5. Current Challenges in the Spanish Energy Market

© 2022 Chapter Authors, CC BY-NC 4.0 https://doi.org/10.11647/OBP.0328.05

Introduction

Today, the study of the energy market, and the ongoing challenges, is one of the main topics of discussion in any context, academic or otherwise. And the role played by public initiatives in this framework is beyond doubt. In this chapter, we intend to make a modest contribution to this debate, albeit concerning the particular situation in Spain.

After reviewing the historical evolution of the energy mix in Spain, we pay special attention to the effect that the different energy packages approved by the EC and their implementations (the regulatory changes they entailed) have had on Spain. In the second section, we focus on public policies and specific support plans for a green transition over the period 2020–2030. Subsequently, in the third section, the current scenario after the COVID-19 pandemic and the Russian invasion of Ukraine is scrutinised, focusing on the Spanish government’s response to the guidelines set by the EC. To be precise, both the Next Generation EU and the REPowerEU plans are examined. Finally, some conclusions and policy suggestions are made.

5.1 Evolution of the Spanish Energy Sector: A Retrospective Review

During the first decades of the twentieth century (1900–1940), electricity production in Spain was based on imported fossil fuels, especially coal. Great Britain was the world’s top coal-producing country (Seo 2008) and the biggest importer of Spain. Then in the years of the Francoist regime (1939–1975), the military regime spread a rhetoric of autarky and self-sufficiency, which they mobilised to build their systems of domestic infrastructures and international connections (Campubrí 2019). Due to the weight given to hydropower, the energy sector in Spain differed from other developed countries, with greater dependence on imports of fossil fuels and greater susceptibility to drought periods (BP Statistical Review 2020).

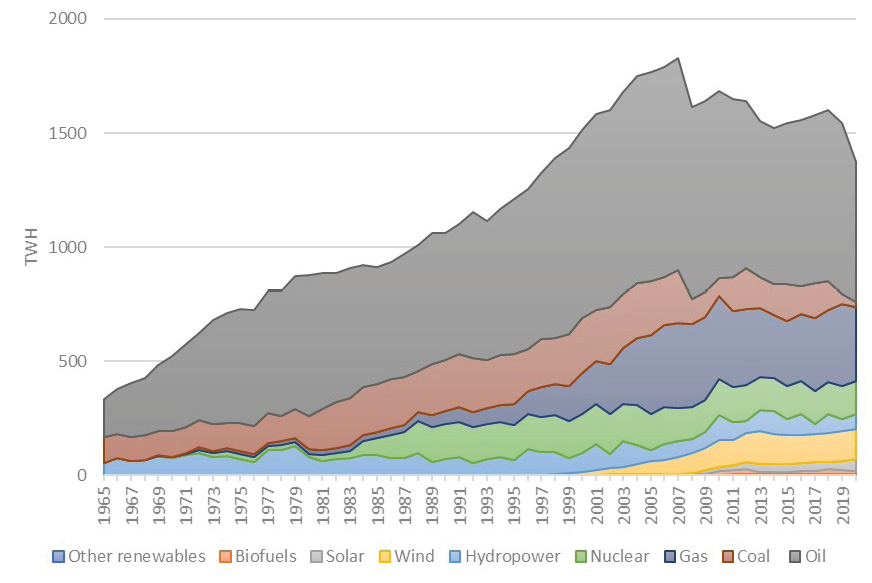

Between 1965 and 1975, the generation structure changed substantially: hydroelectric sources’ weight decreased from 17% in 1965 to only 9% in 1975. Jointly with coal plants, fuel plants’ weight also increased (doubling in ten years) in a low oil price context.

At a global level, two oil crises impacted profoundly global economies, the oil crisis of 1973/1974 and the second major oil crisis of 1979/1980 (Baumenster and Kilian 2016). These crises had an enormous negative impact on the economy and fostered the rise of nuclear energy, whose production increased sixfold between 1970 and 1980. The Spanish Parliament approved the first National Energy Plan in 1975 to deal with Spanish dependence on oil (which accounted for 68% of primary energy consumption in 1974).

The energy policy direction was similar to those in other developed countries. At the end of 1986, coal represented 55% of the energy mix and nuclear energy 11%, while in 1973, they only represented 17% and 3%, respectively (BP Statistical Review 2021).1

In the 1990s, the European Union launched a common EU reform promoting a common European energy market. The first liberalisation directives (First Energy Package) were adopted in 1996 (electricity) and 1998 (gas), to be transposed into member states’ legal systems by 1998 (electricity) and 2000 (gas). The main objectives of this reform were to gain increased competition and maintain a good quality of service while protecting the environment and fostering renewable energies as part of the plan. A wave of deregulation started with the objective of increasing competition since, in most countries, the public sector controlled the whole supply chain.

The deregulation process was complex, and entry barriers to the energy market were substantial. In some cases, there was a coexistence of horizontally and vertically integrated structures, market distortions, inelastic demand and supply, and high external dependence, among other factors. When the average external sourcing dependence in the EU was 65%, external sourcing dependence reached 80% in Spain.

During the first decade of the twenty-first century, it was clear that it was still necessary to address more market integration and deregulation reforms. European legislation pointed to the development of liquid and efficient internal markets as the solution to achieving a solid and reliable European energy market.

