7. A “True” Industrial Policy for Europe Is a Technology and Innovation Policy1

Reda Cherif,2 Fuad Hasanov,3 and Xun Li4

©2024 Reda Cherif et al., CC BY-NC 4.0 https://doi.org/10.11647/OBP.0434.08

Since the Global Financial Crisis of 2008, the “core” European countries have been losing their competitive edge in global markets for sophisticated products such as electronics and green transportation and power technologies, while also missing out on the earlier revolution in information and communication technology (ICT). Meanwhile, the “periphery” European countries have been slowing down and, in pre-crisis years, have mostly channelled their investment into non-tradable industries, concentrating their resources in relatively lower productivity and lower skill activities. The slowdown in growth and convergence highlights the need to reignite productivity and economic dynamism. Lessons from the Asian economic miracles and Europe’s own growth experience suggest the importance of developing sophisticated sectors. The development of these sectors is riddled with both government and market failures, requiring adequate policies to tackle them. We argue that a “true” industrial policy for Europe is a technology and innovation policy (TIP) that focuses on correcting market failures to spur innovation, scale up, and support production networks in sophisticated industries across Europe while reorienting the engines of growth of “periphery” economies toward sophisticated sectors and their complex value chains. TIP’s guiding principles are a focus on global markets, competition, and a strict accountability framework, where the “hard” tools such as tariffs and subsidies may not be necessary and may be potentially counterproductive.

7.1 Introduction: The Challenge of Sustained, Sustainable, and Inclusive Growth

Europe is at the crossroads of economic challenges. Having intensified since the COVID-19 pandemic, these challenges are both old and new. Low productivity, declining dynamism, and the need for inclusive growth and well-paying jobs are seemingly being eclipsed by emerging challenges like intense competition from China, especially in renewables and electric vehicles (EVs), trade and geopolitical conflicts, and increased climate change uncertainties. In the aftermath of the pandemic, economic security, including resilience and supply chain diversification, has become an important policy issue. Moreover, increased global competition in sophisticated products, especially from China, have sent ripple waves across advanced countries such as the US and the European countries and have brought back the “spectre” of the 1980s, when Japan was rapidly gaining global market shares in sophisticated products like electronics and automobiles. The existing macroeconomic weaknesses, such as low productivity growth and stagnating real median incomes, are being amplified by the emerging challenges, worrying policy makers about growth prospects and economic security, amounting to the loss of advanced industries and well-paying jobs.

The fear of losing advanced industries, such as the automotive and clean technology (cleantech) sectors, along with well-paying jobs, encapsulates the key concerns facing policy makers. This fear is not unjustified, as large firms like Nokia in Finland and renewable industries like the solar manufacturing industry in Germany were lost previously. These sophisticated industries are key to innovation, productivity gains and growth, well-paying jobs, and inclusion (Cherif and Hasanov 2019a, 2019b; Cherif, Hasanov, and Aghion 2024). The lack of innovation and production in sophisticated sectors could inhibit the growth of well-paying jobs, reduce broad-based gains in market income (“predistribution”), and jeopardize the competitiveness of European firms in the global market. We argue that the old challenges of low productivity growth and declining dynamism and the new challenges of energy transition, climate change, and trade conflicts boil down to the key challenge of how to address market failures that hinder growth of sophisticated industries, including cleantech. Although, according to the IMF (2024b), a large share of the productivity gap is also due to the non-tech sector, productivity gains in sophisticated sectors have substantial spillover effects to other sectors, while technology diffusion from tech sectors could help narrow the productivity gap in non-tech sectors as well.

Sophisticated sectors generate productivity gains and sustained growth, as demonstrated by the experience of the so-called “Asian miracles”, like Korea and Singapore. These sectors, mostly focused on tradable manufacturing goods, create spillovers to other tradable sectors such as supply chains, and non-tradable sectors such as services (Pisano and Shih 2012). These sectors, as measured by research and development (R&D) intensity, create opportunities in manufacturing-linked services while including professional/scientific and ICT services (Cherif and Hasanov 2019a). More importantly, they create well-paying jobs as high productivity growth and specialized skills are key elements of these sectors. Moreover, some sophisticated sectors such as EVs, renewables, and other clean technology sectors could generate sustainable growth while facilitating fast energy transition and reducing greenhouse gas emissions.

As the IMF (2024a, 2024b) argues, the standard growth approach that focuses on horizontal policies (applicable to all sectors), along with, in the context of Europe, tools to further European integration in support of the single market, would help alleviate the challenge of low productivity. In general, the standard growth approach primarily addresses government or policy failures. These failures include inadequate business environment, low spending on public goods, excessive regulations, and macroeconomic instability. Relative to other major economic blocs, Europe performs relatively well in tackling government failures in general, although policy improvements to improve the workings of the single market and reduce various barriers for business across Europe would be beneficial (IMF 2024a, 2024b; Letta 2024; Hodge et al. forthcoming). Promoting the single market, based on a level playing field, is important to create opportunities for firms and workers. Meanwhile, the level playing field should be complemented by more purpose-specific policies spurring firms to enter more decisively into sophisticated sectors.

The standard growth policy package may not be sufficient to provide incentives for firms to enter the sophisticated sectors because it does not address well what essentially all sophisticated sectors have in common—a myriad of market failures. Among these market failures are learning failure,5 coordination and information failures, externalities, agglomeration effects, spillovers, unfavourable risk-return trade-offs, high uncertainty, and inadequate financing. The implication is that firms underinvest, produce less, or completely forgo entering these markets, potentially resulting even in “missing” markets.

A policy to tackle market failures riddling sophisticated sectors, aligning incentives for firms and workers, and coordinating across public and private stakeholders, is needed. We call it a “true” industrial policy (Cherif and Hasanov 2019a, 2019b). It is not a protectionist policy of the past industrial policies that mostly failed in the medium to long run, or a policy of blank check subsidies to firms ignoring market signal feedback, including the need to restructure failing enterprises. Rather, it is a technology and innovation policy, or TIP (Cherif and Hasanov 2019b).

A TIP for Europe is a coordinated European technology and innovation policy, complementing and reinforcing horizontal policies. It takes European regions as a unit of focus, emphasizing the importance of agglomeration and spillovers and combining pan-European and coordinated national policies. It promotes cross-border industrial clusters and linkages, supporting integration and agglomeration forces. In addition, with a focus on coordination, provision of incentives, and direction for resource flows to tackle market failures, TIP would complement and reinforce horizontal policies for integration in the single market. As Letta (2024) states, the new single market framework to protect five freedoms—the free movement of people, goods, services, capital, and the newly added, research, innovation, and education—should also support “the objective of establishing a dynamic and effective European industrial policy”, requiring speed, scale, and adequate financial resources. The European Commission (2024), in its note to the Eurogroup, argues that a European industrial policy can contribute to productivity growth and European competitiveness. Draghi (2024a, 2024b) further emphasizes the importance of advanced sectors and technology, including innovation and domestic manufacturing, with the need for a radical change in a European strategy with a clear focus on sophisticated sectors and large investments.

