The hall of the Ganz factory in Budapest (1922), Fortepan 95160, Hungarian Geographical Museum, Slide Collection, https://fortepan.hu/hu/photos/?id=95160.

Entrepreneurs, Companies and Markets

5.1.1 Entrepreneurs, Markets and Companies in Early Modern History (ca. 1500–1800)

© 2023 Lozano, Conrad, and Leng, CC BY-NC 4.0 https://doi.org/10.11647/OBP.0323.52

Introduction

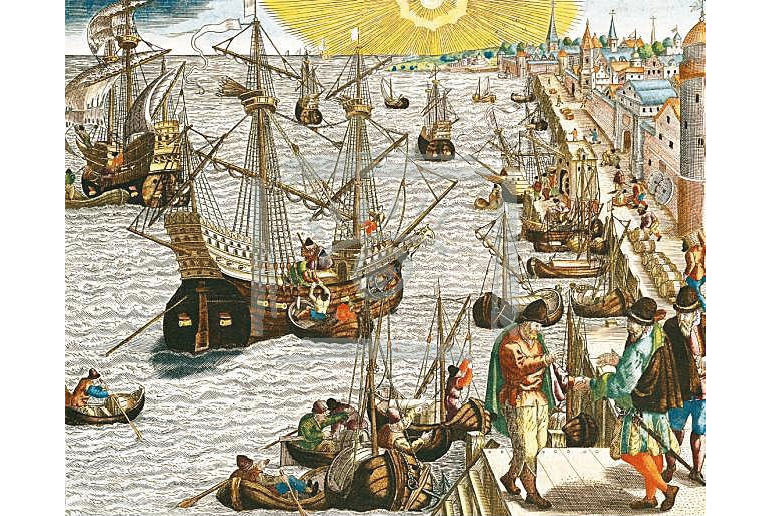

One defining feature of the early modern period as traditionally understood is the expansion of European influence across the globe, initiated by the exploratory voyages of Columbus and Vasco da Gama. As well as marking the beginnings of modern European empires and the subsequent expropriation of land and resources, the position of Europe within the Eurasian economy was transformed by direct sea access to its Chinese and Indian Ocean heartlands. Importantly, this was a competitive process amongst European states, which adopted different institutional solutions to the problems of accessing and controlling distant markets. This chapter begins by discussing how the Portuguese and Spanish empires attempted to secure the gains of their overseas possessions through the regulation of shipping and traffic. By the late sixteenth century, the Iberian monopoly was under pressure from the northern European Atlantic powers, and both the Dutch Republic and England came to rely on novel corporations to spearhead their challenges. Institutional innovation was thus associated with intra-European competition for global leadership: as well as a ‘great divergence’ between a Europe heading towards industrialisation and the rest of the world, the early modern period saw divergences within Europe and a shift in the economic centre from south to north. This cannot wholly be explained with reference to the global economy: the divergence between the labour regimes of Western and Eastern Europe had deeper roots. Divergence does not preclude integration, however, and the chapter ends by considering how the rise of the Northwestern European economies influenced the development of those East of the Elbe.

Fig. 1: Theodor de Bry, Departure from Lisbon for Brazil, the East Indies and America, engraving from ca. 1592, Public Domain, Wikimedia, https://commons.wikimedia.org/wiki/File:Departure_of_fleet_from_Lisbon_harbor.jpg.

The Portuguese Trading Empire

Against a backdrop of religious clashes in the Mediterranean, the spice route was virtually blocked for the Christian powers as the late Middle Ages progressed. After the Portuguese conquest of Ceuta (1415), the expansionist aspirations of the Infante Henry the Navigator led to the exploration of the East coast of Africa, which he circumnavigated to reach India. The Portuguese expeditionaries set up factories, military posts, and trading enclaves, establishing one of the main centres of the slave trade in the Gulf of Guinea. From these enclaves they gained access to and partially controlled the Atlantic trade routes and, after Vasco da Gama’s voyage, the Indian Ocean. At the same time, Pedro Álvares Cabral began the Portuguese expansion into Brazil and the exploitation of its sugar plantations. The Portuguese ‘conquest, navigation and trade’ in America and Africa was administered by governors and donatary captains, while the growing possessions in India would be encompassed from 1510—with the establishment of a colony in Goa—in the State of India under the command of a viceroy. This projection in Asia would lead the Portuguese, from 1543, to trade with the Japanese Empire, but without having a stable base in its territory.

