed by the National Institute of Economic and Social Research (NIESR)7 to come up with some first evaluations.

In line with current market-based EONIA forecasts (European Central Bank 2019), our baseline forecast assumes that the ECB’s monetary policy stance will remain accommodative for a prolonged period of time. Specifically, we assume ECB interest rates to remain zero well into the 2020s and thereafter slowly rise to 1%. From a fiscal policy perspective, our baseline forecast fully adheres to the German debt brake, so that budget deficits are ruled out. This restriction is removed for the shock scenario.

The scenario for our proposed €450 bn debt-financed public investment program is modelled as follows: quarterly public investment is assumed to be €11.25 bn (about 1.5% of GDP) higher vis-à-vis our baseline forecast starting in the first quarter of 2020 and remaining so over a period of ten years. Importantly, we model this additional public spending as entirely debt-financed. In addition, we assume the ECB’s policy rate to remain constant at the baseline rate.

The government investment program triggers an increase in accumulation of both public and private capital. The capital build-up acceleration peaks at the end of the investment program with the overall capital stock being 4% higher than in the baseline.

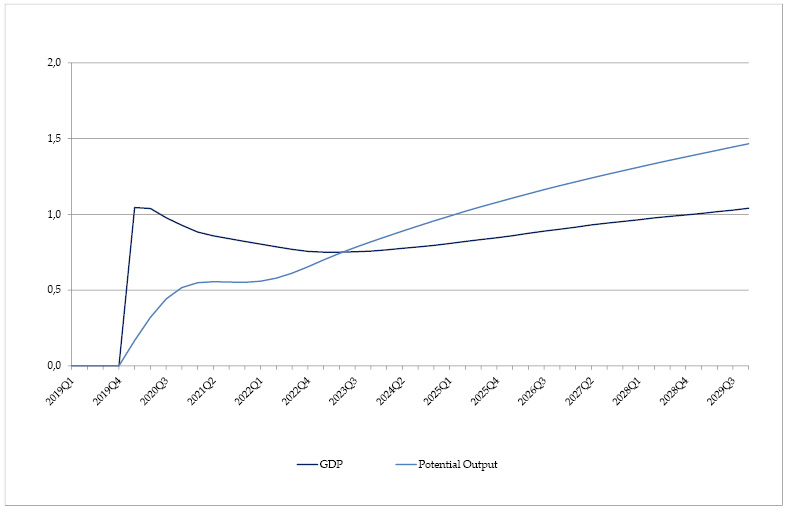

The simulated investment program results in a significant boost to the German economy with GDP initially increasing slightly above 1% vis-à-vis the baseline and about 0.9% (again vis-à-vis the baseline) on average during the public investment program span (Figure 4). Importantly, GDP remains persistently higher, also after the end of the investment program. Due to the increased overall capital stock, potential output increases and remains sustainably higher even beyond 2029, reaching a level of about 1.5% above the baseline in 2029.

Fig. 4 German GDP and potential output increase, level difference in %

Source of data: NiGEM. Figure created by the authors.