To succeed, TIP requires upholding three key principles. Overall, what needs to be done—fostering innovation and production in sophisticated sectors—is relatively clear, and it is a necessity for all European countries, which are relatively rich and largely at the technological frontier. Yet to achieve this goal, we argue that three key principles could facilitate the policy design and implementation: export orientation (a focus on global markets), competition, and multifaceted state support with accountability based on market signals—as the lessons from the successful growth of the Asian economic miracles illustrate—are a key part of TIP. Focus on global markets from the onset supports scale and scope of products. Competition not only internationally but also domestically increases the odds of the industry survival. “The state as a venture capitalist” approach, with a focus on industries or portfolios rather than particular firms, would further raise the chance of success. Various policy tools that provide the appropriate environment (e.g., specific infrastructure, regulation, financing, skill training) and incentives for firms to engage in innovation and production with clear accountability signals of progress and for workers to obtain needed skills, solve numerous market failures, improving the odds of developing competitive and innovative industries.

Lastly, the consistent implementation of TIP is crucial. Policy need not be written in stone and needs to be flexible. As with any policy (and not necessarily more fiscal spending), there are risks of rent-seeking and capture, requiring a careful design and implementation. A dedicated institution or a high-level council, endowed with “embedded autonomy”, to coordinate across all the stakeholders, both public agencies and private firms, on country and European levels, thus resolving coordination and information failures, could drive the change. It is an institution that is in close contact with firms, has a deep knowledge of technologies and markets, and is shielded from external influence (e.g., political or rent-seeking). The focus and support to move toward new sophisticated industries, including the “industries of the future,” would support productivity gains and dynamism and help generate sustained, sustainable, and inclusive growth.

7.2 A TIP for Europe

The following three case studies illustrate the main challenge facing Europe in critically important sophisticated sectors: disruption and international competition. They showcase examples where Europe held a strong initial advantage in an industry, which was subsequently disrupted or lost significant global market shares. These sectors are mobile phones, semiconductors, and EVs/batteries.

7.2.1 The Rise and Fall of Finland’s Nokia

The rise and fall of Nokia highlight both the origins of Europe’s strength in high-tech and the challenges and policy dilemmas it faces moving forwards. Out of a small and relatively poorer nation sprang a high-tech champion dominating the global mobile phone market for more than a decade. The success of Nokia, which started as a modest domestic conglomerate focused on wood pulp production, and later rubber boots and bicycle tires, depended largely on a multi-faceted state intervention helped by regional and EU policies to set up standards.

The rise of Nokia stemmed from a spirit of risk-taking combined with a wide spectrum of state interventions spanning procurement policies, active support for R&D through public research institutes and universities, and the existence of a powerful umbrella institution tackling coordination failures, including financing (Tekes). The company that became Nokia later pivoted to radio telecommunication because of a tender by the Ministry of Defence (which was later cancelled despite the incurred costs). Subsequently, the ministry of telecommunications set up a tender for firms to compete for a wireless communication system to be used along the roads in the northern part of the country where wire communication was costly to maintain due to the weather conditions.

The National Technology Agency (Tekes) funded and supported the technology sector in Finland for decades. Its support quickly concentrated on emerging technologies through sizable financial support to specifically develop Nokia’s mobile and GSM (Global System for Mobile Communications) technologies in the 1970s and 1980s. More importantly, the strategic projects co-financed by Tekes were structured in a way that made it difficult for Nokia to withdraw. This proved useful during the early 1990s recession, when the temptation to cut back on “non-essential” projects was strong. Other tools, largely funded by the government, such as close links with universities and the public industrial research institute (VTT) were critical, as Nokia was given access to laboratories and scientists, and since education policy was geared toward engineering in the 1970s and 1980s.6

Subsequently, Nokia was disrupted by Apple as it missed out on the smartphone revolution in the 2010s. The disappearance of the mobile phone subsidiary accelerated with the takeover by Microsoft, shedding tens of thousands of highly qualified and experienced workers. Given the central role of Nokia in the Finnish economy as an anchor of a high-tech sector, the macroeconomic consequences persisted for at least a decade and may continue to do so. Finland’s performance compared to its Nordic peers in terms of exports, growth, R&D, and productivity has been lagging since the closing down of the mobile phone subsidiary of Nokia (Ali-Yrkko et al. 2021).

How critical was European integration to the rise of Nokia? European integration played a critical role in terms of setting technology standards such as GSM that gave Nokia (and Swedish Ericsson) a valuable head start in the mobile phone market. European integration and cooperation also contributed indirectly by providing a conducive business environment. However, it is difficult to see other direct links of the European market integration with the early success of Nokia for the following reasons: the investment in strategic technologies took place in the 1980s and 1990s when the European market was less integrated than in the 2020s, and the stock price of Nokia peaked in 2000, around the time of the creation of the euro. Nokia was a global player, with the EU representing a significant portion of its market, but not the majority. Its production network was also globalized, with tens of thousands of workers employed outside Finland, mostly outside the EU. Nokia was listed on the New York Stock Exchange in 1994, but it was only listed on the Euronext Paris in 2015, after the decline of its mobile phone subsidiary.

7.2.2 Game of Chips: Semiconductor Rivalry Is Back

After decades of decline and stagnation, the European semiconductor industry became a minor player on the global stage when the COVID-19 pandemic pushed microchips to the fore as a critical product, perhaps only second to vaccines. Global shortages in a wide array of goods appeared in the wake of the pandemic, ranging from consumer electronics and appliances to cars. These shortages were attributed to a lack of semiconductors highlighting their ubiquitous applications. Global sales increased from $139 billion in 2001 to $527 billion in 2023 and are projected to reach about $650 billion in 2025 (SIA 2024). The European share in the global production declined from 44% in 1990 to 24% in 2000 and 8% in 2021 (Duchatel 2022; Huggins et al. 2023). The share of patents has been in decline as well while the remaining firms focused on niche markets (Huggins et al. 2023).

Losing advanced manufacturing to Asia and lagging behind the US and more recently China in fabless sales, or chip design, the European chip industry has maintained an important niche market in the semiconductor value chain. Out of twenty top semiconductor companies in the world by revenue in 2019, only four were European: ASML (equipment supplier), and three integrated device manufacturers (IDMs), STMicroelectronics, Infineon, and NXP Semiconductors (Huggins et al. 2023). In addition to ASML, suppliers such as ASM International in equipment, BASF in chemicals, and Siltronic in wafers are other players in the chip value chain. In the chip design space, the UK’s ARM (owned by Softbank’s Vision Fund and the object of a takeover attempt by the US’s Nvidia) is a critical player while ASML is the sole supplier of cutting-edge lithography equipment to the foundries, or chip manufacturers, especially to TSMC. In addition, European IDMs have maintained relatively light production and relied on the Asian manufacturers, TSMS and Samsung, and Europe lacks foundries at the most advanced technological nodes. In terms of fabless sales, European firms have fallen behind China, which has been steadily gaining market share (Kleinhans and Baisakova 2020; SIA 2024).