The Second Energy Package promoted by the European Commission was adopted in 2003. Its directives were to be transposed into national law by the member states by 2004, and some provisions entered into force only in 2007. In Spain, some regulatory changes were implemented, and in January 2003, consumers were entitled to choose their supplier for the first time. Thus, the level of market concentration in Spain has steadily improved since then due to regulatory and institutional efforts to lower market barriers and improve efficiency in the process. In April 2009, the Third Energy Package drafted by the European Commission sought to further liberalise the internal electricity and gas markets, amending the Second Package and providing the cornerstone for the implementation of the internal energy market. The EC’s rationale for increasing competition within internal markets was to transfer the boundaries of increasing efficiency to the consumers through prices.

In June 2019, the European Commission introduced the Fourth Energy Package, composed of the Electricity Directive 2019/944/EU and three regulations. This new regulatory package aimed to bring in new market rules to increase the penetration of renewable energies while attracting investment. It delivers incentives, such as new limits for PPs eligible for subsidies, or other incentives aimed at consumers. It promotes the role of the Agency for the Cooperation of Energy Regulators (ACER) in dealing with cross-border regulatory issues. As well as this, it introduces an obligation for member states to prepare contingency plans for a potential energy crisis related to the Security of Supply. Also, the fourth package recognises the importance of renewable sources and promotes their penetration.

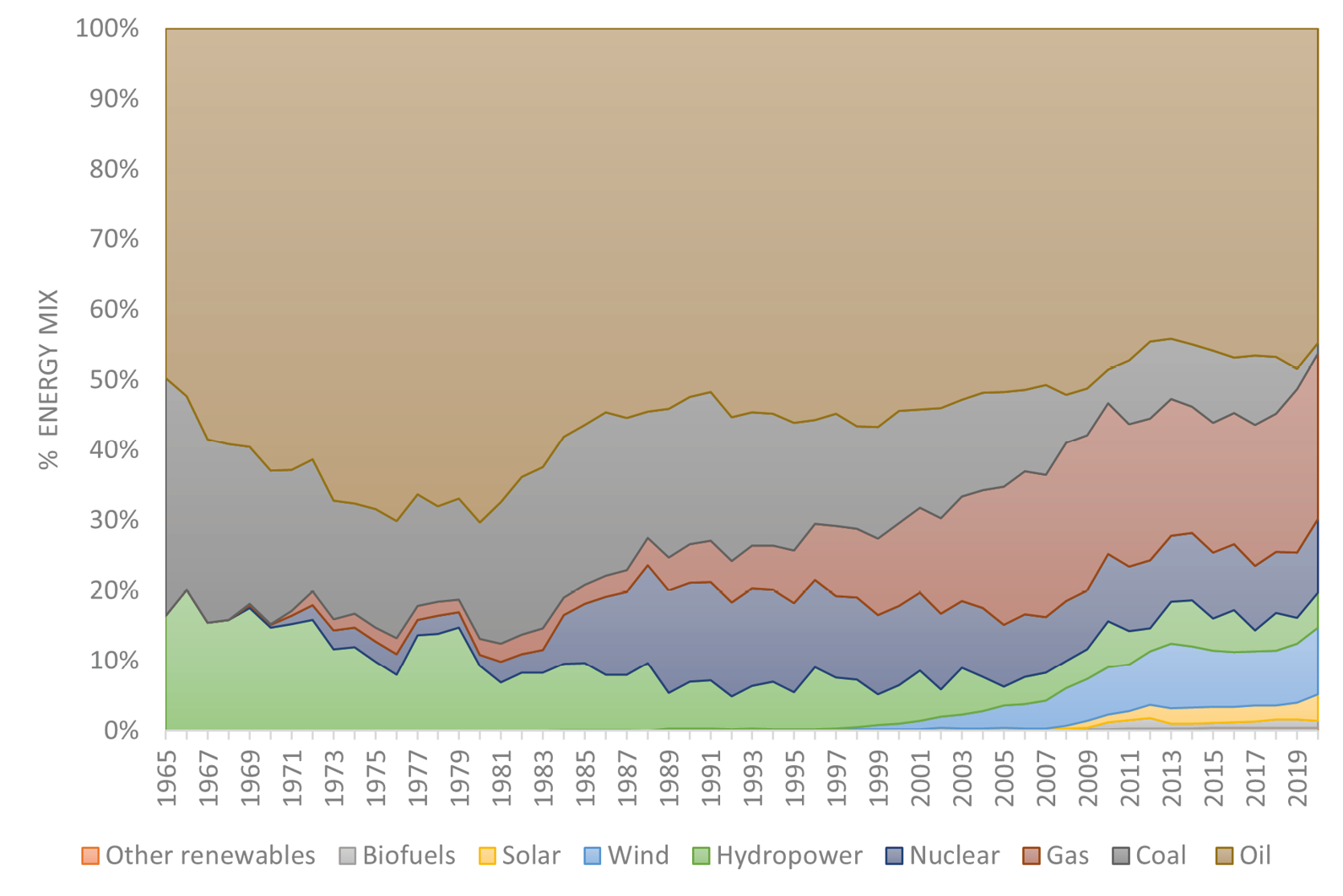

As a summary of all the above, Figures 5.1 and 5.2 present the evolution of the energy mix in Spain in absolute and relative terms. As can be seen, after the transposition of the directives mentioned above into national legislation in Spain, the energy mix has changed significantly. In any case, oil has always been the primary energy source in Spain. Coal played an important role in the second half of the twentieth century, but its weight has been decreasing over the years, like hydropower. The penetration of renewables, especially wind and solar, is remarkable and has been increasing over the last twenty years, mainly due to the role played by subsidies and incentives, which have been determinant factors in the diffusion of renewable energy sources.