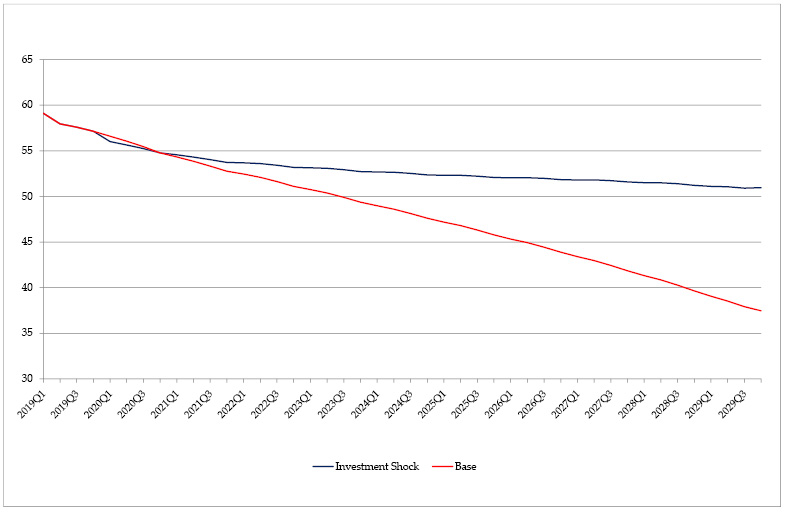

As mentioned above, the investment program is assumed to be completely debt-financed with tax rates kept constant. The evolution of the government debt ratio under the debt-financed public investment program together with the debt ratio of our baseline forecast is shown in Figure 5. Relative to the baseline, the reduction of the debt-to-GDP ratio slows significantly. However, despite the additional borrowing, the ratio continues to fall and constantly stays on the modest level of just above 50% of GDP (Figure 5). Hence, the simulation shows that it is possible to implement a comprehensive public investment program without jeopardizing debt sustainability.

Another important result of our simulation is that the program in fact leads to a reduction in the German current account surplus which falls by almost 1.3 percentage points. The rebalancing is possible through a stark increase in imports, whereas exports essentially remain unchanged.

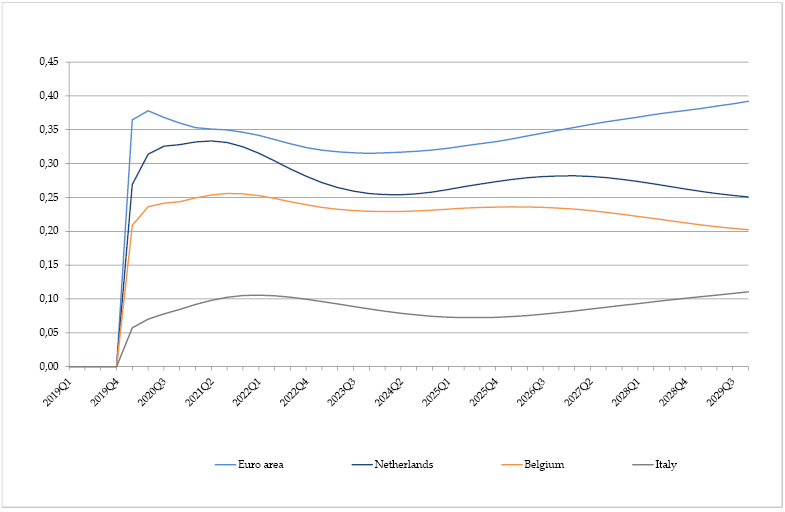

Last but not least, the investment expenditure triggers positive spillover effects on other euro countries. The main beneficiaries of the German fiscal expansion seem to be the nearest small open economies, such as Belgium, Netherlands and Austria (Figure 6). These countries experience a substantial boost to GDP which increases by 0.2 to 0.45% vis-à-vis baseline GDP over the duration of the investment program. GDP in the euro area in total will be positively affected by around 0.4%, again vis-à-vis the baseline.

Fig. 5 Government debt, in percentage of GDP

Source of data: NiGEM. Figure created by the authors.

All in all, the proposed debt-financed public investment plan has the potential to bring about substantial and continuous boost to economic activity in Germany, stimulating domestic demand in the short run and increasing the country’s public and private capital stock in the long run. In addition, our results indicate that such an investment program would considerably rebalance the German current account bringing it in line with levels agreed on under the European Commission’s Macroeconomic Imbalance Procedure. Moreover, positive spillover effects are likely to follow in the rest of the euro area. Crucially, the investment program does not have to impede the soundness of the German public finance.

Fig. 6 GDP of selected countries and euro area, deviation from baseline, level difference in percent

Source of data: NiGEM. Figure created by the authors.

Conclusion

This chapter has argued that the stagnating German public capital stock poses significant risks for future economic growth of the country. Various indicators point at severe and persistent underinvestment, a significant part of which can be traced back to lack of funding. Additional investment needs have been estimated to be roughly €450 bn over the coming decade. As simulations show, such a program could be entirely debt-financed while keeping the German debt-to-GDP ratio below the Maastricht threshold of 60% of GDP. Moreover, it would significantly lift both German potential and actual GDP. It would also contribute to bring Germany’s current account surplus from its currently very high levels of 7–8% to below 4%, bringing it in line with the levels set by the European Commission’s Macroeconomic Imbalances Procedures. Whilst the spillover effect to other European economies would be limited, they will nevertheless be felt positively and might even be reinforced if other European governments follow the German example and also start modernizing their public capital stocks.