With the disruptions in the global chip supplies during the COVID-19 pandemic as well as the increased technological rivalry between the US and China, especially in the cutting-edge semiconductor market, the future of Europe’s chip industry has come to the forefront of the policy makers’ agenda. The EU Chips Act that came into force in 2023 is designed to reinvigorate the European chip industry and increase its global market share of production capacity from 10% to 20% by 2030 (Huggins et al. 2023). The Act has allocated €43 billion to support new production facilities, create startups, and develop skills. It includes such initiatives as the supply chain mapping of the sector, the development of a virtual design platform to support firm entry, financing solutions through the Chips Fund, competence centres in all EU member states to provide access to the design platform, and the European Semiconductor Board to advise the European Commission (Kleinhans 2024). This array of policy tools is intended to tackle market failures that are particularly acute in the chips industry related to coordination among various stakeholders, economies of scale and learning, underinvestment in skills, and agglomeration externalities.

Concentrated in a few regions in Europe, the industry needs a focus on commercialization, collaboration across clusters, and increased investment to stage a comeback (Huggins et al. 2023). These semiconductor clusters are mainly located in Leuven (Belgium), Eindhoven (Netherlands), Dresden (Germany), Grenoble (France), Catania (Italy), and Cardiff (UK), the most recently created cluster. Huggins et al. (2023), having interviewed various actors in the industry, suggest that the European policy focuses mostly on research and much less on commercialization. There is a need for much higher scope for collaboration and knowledge sharing across clusters, which is being supported by Silicon Europe alliance. Manufacturing cutting-edge chips requires large investments, better integrated European supply chains, and local demand from end users of those chips.

The EU Chips Act calls for “digital sovereignty”, but “indispensability” is another approach for the industry’s revival. Self-sufficiency in semiconductors may be hard to achieve as the semiconductor industry is globally interdependent. Moreover, competition to attract incumbents could require giving large subsidies in the context of the US’s Inflation Reduction Act (Cherif and Hasanov 2024). Although some question whether cutting-edge manufacturing is worthwhile to invest in before investing in chip design capabilities, a focus on key technologies and nodes in the value chain, emphasizing “indispensability” of the European firms (like Japan’s model) could also be a feasible option (Kleinhans 2024; Duchatel 2022). Given the size of the European market, however, it is an open question whether to promote chip design first or target manufacturing and design simultaneously, and legislation would not necessarily solve it. Rather, policymakers and industry participants would have to decide which goals the European chips industry should pursue, redirecting policy tools and resources toward achieving those goals.

7.2.3 European Automotive Industry at the Crossroads

In the race to dominate the electric vehicle (EV) industry, a key cleantech technology, European firms started with clear advantages a priori. European firms were in the lead in the global markets of internal combustion engine (ICE) vehicles, including in China. They spanned all the segments of the market, from luxury to more accessible vehicles. The sector contributes to about 10% of manufacturing jobs in the EU, with production networks in several countries, accounting for a large share of the exports of Germany and several other European countries. The automotive industry also contributes massively to the total R&D expenditure and is one of the few high R&D intensity industries.

In the 2010s, the EV revolution was already gathering pace in the US and globally. While the cost of EVs was still high and the EV market share was below 1% of annual sales, evidence of a coming disruption was already clear by the mid-2010s (Cherif, Hasanov, and Pande 2017, 2021; Cherif, Hasanov, and Zhu 2021). Although major producers such as Volkswagen were already drafting ambitious plans to build EVs in 2017, they have been mostly playing catchup with Tesla in the luxury segment, and since the early 2020s with Chinese brands in all segments.

A few headwinds slowed the development of the European EV industry. European automotive firms were struggling to reach sufficient economies of scale in battery production, a critical input for EVs. However, beyond batteries, European firms have also been lagging behind US and Chinese counterparts in terms of software development, another key component of EVs. This is not surprising since leaders in the ICE market have not been well prepared for a radically different product structure, compared to new entrants building EVs from the bottom up.

An ambitious initiative, the European Battery Alliance (EBA), was put in place by the European Commission in 2017 to invest in battery technologies and production. The alliance gathers a wide array of actors such as EU national authorities, regions, and research institutes. Through an array of financial and regulatory tools (e.g., European Investment Bank), the EBA is designed to tackle market failures preventing the industry from reaching economies of scale and becoming competitive and innovative, by supporting all segments of the value chain, including by encouraging startups. By 2022, European investment in the battery ecosystem had already reached €180 billion.