Fig. 5.1 Evolution of the energy mix in Spain in absolute terms (1965–2020, TWh).

Source of data: Own production, BP Statistical Review (2021).

Fig. 5.2 Evolution of the energy mix in Spain in relative terms (1965–2020, %).

Source of data: Own production, BP Statistical Review (2022).

Spain is one of the countries in the EU with the most hours of sunshine: on average around 2,500 hours per year and radiation of 1650 kWh/m2. For that reason, electricity generation through solar panels has great potential. As for wind energy, Spain is the fifth country globally in terms of installed wind power after China, the US, Germany and India.

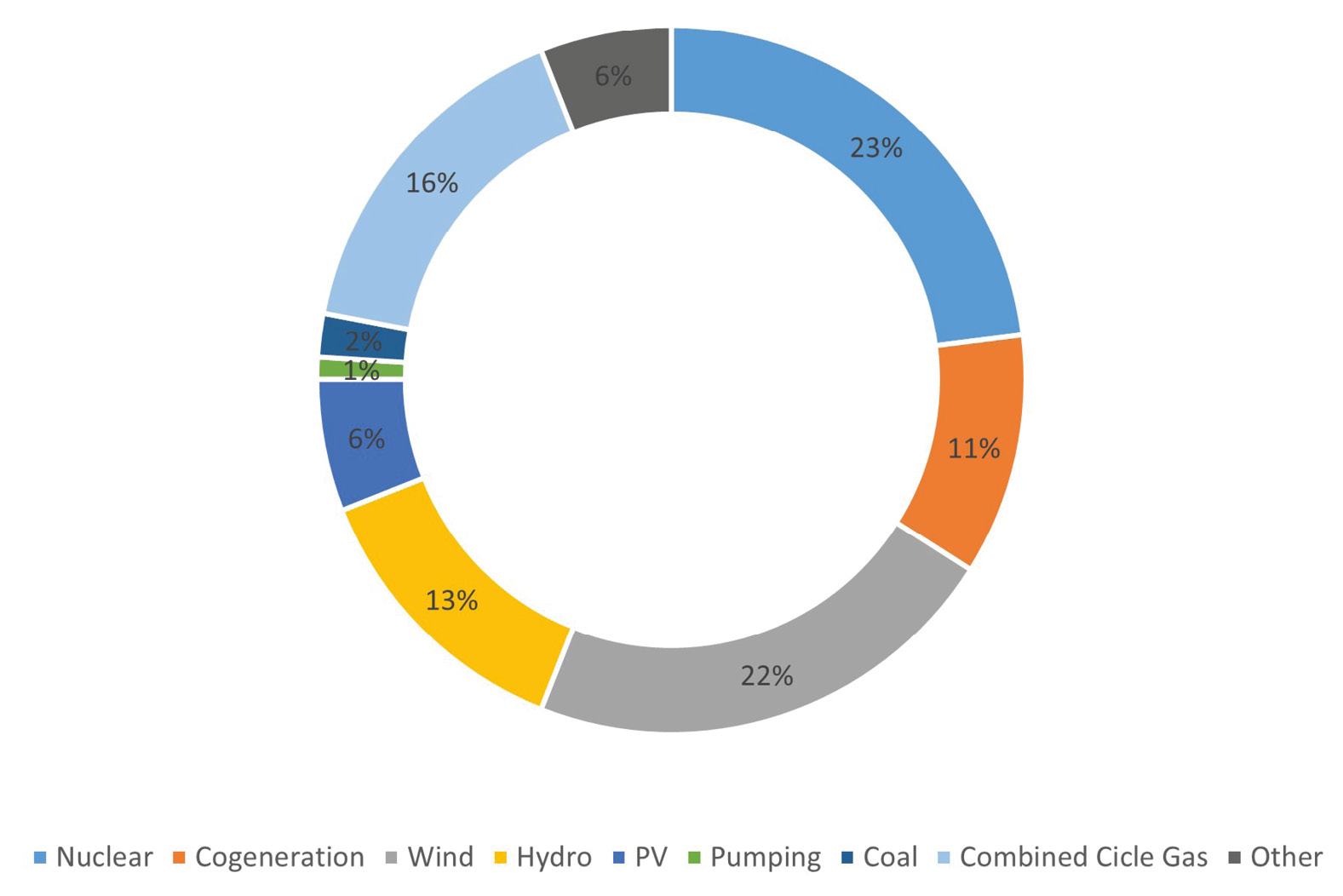

Figure 5.3 focuses on the year 2020. It illustrates the technologies that represented a more significant share of electricity generation in 2020, such as nuclear (23%), wind (22%) and combined cycle (16%), followed by hydro (13%) and cogeneration (11%). Compared to the previous year (although this is not shown owing to space restrictions), the reduction in the shares of generation from natural gas combined cycle (16% in 2020, compared to 21% in 2019) and from coal (2% in 2020, compared to 4% in 2019) stood out due to a lower registered demand due to the health crisis and the greater participation of generation via renewable technologies. The share for generation via renewable technologies stood at 46% in 2020 (39% in 2019).