A potential obstacle might be existing fiscal rules such as the German debt brake, but at least for a significant part of the investments needed, technical solutions such as public entities devoted to investments could allow some sort of debt-financing. Beyond what is possible under current fiscal rules, a reform of the legal framework should be considered, given that it has been designed under the assumption of persistently much higher interest rates compared to what we have been observing in the past years, and given that sticking to current fiscal rules while neglecting much needed public investment might carry high welfare costs.

References

Baldenius, T., S. Kohl and M. Schularick (2019) Die neue Wohnungsfrage: Gewinner und Verlierer des deutschen Immobilienbooms. Bonn: Macrofinance Lab, https://pure.mpg.de/rest/items/item_3070687_1/component/file_3070688/content

Bardt, H., S. Dullien, M. Hüther and K. Rietzler (2019) “Für eine solide Finanzpolitik: Investitionen ermöglichen!”, IMK-Report 152.

Baxter, M. and R. G. King (1993) “Fiscal Policy in General Equilibrium”, American Economic Review, 83(3): 315–34.

Behrend, A., K. Gehr, C. Paetz, T. Theobald and S. Watzka (2019) Europa kann es besser: Wirtschaftspolitische Szenarien für stabileres Wachstum und mehr Wohlstand. Bonn: Friedrich-Ebert-Stiftung, http://library.fes.de/pdf-files/fes/15862.pdf

Blanchard, O. (2019) “Public Debt and Low Interest Rates”, American Economic Review, 109(4): 1197–229, https://doi.org/10.1257/aer.109.4.1197

Bundesministerium für Verkehr und digitale Infrastruktur (2016) “Stand der Ertüchtigung von Straßenbrücken der Bundesfernstraßen”, https://www.bmvi.de/SharedDocs/DE/Anlage/StB/bericht-stand-der-modernisierung-von-strassenbruecken-2016.pdf?__blob=publicationFile

Clemens, M., M. Goerge and C. Michelsen (2019) “Öffentliche Investitionen sind wichtige Voraussetzung für privatwirtschaftliche Aktivität”, DIW-Wochenbericht 31: 537–43, https://www.diw.de/documents/publikationen/73/diw_01.c.670904.de/19-31-3.pdf

Dena (2018) dena-Leitstudie Integrierte Energiewende: Impulse für die Gestaltung des Energiesystems bis 2050. Berlin: Deutsche Energie-Agenture GmbH (dena), https://www.dena.de/fileadmin/dena/Dokumente/Pdf/9261_dena-Leitstudie_Integrierte_Energiewende_lang.pdf

Destatis (2018) “Anlagevermögen nach Sektoren ab 1991 bis 2017 — Stand: August 2018”, https://www.destatis.de/DE/Themen/Wirtschaft/Volkswirtschaftliche-Gesamtrechnungen-Inlandsprodukt/Publikationen/Downloads-Vermoegensrechnung/anlagevermoegen-sektoren-5816101187004.html

Destatis (2019) “Investitionen — 2. Vierteljahr 2019”, https://www.destatis.de/DE/Themen/Wirtschaft/Volkswirtschaftliche-Gesamtrechnungen-Inlandsprodukt/Publikationen/Downloads-Inlandsprodukt/investitionen-pdf-5811108.html

Dullien, S. (2017) A New “Magic Square” for Inclusive and Sustainable Economic Growth: A Policy Framework for Germany to Move Beyond GDP. Bonn: Friedrich-Ebert-Stiftung.

Dullien, S. and K. Rietzler (2019) “Verzehrt Deutschland seinen staatlichen Kapitalstock? — Replik”, Wirtschaftsdienst 99(4): 286–91, https://doi.org/10.1007/s10273-019-2445-5

Earthman, G. I. (2017) “The Relationship between School Building Condition and Student Achievement: A Critical Examination of the Literature”, Journal of Ethical Educational Leadership, 4(3): 1–16.