7.3 A Few Stylized Facts: Relative Income, Investment, Exports, and Global Firms

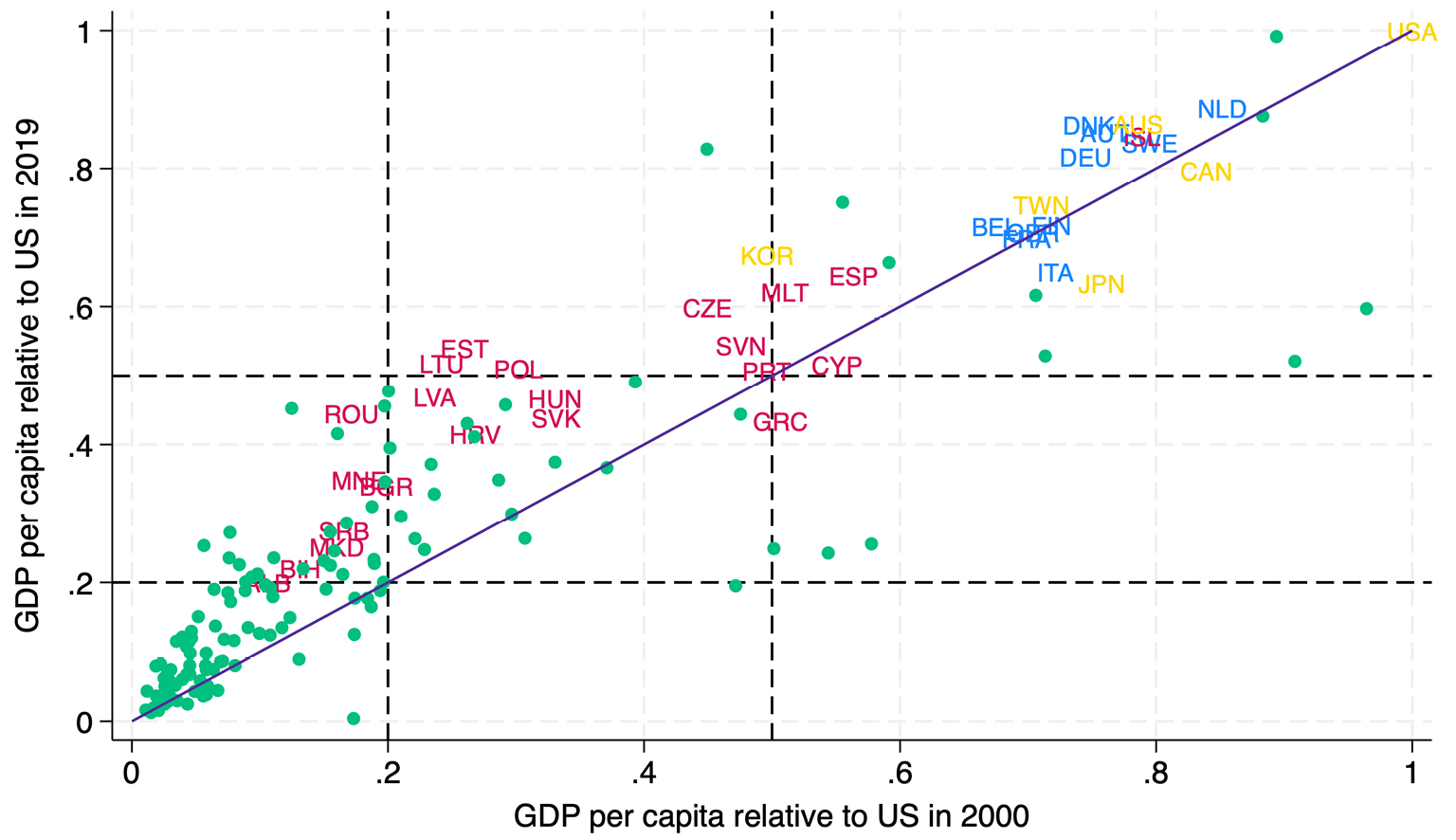

A few stylized facts show that much of Europe has forged ahead while some countries have largely stagnated. Investment and manufacturing exports have slightly declined or barely have changed, but innovation has been low while large multinationals have fallen behind. Much of emerging Europe and the European periphery, including countries like Estonia and Ireland, have converged with advanced and core Europe, while some countries, like Greece and Italy, have fallen behind (Figs 7.1 and 7.2). The picture became much gloomier after the Global Financial Crisis (GFC) of 2008, resulting in slower growth in much of Europe, as in the US. Although investment and manufacturing exports have broadly held up on average, even before the 2008 crisis, innovation has been much lower than in the US while China has been fast in catching up. The share of European firms in Fortune Global 500 had been on a steady decline, and firms that have remained on the list are in traditional manufacturing sectors rather than high-technology sectors. The relatively good income performance was bound to come to an end once a large shock hit the economy, such as the 2008 Global Financial Crisis.

Fig. 7.1 The map of Europe. Source: Authors’ classification.

The growth experience of the European countries for the 2000–2019 period (before the COVID-19 pandemic) suggests not only convergence for much of emerging Europe and some advanced European countries, but also stagnation or a decline for a few countries. In terms of relative income per capita compared to the US (measured in real GDP per capita in constant PPP dollars), most countries in Europe have improved their relative income rankings, especially in emerging Europe and core European countries, while the European periphery has stagnated or fallen behind (Fig. 7.2). All European countries (with Albania at the threshold) were either in the upper-middle-income category (above 20% of the relative US income) or high-income category (over 50% of the relative US income) in 2019.7 Some of the lower-middle-income countries such as Bosnia and Herzegovina, Serbia, and Romania have crossed into upper-middle-income category while others in the upper-middle-income category, such as Estonia, Lithuania, and Poland, have reached high-income status by 2019. Several countries such as Hungary and Latvia have been converging slowly, remaining in the upper-middle-income category. Overall, they have done better than the rest of the emerging world (Fig. 7.2, green dots). Advanced Europe has broadly been closing the gap with the US, but many large countries, like France and the United Kingdom, have experienced growth similar to that of the US. Cyprus, Greece, and Italy have fallen behind, while Ireland, Norway, Luxembourg, and Switzerland have reached income per capita levels that exceed those of the US (literally, they are off the chart in Figure 7.2). Compared to other advanced countries (Fig. 7.2, yellow labels), the European core has been growing relatively well.

Fig. 7.2 The European growth experience, 2000–2019. Source: R. C. Feenstra, R. Inklaar, and M. P. Timmer (2015), “The Next Generation of the Penn World Table”, American Economic Review 105(10): 3150–3182, https://doi.org/10.1257/aer.20130954