Fig. 5.3 Energy mix in Spain (2020).

Source of data: Own elaboration, CNMC (2022).

Consequently, the peninsular generating park reached 105,683 MW in 2020 due to an increase of 1GW related to the installation of an improved renewable generation capacity (4,735 MW) and the closure of coal-fired power plants (3,723 MW) (CNMC 2022).

5.2 Public Policies for a Green Transition (2020–2030)

Taking action to prevent environmental degradation is a core principle of the Treaty of the European Union and a priority objective for the ’EU’s internal and external policies. The Treaty of the European Union sets out its vision for sustainable development based on balanced economic growth combined with a high level of protection and improvement of the quality of the environment. In the fight against environmental degradation, the EC works on different but complementary key points, such as urban environment, sustainable consumption and industrial sustainability.

As part of the EU, Spain follows the same energy policy framework. In line with EU objectives, the aims of the Spanish government are: (1) to reduce dependency and ensure the security of supply, (2) to reduce greenhouse emissions and (3) to reduce energy intensity. It could be said that Spain has been one of the leading EU countries in terms of enactment of the energy transition in recent years. One of the factors for this success has been the significant penetration of renewable energy sources.

The 20–20–20 Strategy provided a set of laws defined by the European Commission to cut greenhouse emissions, increase ’the share of renewables, and improve energy efficiency by 2020. These objectives were settled in 2009 through EU legislation. Spain achieved the last two of these goals, but did not accomplish the goal regarding greenhouse emissions (20% cut in greenhouse gas emissions from 1990 levels). This objective is deferred for 2030, meaning Spain’s economy would have to produce no more than around 230 million tons of CO2 equivalent in nine years.

Consequently, in 2020 the Spanish government presented an ambitious plan to cut the country’s net carbon emissions to zero by 2050. The goal to decarbonise the Spanish economy and achieve carbon neutrality by 2050 will be achieved, on the one hand, by reducing emissions and, on the other, by offsetting the emissions that continue to be produced with mitigation actions. The so-called Long-Term Decarbonisation Strategy will allow a 90% reduction in greenhouse gas emissions in 2050 compared to those emitted in 1990. The remaining 10% will be absorbed by carbon sinks (about 37 MtCO2eq by 1950), as the government details.

As for the second goal (more specifically, that 20% of the EU’s energy comes from renewable energies), Spain has fulfilled its role. At the end of 2020, 21.2% of the final energy demand in Spain was covered with renewables, a percentage slightly below the EU average (22.1%), but above the 2020 objective.

The government’s main approach to pushing for renewable energy sources was the introduction of a feed-in tariff (FIT) scheme that was suspended in 2013 in response to the economic crisis. After the suspension of the FIT scheme, the sector initially collapsed. In 2015, however, the renewable energy market pumped once again.

Finally, Spain reached the third objective (20% improvement in energy efficiency). It was significantly exceeded in Spain, achieving 35.4% by 2020. Regarding the energy intensity target previously mentioned (reach 20%), endorsed with the adoption of the Energy Efficiency Directive 2012/27/EU in 2012, between 2017 and 2019, the total energy consumption in Spain was reduced by 14.2%, making Spain the third best country in the EU.

To reach third place, Spanish authorities launched several subsidy schemes to push for energy efficiency measures that would achieve such an improvement. One example was the so-called PAREER-CRECE programme (Programa de Ayudas para la Rehabilitación Energética de Edificios existentes), a support scheme for increasing the energy efficiency of existing buildings, launched in May 2015 with a total budget of €200M.

In the same vein, more recently, in December 2020, the European Commission proposed new goals for the following decade as part of the European Green Deal, known as the 2030 climate and energy framework. Its objectives are: (1) to reduce greenhouse emissions to at least 40% compared to 1990, (2) at least a 32.5% improvement in energy efficiency and (3) a minimum 32% share of renewable energy sources in the generation mix. The emissions trading system goes some way towards the 40% reduction of greenhouse emissions.

Following this path, Spain was authorised the Estrategia Nacional de Energía 2020, focusing on various measures like improvements in the energy management of public and private lighting, fostering RES in generation (mainly solar, but also wind), innovative projects related to smart grids, local energy communities and electric vehicles and fiscal incentives.

- Reduction of emissions: The measures contemplated in the Plan Nacional Integrado de Energía y Clima (PNIEC) seek a reduction from 340.2 million tons of CO2 equivalent (MtCO2-eq) emitted in 2017 to 226 MtCO2-eq in 2030. The decrease in GHG emissions will be accompanied by a reduction in primary pollutants affecting air quality.

- Promotion of renewable energies: The promotion of renewable energies in the next decade is one of the main vectors for achieving the objectives of the PNIEC. Renewable energies are expected to amount to 42% of the country’s total energy use in 2030. In the case of electricity generation, the percentage of renewables is set to reach 74%. Concerning storage, the increase in pumping and battery technologies stands out, with an additional capacity of 6 GW providing greater generation management capacity. Spain is looking at a future of increased electrification of end-use sectors and sector coupling as analysed by the IEA.

- Sustainable mobility: The mobility and transport sector will reduce emissions by 28 MtCO2-eq between 2021 and 2030. The penetration of renewables in the mobility sector will reach 22% in 2030 through the incorporation of around five million electric vehicles and advanced biofuels. Based on this commitment, a Comprehensive Support Plan for the Automotive Sector 2019–2020 has already been established, and allocated €562 million.