European Central Bank (2019) “Economic Bulletin 06/2019”, https://www.ecb.europa.eu/pub/economic-bulletin/html/eb201906.en.html

Expertenkommission (2015) Stärkung von Investitionen in Deutschland: Abschlussbericht. Berlin: Bundesministerium für Wirtschaft und Energie, https://www.bmwi.de/Redaktion/DE/Publikationen/Studien/staerkung-von-investitionen-in-deutschland.pdf?__blob=publicationFile&v=11

Gerbert, P., P. Herhold, J. Burchardt, S. Schönberger, F. Rechenmacher, A. Kirchner, A. Kemmler and M. Wünsch (2018) “Klimapfade für Deutschland”, https://www.zvei.org/fileadmin/user_upload/Presse_und_Medien/Publikationen/2018/Januar/Klimapfade_fuer_Deutschland_BDI-Studie_/Klimapfade-fuer-Deutschland-BDI-Studie-12-01-2018.pdf

Grömling, M. and T. Puls (2018) “Infrastrukturmängel in Deutschland: Belastungsgrade nach Branchen und Regionen auf Basis einer Unternehmensbefragung”, IW-Trends 45(2): 89–105.

Henger, R. and M. Voigtländer (2019) “Ist der Wohnungsbau auf dem richtigen Weg?: Aktuelle Ergebnisse des IW-Wohnungsbedarfsmodells”, IW-Report 28.

Hüther, M., “10 Jahre Schuldenbremse: Ein Konzept mit Zukunft?”, IW Policy Paper 3

IMF (2018) “Germany: Staff Concluding Statement of the 2018 Article IV Mission”, https://www.imf.org/en/News/Articles/2018/05/14/Germany-Staff-Concluding-Statement-of-the-2018-Article-IV-Mission

Krebs, T. and M. Scheffel (2017) “Öffentliche Investitionen und inklusives Wachstum in Deutschland”, Bertelsmann Stiftung, Inklusives Wachstum für Deutschland, https://www.bertelsmann-stiftung.de/fileadmin/files/BSt/Publikationen/GrauePublikationen/NW_OEffentliche_Investitionen_und_inklusives_Wachstum.pdf

Kreditanstalt für Wiederaufbau (2019) “KfW-Kommunalpanel 2019”, https://www.kfw.de/PDF/Download-Center/Konzernthemen/Research/PDF-Dokumente-KfW-Kommunalpanel/KfW-Kommunalpanel-2019.pdf

OECD (2016) OECD Economic Surveys: Germany 2016. Paris: OECD Publishing.

Rachel, L. and L. Summers (2019) “On Secular Stagnation in the Industrialized World”, NBER Working Paper w26198, https://doi.org/10.3386/w26198

Truger, A. (2016) “The Golden Rule of Public Investment — a Necessary and Sufficient Reform of the EU Fiscal Framework?”, IMK Working Paper 168.

Verband Deutscher Verkehrsunternehmen (2017) “Deutschland mobil: Handlungsempfehlungen für die 19. Legislaturperiode des Deutschen Bundestages”, https://www.vdv.de/neue-mobilitaet-fuer-ein-mobiles-land.pdfx

World Bank (2019) “Gross Fixed Capital Formation in % of GDP, Years 1970 to 2018”, https://data.worldbank.org/indicator/NE.GDI.FTOT.ZS?end=2017&most_recent_value_desc=true&start=1970

1 Hochschule für Technik und Wirtschaft — HTW Berlin; Institut für Makroökonomie und Konjunkturforschung — IMK.

2 Institut für Makroökonomie und Konjunkturforschung — IMK.

3 Institut für Makroökonomie und Konjunkturforschung — IMK.

4 Given reasonable assumptions about the trend growth of German GDP, net public investment of 0.6 % of GDP are necessary to keep the public capital stock-to-GDP ratio constant. See Dullien (2017).

5 Clemens, Goerge and Michelsen (2017) find that 1 bn euro of public investment in Germany will increase private investment by around 1.1 bn euro after around five years.

6 One reason for the disproportional increase for transport services has been the eastward expansion of the European Union and Germany’s central geographical location within the EU.

7 NiGEM is a comprehensive multi-country simulation and forecasting model for the global economy with detailed country models for all OECD countries as well as numerous emerging nations. See also nimodel.niesr.ac.uk/. We use a slightly modified version with re-estimated import equations for Germany, France, Italy and Spain (see Behrend et al. 2019).