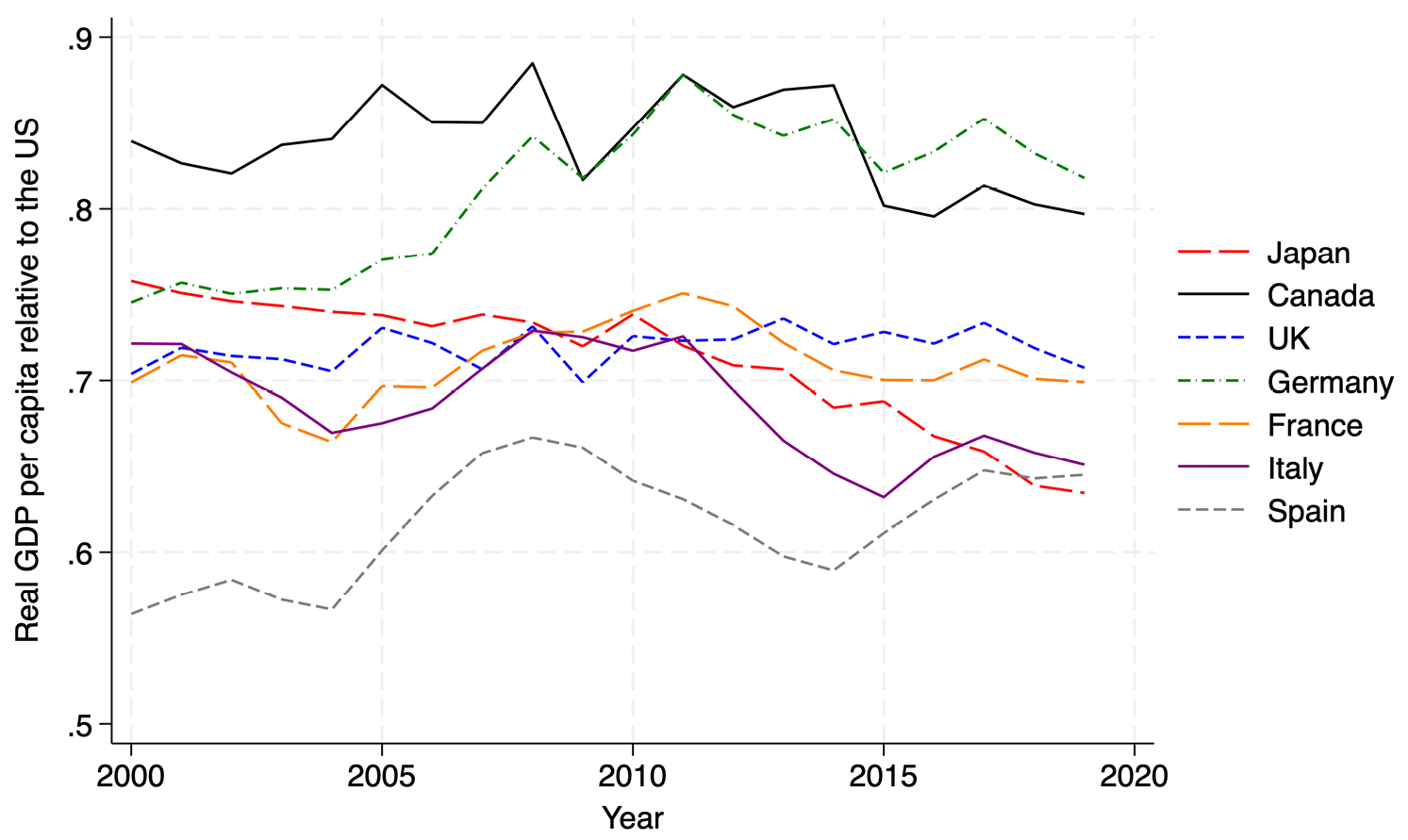

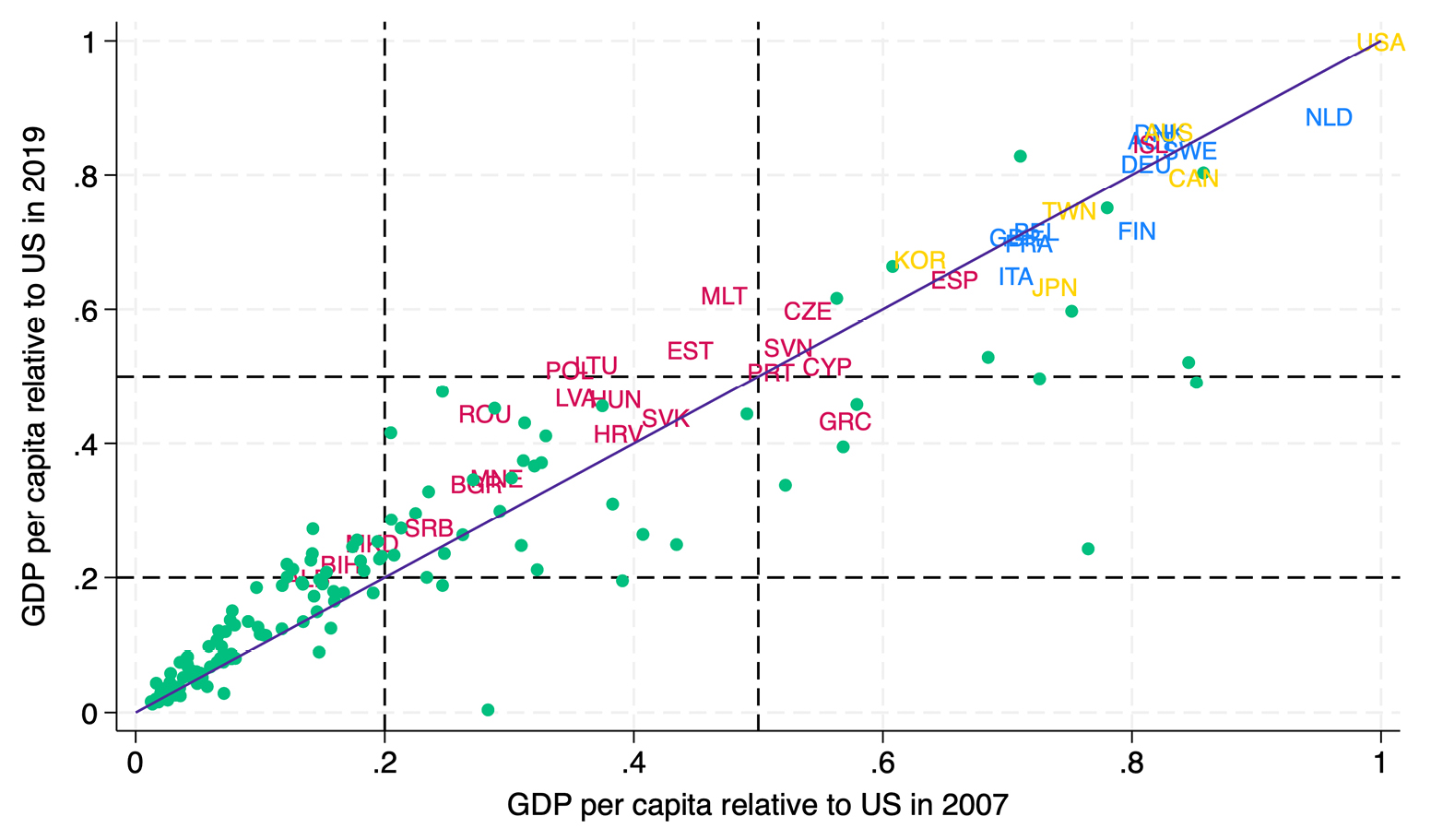

Yet this relatively optimistic picture of European growth becomes much less encouraging after the 2008 Global Financial Crisis. The European periphery in emerging Europe has been catching up but at a much slower rate, while Cyprus, Greece, and Spain have continued to fall behind. The European core countries have stagnated in relative income terms, growing as much as the US, with more countries such as Finland, Italy, and Netherlands falling behind (Figs 7.3 and 7.4). Relative incomes have not increased, including those in Germany and the UK (Fig. 7.3), and more worryingly, total factor productivity (TFP) has been on a declining or sideways trend in many European countries (Fig. 7.5). Germany seems to be an exception as its relative income has stayed the same, but its total factor productivity has grown since the GFC. For countries like Italy and Spain, it was mostly a declining trend with little growth in the late 2010s.

The growth picture becomes clearer in the recent decades when comparing TFP growth in the 2000s before the GFC and in the 2010s (Fig. 7.6). The TFP growth has slowed down almost everywhere and has turned to negative growth in some countries like Finland, Belgium, and Greece. In other countries like Portugal and Spain, TFP growth has become slightly positive, a better outcome compared to the numbers before the GFC, but still suggesting very low TFP growth. Even in Germany where TFP growth has stayed about the same, it is still relatively low, at about average 0.5% per year.8

Fig. 7.3 Relative income for a few countries, 2000–2019. Source: R. C. Feenstra, R. Inklaar, and M. P. Timmer (2015), “The Next Generation of the Penn World Table”, American Economic Review 105(10): 3150–3182, https://doi.org/10.1257/aer.20130954

Fig. 7.4 Relative income, 2007–2019. Source: R. C. Feenstra, R. Inklaar, and M. P. Timmer (2015), “The Next Generation of the Penn World Table”, American Economic Review 105(10): 3150–3182, https://doi.org/10.1257/aer.20130954

Fig. 7.5 Total factor productivity for a few countries, 1990–2019. Source: R. C. Feenstra, R. Inklaar, and M. P. Timmer (2015), “The Next Generation of the Penn World Table”, American Economic Review 105(10): 3150–3182, https://doi.org/10.1257/aer.20130954

Fig. 7.6 Total factor productivity growth, 2000–2007 versus 2011–2019. Source: R. C. Feenstra, R. Inklaar, and M. P. Timmer (2015), “The Next Generation of the Penn World Table”, American Economic Review 105(10): 3150–3182, https://doi.org/10.1257/aer.20130954