The Portuguese monopoly in African, Indian, and Asian waters sparked strong competition with the Crown of Castile. As their respective overseas expansion ventures progressed, various treaties were concluded to settle their competing claims and delimit their respective areas of navigation and private trade, giving rise to an Iberian mare clausum. For the administration of his overseas empire, and according to the Casa da Guiné e Mina, Manuel I founded the Casa da Índia in Lisbon around 1500. This institution was responsible for the commercial affairs of the factories, the customs registration of overseas goods, the provision of caravels and ships that traded with the various Portuguese enclaves, the organisation of the Armadas da Índia that connected Lisbon with Goa every year, the monopoly on certain products, the sponsorship of expeditions and the preservation of mercantile interests.

In 1580, the integration of Portugal into the monarchy of Spain created a vast empire with dominions in all four parts of the world. The Iberian Union, personified by Philip II, posed a challenge to its overseas administration, although each crown retained its sovereignty, economic autonomy, and mercantile structure. Both crowns would see their trade routes cut off in the face of corsair attacks and piracy by the English and Dutch. After sixty years of shared existence, the War of Restoration (1640–1668) separated their interests once again at a time when the threat of third powers ended up breaking the mare clausum in the face of the new dynamics of extra-European economic exploitation.

Across the Seas: Spanish Projection

The arrival of Christopher Columbus in America in 1492 opened up new markets for the Crown of Castile. Access to and exploitation of raw materials, as rich as gold or the coveted spices, allowed the access of people eager to participate in the lucrative business, and the circulation and exchange of goods of high mercantile value. The regulation of Atlantic traffic that followed the four voyages of Columbus, the process of expansion and settlement of the population, and the establishment of trade circuits was articulated in a system centralised in a cardinal institution for the interests of the Spanish monarchy. In 1503, the Catholic kings formalised the foundation of the Casa de la Contratación. Located in Seville, the only port authorised for overseas imports and exports, this body mediated the Carrera de Indias, the American convoy. This court controlled the navigation and commercial activity of the metropole with the Caribbean islands and the lands of the American continent, governed by the Consejo Real y Supremo de las Indias (1511–1524). The functions of the Casa de la Contratación were to supervise the reception of ships coming from America, to authorise the provisioning of vessels bound for the New World, to manage and register the shipment of passengers and royal officials, and to recognise new shipments of goods to those kingdoms to avoid fraud.

In this active bidirectionality, the institution assumed the monopoly of Spanish trade in the Atlantic. In 1543, the creation of the Consulado de Cargadores a Indias in Seville assumed the legal powers in the civil sphere of the Casa de la Contratación to protect the interests of businessmen and merchant traders with business in America against the interference of other private individuals and foreigners. Apart from administering the avería (tax for the protection of merchant ships), this commercial lobby was the driving force behind the organisation of two fleets or armadas that covered the route to the mainland and New Spain each year. These convoys transported the silver extracted in the Peruvian and Mexican mines. The much-demanded that precious metal was sent back to the Old World, and was additionally used for the exchange of Asian goods through the Manila Galleon.

The Casa de la Contratación, like the Portuguese Casa da Índia, had a scientific function. Among its maritime attributions, it was in charge of training the pilots who would cover the inter-oceanic crossing, the design and production of nautical charts—such as keeping the Royal Register up to date—and other navigational instruments, and the administration of the news received from the geographical advances of the different expeditions sponsored by the kings of Spain. In 1717, the definitive transfer of its headquarters to Cadiz, together with the Consulado de Cargadores, had a strong impact on Seville, which ceased to be the epicentre of the Carrera de Indias. This change of location had been planned for decades, but it was not until that year that it was officially formalised. However, Charles III’s reforms and his measures in the last quarter of the eighteenth century to liberalise American trade weakened the mercantile strength that the Casa de la Contratación had enjoyed since its creation.

Fig. 2: Aelbert Cuyp, VOC Senior Merchant with his Wife and an Enslaved Servant (ca. 1650–ca. 1655), https://www.rijksmuseum.nl/en/collection/SK-A-2350.