- Energy efficiency: As a result of applying the measures defined in the PNIEC, energy efficiency is expected to achieve a 39.5% share by 2030, which equates to an improvement in primary energy intensity of 3.5% per year until 2030. Among the measures proposed in this regard, priority is given to energy rehabilitation of existing buildings, in line with the objectives of the Spanish Urban Agenda, which also includes the fight against energy poverty and improving universal accessibility, especially for vulnerable consumers. The PNIEC forecasts an average annual rate of energy rehabilitation of 120,000 houses in the next decade. Public investment is articulated, among other mechanisms, through the State Housing Plan.

The 2020 and 2030 objectives have been and will be accomplished through public policies and specific support plans. Apart from the specific funding plans mentioned in the previous paragraphs, RD&D programmes have been an essential pillar of the energy transition and are important for securing competitiveness in the provision of clean energy in Spain. Two examples are the Strategic Energy Technology Plans (SET-Plans) that endorse collaborative RD&D engagement, and the National Energy and Climate Plans (NECPs) that shape the EU’s energy sector governance and ensure it meets its climate and energy targets. NECPs also address the need to align state research and development activities, particularly those that target renewable energy technologies (EU 2019; IEA 2020).

In December 2015, the European Union and twenty-four governments signed the Mission Innovation (MI) initiative in conjunction with the Paris Agreement. They committed to double public R&D support for clean energy technologies up to 2020 (Cunliff 2019). Additionally, the European Green Deal (EU 2019) and the European Commission’s research and innovation programme ‘Horizon Europe’ (2021–2027), have configured a powerful organ with a total budget of €95.5 billion. This policy instrument is the largest ever transnational research and innovation programme, 35% of whose funding will be allocated to correcting climate change.

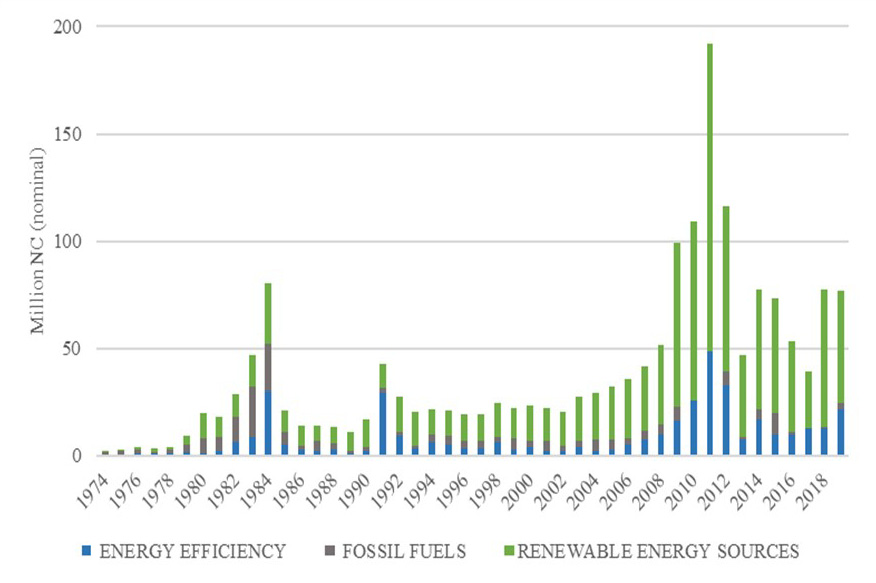

The advances in the Spanish energy sector have been supported by the relevance of public research and development funding for renewable energy technologies, increasing public RD&D investment. Figure 5.4 presents the evolution of RD&D investments in the energy sector in Spain between 1974 and 2019.

Fig. 5.4 RD&D investments in the energy sector in Spain.

Source of data: Own production, OECD (2022).

As shown in Figure 5.4, since the beginning of the twenty-first century, RD&D investments in energy in Spain have gradually increased, reaching their highest values between 2009 and 2012. RD&D dedicated to developments in the fossil fuel sector was significant, especially during the 1980s, but is nowadays marginal. In the last decades, most of the RD&D invested in energy has been in renewable energies development (around 70% in 2019) and energy efficiency (around 28% in 2019). The increase in RD&D between 2000 and 2019 has multiplied by 4.3 in the case of energy efficiency and by 2.3 in the case of RES, taking into account European Guidelines.

Recent R&D funding that targeted RE technologies and was issued through the Horizon 2020 (2014–2020) funding programme did not vary strongly across most NUTS 2 regions. However, economically strong regions profited significantly more than others. Spain received 46% of its total public RD&D support from the EC for renewable energy technologies from the European Commission.

5.3 Current Scenario after the COVID-19 Pandemic and the Russian Invasion of Ukraine

Energy markets worldwide have been subjected to the greatest supply and price tensions in recent decades. This situation is explained as the result of a cumulative set of circumstances, beginning in 2019 with the health crisis caused by COVID-19, which brought an evident slowdown in investment in all economic sectors, followed by the energy crisis caused by Russia’s invasion of Ukraine. The EC designed the Next Generation EU Plan and the REPowerEU Plan to deal with both crises, in order to achieve major independence from external producers while increasing the efforts towards the green transition. Here, as is pertinent, we will pay specific attention to the Spanish case.