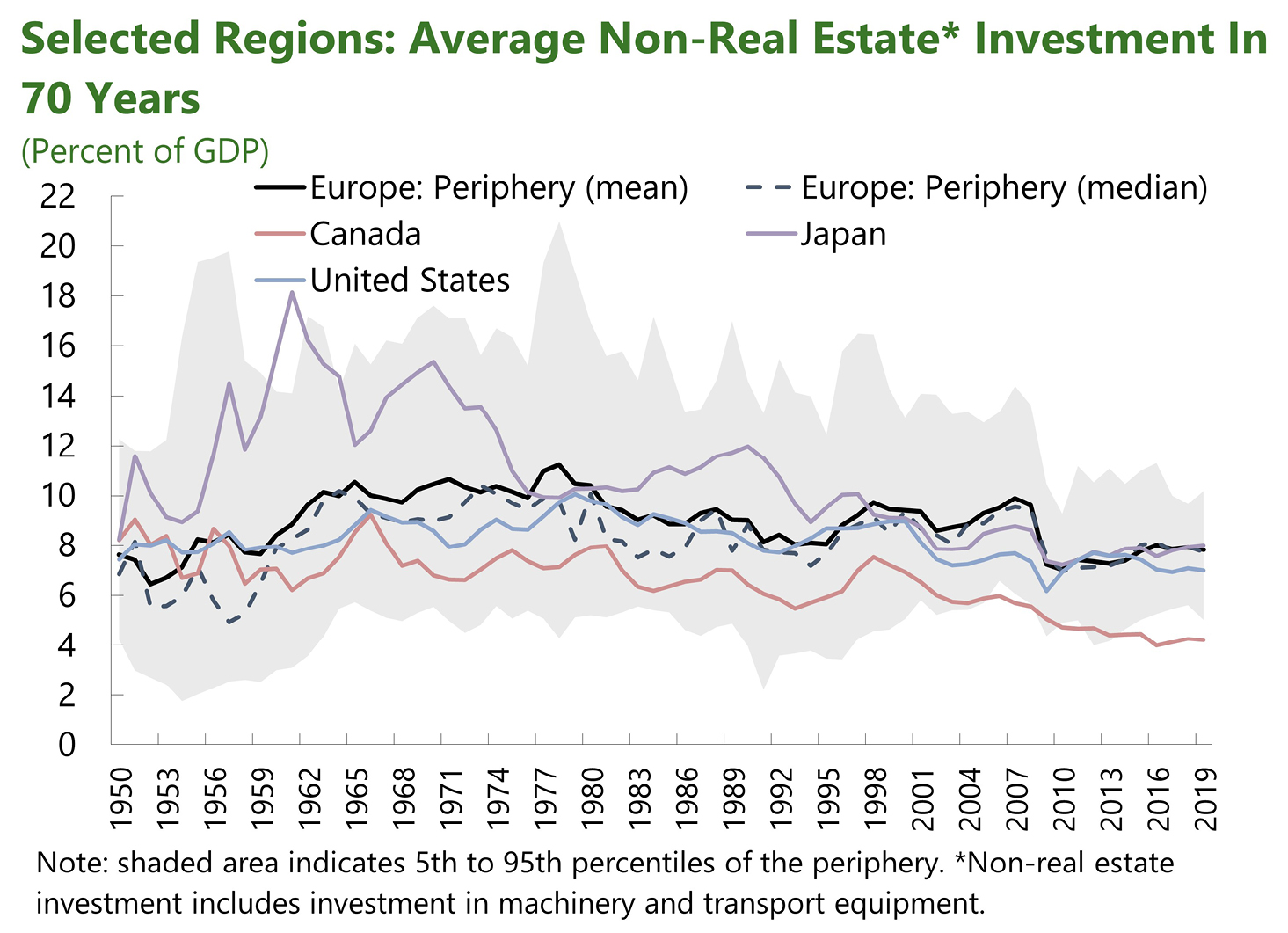

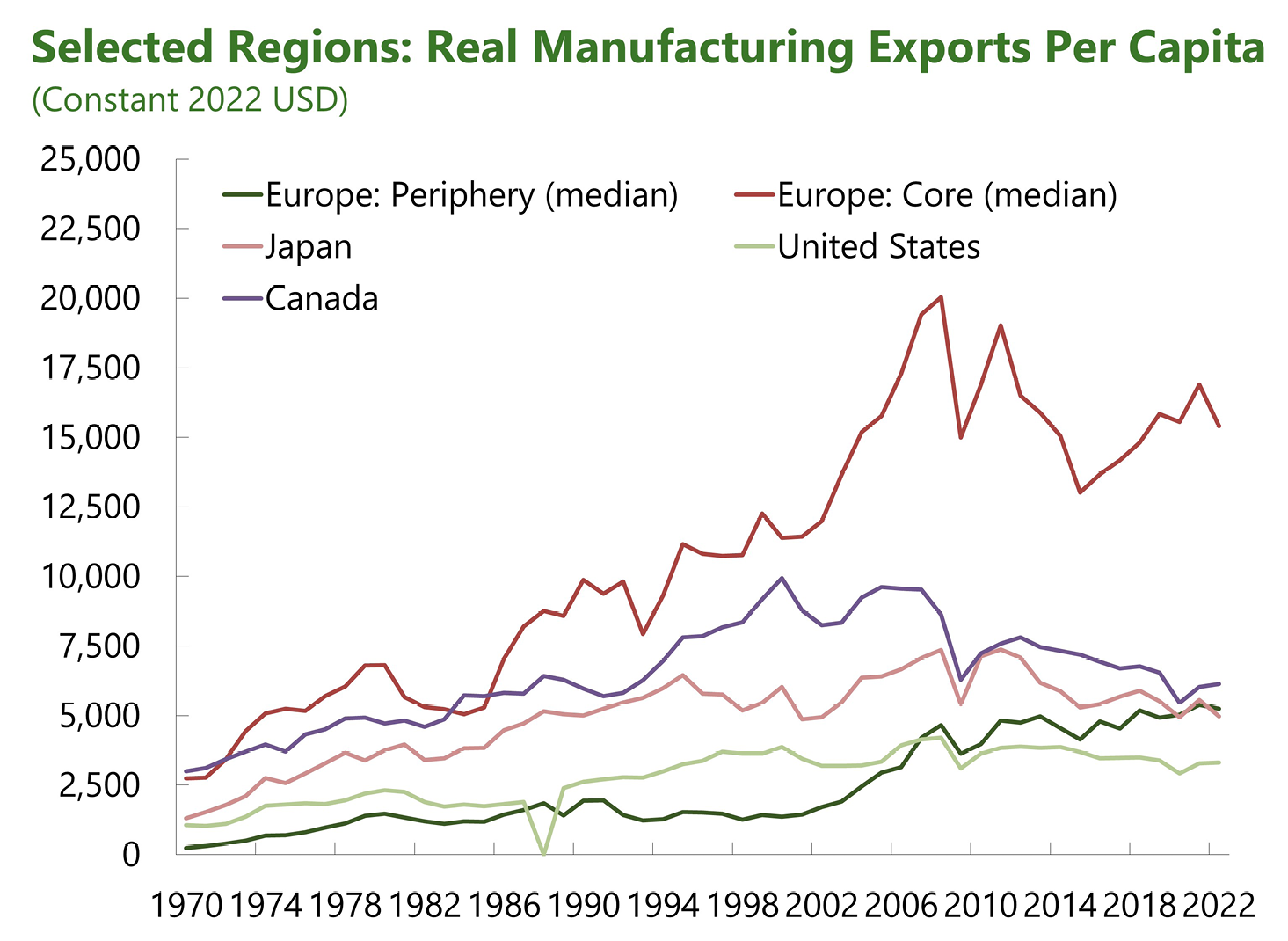

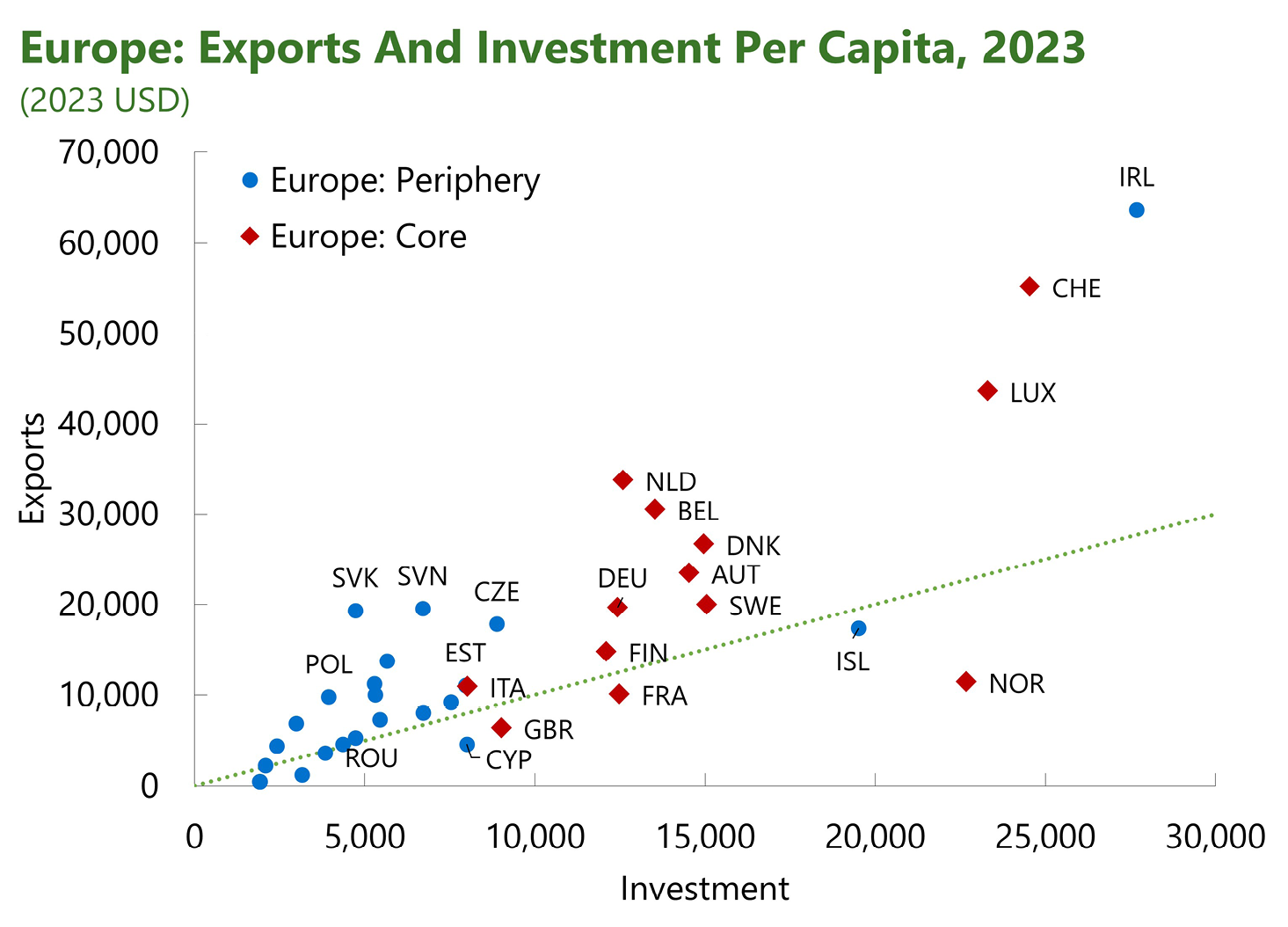

Although investment in machinery and transport has held up generally well, it has fallen since the 2008 GFC while manufacturing exports have not grown much. Both in the core and periphery Europe, investment fell to about 8% of GDP after 2008, as in other advanced countries like the US, although it was already on a declining trend in the European periphery (Fig. 7.7).9 Real manufacturing exports per capita in the European core have been relatively high, about $15,000 per capita, and even the European periphery median investment of about $5000 per capita has been in line with that of other advanced countries. Yet in both European core and periphery, manufacturing exports’ growth seems to have stalled. Total exports per capita exceed investment per capita in many countries, and richer countries have both high investment and exports per capita (Fig. 7.8). In addition, the global export market shares in sophisticated products like electronics, machinery, and vehicles of core European countries has been on a declining trend (Atlas of Economic Complexity 2024).