The Dutch and English East India Companies

Well before the late eighteenth century, the Iberian empires were facing rivalry from aggressive intruders, particularly England and the Dutch Republic. The Dutch Revolt had robbed the city of Antwerp of its previous role channelling Mediterranean goods to northern Europe. The exodus of Antwerp’s mercantile population northwards boosted the capital and expertise available to the new state, the United Provinces of the Netherlands. Commercial incentives for merchants to seek new routes to purchase goods from the Far East were further reinforced by the strategic desirability of interrupting Iberian traffic during the Dutch War of Independence from the Habsburg Empire. In the late 1590s a series of mercantile consortiums funded expeditions from different Dutch cities to the Far East, enterprises that would in 1602 be amalgamated in a new organisation, the Vereenigde Oostindische Compagnie (VOC, or the United Dutch East India Company). This organisation followed Iberian precedents insofar as the Dutch States General endowed it with considerable monopoly privileges but differed by being funded through joint stock equity funding, with around 1,800 investors drawn to the initial share issuance. This was a sign of how the pre-existent stock market in government bonds had created an investing public. Thus, the VOC was extremely successful in enlisting private investment, but this enterprise was closely associated with the Dutch state, pursuing its war aims aggressively in the Far East by conquering such Portuguese bases as Malacca. Violence was not only used against European rivals: the inhabitants of the nutmeg-producing Banda Islands were subject to near extermination when they reneged on supposed ‘agreements’ to sell their product exclusively to the VOC, which became a territorial ruler managing slave-based plantations. Jayakarta, part of the Banten Sultanate on the island of Java, was also sacked by the VOC, then becoming the site of its Asian headquarters, Batavia. Because of its importance to the Dutch war effort, the VOC was required to be a perpetual entity, with investors denied the opportunity to withdraw their stock, although they could sell their shares.

The relationship between the crown and the English East India Company (EIC) was less close than that between the VOC and the Dutch States General, although the EIC did received royal privileges in the form of a charter granting monopoly trading rights and making it a corporation with the right to own property and take legal action independently of its members. This was an extension of an established corporate tradition in England which encompassed the regulation of overseas trade, with companies acting as the governmental framework to engender cooperation amongst independent merchants. What distinguished the EIC from most other companies was its joint stock, although this was not referenced explicitly in its founding charter. Instead, members were constituted as ‘freemen’, granted participatory rights to meet in a general court and vote for company governors, irrespective of how much they had invested. The EIC was initially financed on a voyage-by-voyage basis, with investors paid a share of the profits on return; only in the 1650s was a permanent joint stock founded. This difference in organisation was reflected too in the EIC’s commercial strategy as compared to the aggressive VOC. Initially, the EIC was reluctant to engage in expensive military and territorial enterprises, hoping to profit from arbitrage (buying low in Asia and selling high in Europe) via a network of trading factories, rather than control production in Asia. Even so, it was increasingly drawn into participation in the intra-Asian ‘country’ trade as a means to generate purchasing power to pay for imports into Europe, where there was an imbalance of trade with Asia. The EIC’s inability to prevent its agents in Asia from trading independently ultimately became an asset, expanding its network, so much so that the practice was formally permitted (a contrast to the VOC). Only in the second half of the seventeenth century did the EIC acquire rule over extensive trading settlements like Bombay, beginning its gradual shift into a territorial power in India. By the 1690s its shares were being traded on the London stock market.

The Significance of the Joint-stock Company

These joint-stock companies successfully overcame the barriers to entering the far eastern market, not least Portuguese hostility. The VOC was able to overwhelm the Portuguese thanks to its fiscal power, whilst the corporate form enabled the longevity necessary to build up a presence in the Asian market; these were important antecedents to modern business corporations. On the other hand, these ‘company states’ performed roles quite alien to the modern corporation: they were granted rights of government (including to make war, at least with non-Europeans). This was a sign of their origins in Europe characterised by ‘hybrid’ sovereignty which could be deployed creatively in Asia: the VOC could assume a very different face when acting as vassals to the Tokugawa Shogun as compared to its role as colonial power in the Banda Islands, for instance.

The success of these companies also meant that they were imitated, both by other European nations seeking to trade with the Far East, and in order to challenge Spanish domination in the Atlantic. Here they were less successful: the joint-stock Virginia Company, chartered by the English Crown in 1606, foundered once Virginia became a crop-producing economy in which long-term investment and local management was advantageous. The Dutch West India Company had a longer existence and conquered Iberian Brazil and Angola. However, its endeavours were extremely expensive, and it was less successful commercially than militarily. As the slave-trading Royal African Company would find out, the Atlantic economy proved to be difficult to monopolise by corporate means, and in this region merchant networks and partnerships would play the major role.

Markets and Enterprise in Central and Eastern Europe

The rise of the northern Atlantic economies ultimately contributed to a new north-south division in the European economy, but historians have also identified a continental divide between the East and West. Was there a divide in early modern Europe between an advanced western and backward eastern part, with the Elbe as its border splitting the Holy Roman Empire into two parts? On the one hand, scholars have pointed out early elements of urbanised countries in Western Europe, linked to early market societies and the putting-out system. The economy of the Dutch Republic, for instance, is often described as the first modern market society. The states of the Holy Roman Empire, besides several smaller and short-lasting attempts, never did take part in overseas colonisation. But they nonetheless benefitted from the overseas trade, with the southern German company of the wealthy Fugger family as a notable example. Italian states such as the Republic of Genoa in the Ligurian and Tyrrhenian Sea or the Republic of Venice in the Adriatic Sea also benefitted from this overseas trade as their power peaked in the sixteenth century. On the other hand, the folwark or manorial economy in Eastern Europe lasted until the nineteenth century. Founded upon serfdom, a renewed form of enslavement, and enduring together with the remaining vestiges of the feudal system, the manorial economy has been described as a conservative, Eastern European form of economic order.