5.3.1. Next Generation EU

The Recovery and Resilience Facility (RRF) is the central pillar of the European recovery plan called Next Generation EU, designed to provide financial aid to EU member states in order to combat the economic and social effects of the COVID-19 pandemic and to make the European economy more resistant to future shocks. The RRF has a financial provision of €672.5 billion. The RRF is translated into separate national Recovery and Resilience Plans (RRPs), which must be aligned with the strategic priorities of the EU and should also support the green and digital transitions, allocating 37% and 20%, respectively, of their total value to these areas.

In Spain, there was an overall reduction in electricity and natural gas demand during 2020 due to the COVID-19 pandemic. Electricity demand in Spain in 2020 was 223 TWh, which meant a decrease of 6% compared to 2019, while natural gas demand was 358 TWh, 10% lower than it had been in 2019. This reduction had a greater impact on the SMEs, and industrial segments, which saw 12% and 9% drops, respectively (CNMC 2020). On the contrary, the demand for electricity in the domestic sector increased by 6%, due to confinement and of the need for teleworking.

To fight the economic slowdown, Spain will receive a total of €69.5 billion to handle its RRP. The plan supports the green transition through investments of over €7.8 billion in the energy efficiency of public and private buildings, including new social housing. Furthermore, €13.2 billion will be invested in sustainable mobility in urban and long-distance transport, notably by improving railway infrastructure, creating low-emission zones in urban areas, financing green public buses, deploying electric charging stations and developing urban public transport more generally. The plan supports the decarbonisation of the energy sector by investing €6.1 billion in clean technologies and infrastructure (including storage and electricity grids) and accelerating the development and use of renewables, including renewable hydrogen. Finally, the plan also includes measures to help mitigate the adverse effects of climate change by preserving coastal spaces, ecosystems and biodiversity. It promotes the circular economy by improving water and waste management in the country. The plan comprises a law on climate change and energy transition, enshrining in law the renewable targets for 2030 and the objective of climate neutrality by 2050, including a 100% renewable electricity system. It also includes a Renewable Hydrogen Roadmap, new strategies for building rehabilitation, decarbonisation and energy storage, and new procurement auctions for renewable electricity.

5.4 REPowerEU

The occupation of Ukraine by Russia, which started in February 2022, has had a tremendous impact on energy markets, pushing the resilience capacity of European countries to the limit, mainly due to the high dependence of Central European countries on Russian gas. Looking at the numbers, the EU imports 90% of its gas consumption, with Russia providing around 45% of those imports at varying levels across member states. Furthermore, Russia also accounts for around 25% of oil imports and 45% of coal imports (Eurostat 2022).

As presented in Chapter 1 of this book, in response to the Russian invasion, the European Union imposed strong economic sanctions on Russia, a move to which Russia responded with energy supply cuts to central European countries. Consequently, Europe is contending with fossil fuel prices that have never been seen before in the leading national and international trading hubs. The rise to hitherto unknown levels in the price of gas throughout Europe has dragged down the electricity market price. In the case of natural gas in the Iberian Peninsula, the average price of the D+1 product at the virtual balance point—PVB—in the first four months of 2022 stood at €95.98/MWh, a value nine times higher than the average price of the same product during 2020, and two times higher than the price during 2021. On March 8 2022, the D+1 product stood at €241.36 /MWh, a historical record that is reflected in the other counterpart European trading parks (CNMC 2022). According to the CNMC, electricity prices increased over 200% compared to the previous year, due to the multiplication of natural gas versus electricity prices, owing to the weight of natural gas combined cycles within the energy mix.

This geopolitical reality made it necessary to draft a new EU-level energy policy strategy. The European Commission created the REPowerEU Plan, intended to make Europe unreliant on Russian oil, gas and coal by 2030, while contributing to the clean energy transition.

Delivering REPowerEU objectives requires an additional investment of €210 billion between now and 2027. In the words of the EC, this is a down payment on our independence and security. Cutting Russian fossil fuel imports can save us almost €100 billion per year. These investments must be met by the private and public sectors and at the national, cross-border and EU levels.

To support REPowerEU, €225 billion is already available in loans under the RRF. The Commission adopted legislation and guidance for member states on modifying and complementing their RRPs in the context of REPowerEU. The plan highlights the importance of replenishing gas stocks before next winter and proposes several measures to respond to increasing energy prices. Among the emergency measures to mitigate high prices are financial support for companies and individuals, a plan to keep underground gas storage replenished by 90% before 1 October each year, investigation options to optimise the electricity market design taking into account ACER’s recommendations, diversifying natural gas sources via higher LNG imports and biomethane or hydrogen production, boosting energy efficiency, fostering electrification and promoting a higher penetration of renewable energies (45% by 2030). By taking these steps, the European Commission expects EU demand for Russian gas to be reduced by two thirds by the end of 2022.