The striking pattern in the data is the relatively clear clustering of countries within three categories and the high level of dispersion among them. Periphery countries are clustered together and certain core countries are inching toward the periphery (e.g., Italy and Great Britain)—“main” core—while “advanced” core (e.g., Luxembourg and Switzerland) is clearly further away from the rest. On average, main and advanced core economies invest and export about two to three times, and five to seven times, respectively, more than the periphery economies. Meanwhile, some core European countries like Italy and the UK have relatively low investment and exports per capita, closer to those in the European periphery. Incidentally, these are the core economies that have been losing ground in terms of relative income and productivity.

Fig. 7.7 Investment in machinery and transport equipment, 1950–2019, in (a) the core (above); (b) the periphery (below). Source: R. C. Feenstra, R. Inklaar, and M. P. Timmer (2015), “The Next Generation of the Penn World Table”, American Economic Review 105(10): 3150–3182, https://doi.org/10.1257/aer.20130954. Note: shaded area indicates 5th to 95th percentiles of the core.

Fig. 7.8 Manufacturing exports and investment in (a) selected regions (constant 2022 USD) (above); (b) Europe (2023 USD) (below). Source: World Bank’s World Development Indicators database and IMF’s World Economic Outlook database. Note: the dotted line in (b) is a 45-degree line.