For the Baltic Sea region, the transition from the Middle Ages to the early modern age marked the end of dominance by the Hanseatic League. New states such as Sweden and the Polish-Lithuanian Commonwealth gained access to the Baltic Sea, followed by Russia in the eighteenth century; however, they often relied on German sailors, who came from their German minority populations. Furthermore, in many cases trade was carried out by foreigners, especially from Britain or the Dutch Republic. In the eighteenth century, the influence of Western European companies in Eastern Europe grew. Dutch trade and banking houses, mostly from Amsterdam—for example, Hope & Co. or Theodore de Smeth—became major financiers of states and particular nobles. The House of Hope gave loans to Sweden, the Polish-Lithuanian Commonwealth, and Russia. These ties endowed the creditors with a certain degree of influence on the domestic and foreign policies of monarchs and governments. In Poland-Lithuania, for instance, the king and several magnate families were heavily indebted. By 1801, Russia owed 137 percent of its annual state income to Hope & Co., an enormous sum.

The trade between East and West allowed a small elite of landowners and a limited number of seaports to accumulate a considerable amount of wealth. Thus, the German-speaking city of Danzig was Poland’s biggest and only port of significance. Königsberg was Danzig’s equivalent in East Prussia and in Russia’s case the new capital of St Petersburg, founded in 1703, assumed this role alongside Riga in Livonia. The immense wealth of these few towns stood in stark contrast to their poor hinterlands.

It is worth noting that the process of integration of the European economies and the demographic and economic growth of Western Europe led to a stabilisation of the folwark or manorial system in Eastern Europe. Eastern European noblemen in Austria, Hungary, Poland-Lithuania, Prussia, and Russia could deliver grain at cheaper prices than Western European countries. While Western European landowners were obliged to pay wages, their East European counterparts could forgo these expenses on account of the corvée of the peasantry. This represented the key difference between Western and Eastern European economies.

Conclusion

In recent years a major theme of early modern economic history has been the divergence between Europe and Asia, with debates about the timing of this shift and its causes. In terms of the latter, historians have tended to either highlight changes internal to Europe, such as new energy sources or political regimes and cultural beliefs supporting enterprise, or Europe’s often predatory relationship with other regions. Ostensibly the themes of this chapter might be seen to fit most with the first of these explanatory frameworks. New forms of business organisation, including those which aided the integration of eastern and western economies, might appear to be a sign of European success in cultivating dynamic enterprise. However, this chapter has shown that these innovations were often associated with Europe’s global interactions, and the inter-European competition this entailed. European rulers might have been compelled to respect private property rights internally, but this was accompanied by expropriation overseas. European states were also willing to deploy violence when infringing on each other’s claimed monopolies, which they did in alliance with private agents. This is a sign of how, although the early modern period saw important innovations in global enterprise that foreshadowed later developments in business organisation, there were important differences. For instance, in the different political climate of the nineteenth century, its military and political functions would make the EIC appear outdated, a private company intruding in the proper sphere of the state, which consequently absorbed its Indian territories into the British Empire.

Discussion questions

- In which ways did early modern economies differ in Eastern and Western Europe?

- What was the economic role of colonialism in early modern Europe?

- In what ways did global expansion promote new forms of enterprise in Europe?

- In which ways does the early modern period still shape the European economy today?

Suggested reading

Augustyniak, Urszula, History of the Polish-Lithuanian Commonwealth: State—Society—Culture (Frankfurt: Campus, 2015).

Bouza, Fernando, Pedro Cardim and Antonio Feros, eds, The Iberian World, 1450–1820 (New York: Routledge, 2019).

Buist, Marten Gerbertus, At Spes Non Fracta. Hope & Co., 1770–1815: Merchant Bankers and Diplomats at Work (Den Haag: Martinus Nuhoff, 1974).

Harris, Ron, Going the Distance: Eurasian Trade and the Rise of the Business Corporation, 1400–1700 (Princeton, NJ: Princeton University Press, 2020).

Phillips, Andrew and J. C. Sharman, Outsourcing Empire: How Company-States Made the Modern World (Princeton, NJ: Princeton University Press, 2020).