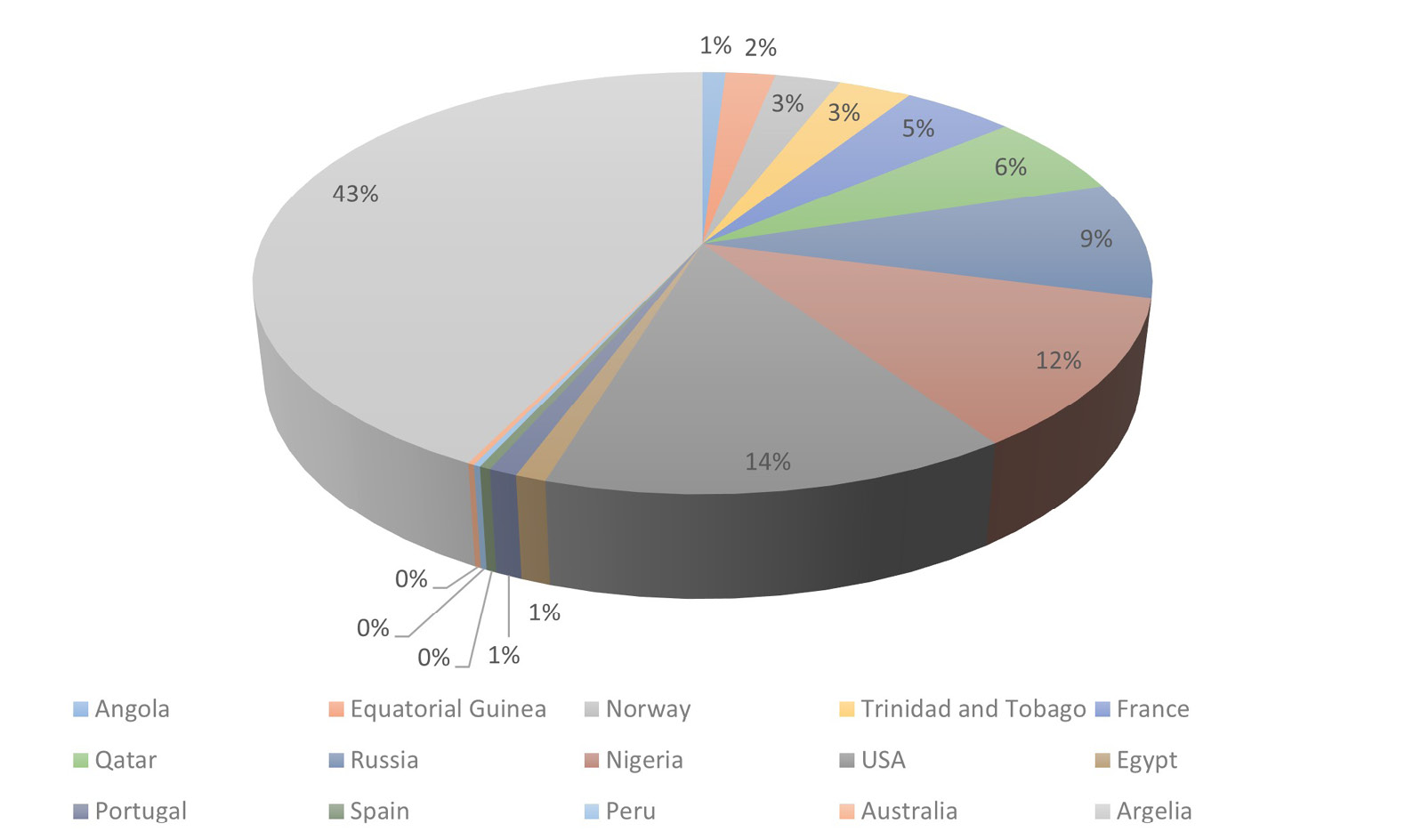

All of these objectives are of great importance to Spanish authorities. The security of supply is a real threat since Spain is still heavily dependent on external producers to meet its demand.2 Natural gas sources are diversified in Spain, as presented in Figure 5.5 (NG comes from sixteen countries, via pipelines or in the shape of LNG). However, the country is highly dependent on Algerian gas.

Fig. 5.5 Spain. Natural gas sourcing by origin in 2021.

Source of data: Own production, CNMC (2021).

The leading natural gas supplier for Spain is Algeria (which provides 43% of Spain’s total demand). After Algeria, the most prominent suppliers are the USA (14.2%), Nigeria (11.5%), Russia (8.9%) and Qatar (6.3%). Internal production is small (1.418 GWh) and equates to 0.34% of total demand.

In comparison with 2020, the price of natural gas imports increased by 337% in 2021, according to CNMC (2021), changing from 13€/MWh in December 2020 to 58€/MWh in December 2021. 45.5% of total imports arrived by pipeline; 81.66% of them came from Algeria and 18.34% from the European internal market. The remaining 54.5% of the gas supply arrived in the form of LNG.

Prompted by Algeria and the current situation caused by the Russian occupation of Ukraine, the Spanish government settled on new measures to ensure greater security of supply in the country. Spanish objectives are aligned with EC goals; achieving greater sourcing diversity and independence through higher electricity production from renewable energy sources, greater diversification of natural gas sources and reduced energy demand through energy efficiency measures.

Nonetheless, interconnectivity with other neighbouring countries within the EU will be crucial. At the moment, there are only two low-capacity pipelines connecting Spain to France, and thus to the rest of the EU, but the current situation has revived the debate of building a third natural gas interconnector between Spain and France, called STEP (previously called MidCat), whose purpose would be to bring gas from Algeria to the rest of Europe in order to end the energy isolation of the Iberian Peninsula. Besides its interconnection with Algeria, Spain has six terminals for regasifying liquefied natural gas (more than any other European country). These facts, together with a gas port in Portugal, could make the peninsula a prime gateway for gas into the EU in efforts to reduce EU dependence on Russian fossil fuels.

5.5 Final Conclusions and Policy Recommendations

Energy policies designed at the European level and transposed by EU governments have meant significant advances in market competitiveness, development and openness. However, not all the work is yet done, as demonstrated by the demand crisis caused by the COVID-19 pandemic and the energy crisis caused by the Russian occupation of Ukraine.

The main objective of the European Commission is to achieve an independent, sustainable and resilient internal energy market. These objectives were made explicit in the signing of the European Union Treaty, and later, in the 2020 and 2030 strategies, they were converted into solid figures.

As shown in the previous sections of this chapter, Spain has managed to achieve several of the objectives proposed by the 2020 strategy, but not all of them, since it is now focused on achieving the newly devised 2030 strategic objectives. All efforts to achieve these objectives are essential for the green transition and in order to reduce dependence on external fossil fuel producers and ensure good levels of security of supply.

From our perspective it is significant to note, as is always important from a political point of view, that citizens agree with using public funds to achieve these objectives. According to data from the Barómetro del Real Instituto Elcano (Real Instituto Elcano 2020), Spanish citizens consider the fight against climate change to be a priority in terms of foreign policy, as they feel that we are facing a climate emergency (61%) or a serious situation in relation to climate change (31%). We have, therefore, a clear blueprint for a joint strategy between politicians, on the one hand, and business, trade unions and citizens’ organisations, on the other. We need a system that is capable of combining these different actors’ interests while facing up to the fear of change and the uncertainties that exist in the current energy context.

Hence, energy policies in Spain will need to continue to increase internal production via renewable energies, fostering energy efficiency to reduce the country’s internal energy needs and promoting different measures to reduce atmospheric pollution levels, such as fostering electric mobility. More extensive efforts will need to be made to accelerate these processes given the current situation, and the EU will be a great contributor of public funding. However, it is essential to note that the previous increase in EC contributions has compensated for decreasing national budgets. There is a need to stabilise total public RD&D support for renewable energy technologies and energy efficiency practices in the forthcoming years; otherwise, significant progress will be difficult to achieve.

Apart from those technologies currently available, policymakers need to promote technological development and complementary actions between public RD&D and private sector or international funding schemes and enhanced country-level accessibility and categorisation.

References

Baumeister, C. and L. Kilian (2016) “Forty Years of Oil Price Fluctuations: Why the Price of Oil May Still Surprise “, Journal of Economic Perspectives 30(1): 139–60.

BP (2020) BP Statistical Review of World Energy 2019. UK: BP, https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019-full-report.pdf.

BP (2021) BP Statistical Review of World Energy 2020. UK: BP, https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2020-full-report.pdf.

BP (2022) BP Statistical Review of World Energy 2021. UK: BP, https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2021-full-report.pdf.

Camprubí, L. (2019) “Whose Self-sufficiency? Energy Dependency in Spain from 1939”, Energy Policy 125: 227–34, https://doi.org/10.1016/j.enpol.2018.10.058.

CNMC (2018) Spanish Energy Regulator’s National Report to the European Commission. Spain: CNMC, https://www.cnmc.es/sites/default/files/2168599_3.pdf.

CNMC (2021) Informe de supervisión de los mercados minoristas de gas y electricidad. Spain: CNMC, https://www.cnmc.es/sites/default/files/3981989.pdf.

CNMC (2021) IS/DE/013/21: Informe de supervisión mercado peninsular mayorista al contado de electricidad año 2020. Spain: CNMC, https://www.cnmc.es/sites/default/files/3722490_0.pdf.

CNMC (2022) Boletín informativo del mercado mayorista de gas y aprovisionamiento. Spain: CNMC, https://www.cnmc.es/sites/default/files/4351303.pdf.

CNMC (2022) Boletín informativo del mercado minorista de gas, Primer trimestre de 2022. Spain: CNMC, https://www.cnmc.es/sites/default/files/4304039.pdf.

Cunliff, C. (2019) Omission Innovation 2.0: Diagnosing the Global Clean Energy Innovation System. Information Technology and Innovation Foundation. Research Gate, https://doi.org/10.13140/RG.2.2.21713.15204.

EU European Commission (2019) Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions: The European Green Deal. Communication no. COM/2019/640. Brussels: European Commission, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2019%3A640%3AFIN.

Eurostat (2022) https://ec.europa.eu/eurostat/web/environment/waste/database.

International Energy Agency (2020) Spain 2021. Energy Policy Review. France: International Energy Agency, https://iea.blob.core.windows.net/assets/2f405ae0-4617-4e16-884c-7956d1945f64/Spain2021.pdf.

OECD (2022) https://www.oecd-ilibrary.org/energy/data/iea-energy-technology-r-d-statistics/rd-d-budget_data-00488-en.

Seo, B.S. (2008) “The Political Importance of Coal as portrayed in Punch (1898–1900)”, Korean Minjok Leadership Academy International Program, https://www.zum.de/whkmla/sp/0910/sbs/sbs2.html.

1 At that point, the level of inflation was high, so the government decided to regulate energy prices. The government intervened in the sector in different ways; one was the transmission of high-voltage lines or the creation of the 1985 Red Eléctrica de España (REE) to deal with the electricity system operation. That same year, Spain joined the European Union.

2 Security of supply was threatened on 1 November 2021, when there was a supply cut due to the lack of any agreement between Algeria and Morocco to renew the gas transit contract related to the Medgaz pipeline.