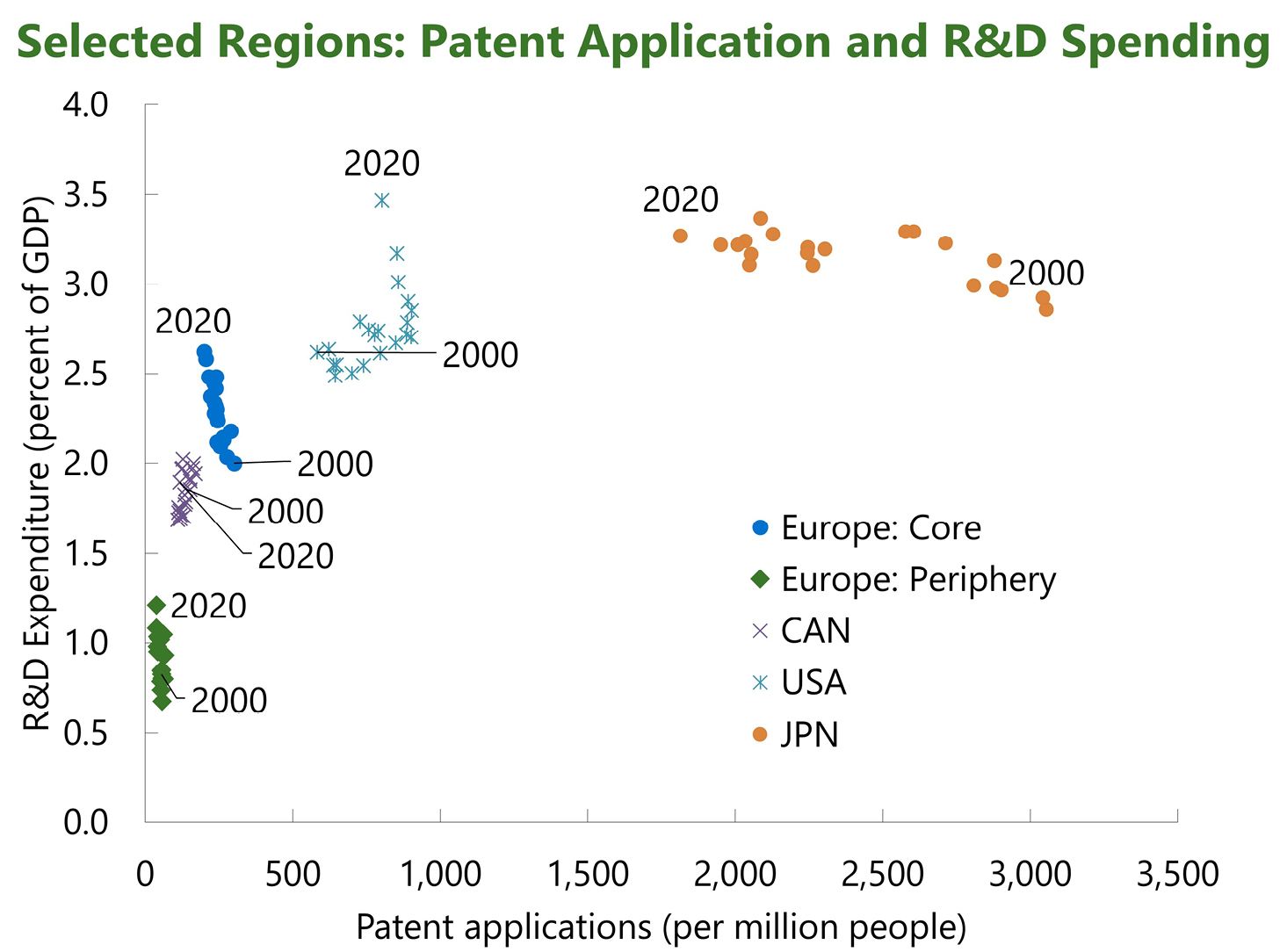

Fig. 7.9 Innovation in Europe: (a) patent application and R&D spending (above); (b) researchers in R&D and R&D spending (2000–2020) (below). Source: Our World in Data (2024) (data adapted from World Bank, United Nations) and World Bank’s World Development Indicators database.

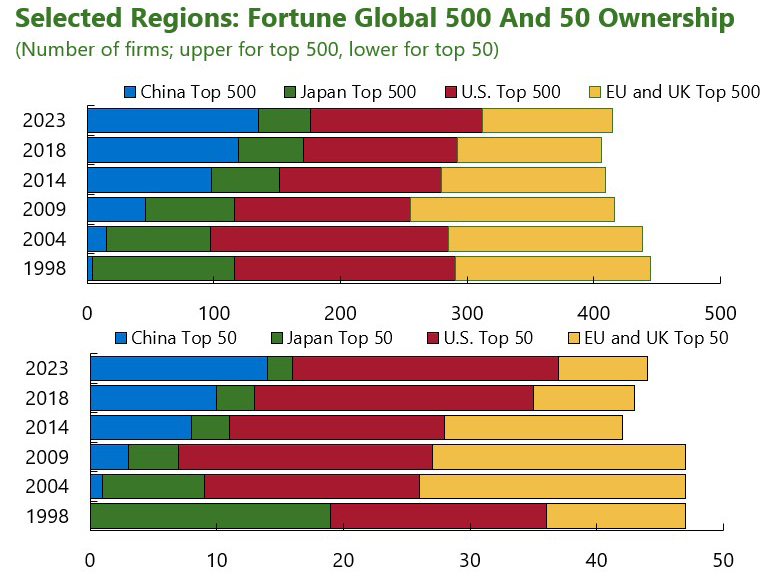

Fig. 7.10 Fortune Global 500. (a) Selected regions: Fortune Global 500 and 50 ownership (above); (b) EU and UK: Fortune Global 50 firm primary industry (below). Source: Fortune and S&P Capital IQ.

Lastly, more importantly, innovation indicators in Europe have largely been lagging behind those of the US and other top innovators, and large firms have been losing ground globally, which would have a negative effect on sophisticated sectors. The core Europe increased its R&D spending to about 2.5% of GDP by 2020 from 2% of GDP in 2000, still below the levels of the US and Japan, about 3.5% of GDP (Fig. 7.9). Bergeaud (2024) stresses the lower level of private R&D in Europe than in the US. This spending is mostly directed at mid-tech sectors such as automotive and chemicals, rather than high-tech sectors such as ICT and biotech, as in the US (Bergeaud 2024; Fuest et al. 2024). In addition, patent applications per capita, despite about the same number of researchers per capita as in the US and Canada, are much lower in Europe than in the US and are more comparable to that in Canada. The levels in the European periphery are much lower across various innovation indicators.

The sharp decline in the global standing of European firms is evident in their relative rankings in Fortune Global 500. In 1995, Europe had 153 firms on the list, but by 2023, that number had dropped to 103—a loss of 50 firms, less than Japan’s decline (Fig. 7.10). The US lost only 18 firms, ending up with 136, while China gained ground substantially, increasing from just 3 firms to 135 by 2023. In addition, fewer than 10 European firms now rank among the global top 50, and most are in traditional manufacturing sectors rather than high-technology sectors (Fig. 7.10). This is consistent with the comparison of the US and European firms in terms of patents and R&D. In Europe, the top firms have broadly stayed the same since 2000 (mostly in chemicals, mobile communications, consumer electronics, and automotive) while in the US, they have changed substantially, moving from mid-tech to high-tech sectors such as software and advanced electronics (Bergeaud 2024; Fuest et al. 2024).

7.4 Technology and Innovation Policy—A TIP from the Asian Miracles and from Europe’s Past

The sustained high growth of the Asian economic miracles, along with Europe’s past successes, offer lessons for tackling growth and productivity challenges currently facing Europe. In particular, given declining export market shares in advanced products and the loss of global rankings of European firms, the creation and growth of sophisticated sectors should not be ignored. Indeed, Korea’s experience, for example, is relevant for Europe’s periphery where convergence has slowed down after 2008. The emergence of Korean and Taiwanese global players in high-tech sectors where they a priori had no prior experience (and even less “comparative advantage”) is also instructive for European countries losing ground in the global top firm ranks. The experience of European economies, at the national level and through European-wide initiatives, as illustrated in the case studies, can help draw a path forward.

The key lessons from the Asian miracles can be summarized as follows: (i) a multifaceted state strategy that goes beyond traditional tools like tariffs/subsidies, to develop sophisticated, R&D-intensive industries; (ii) export, export, export: that is, an emphasis on export orientation and global markets; and (iii) the enforcement of accountability, even when the support received is indirect (e.g., collaboration programs with public research institutes or access to specialized infrastructure), along with fostering competition among firms (Cherif and Hasanov 2019a, 2019b). Spurring the creation and growth of firms in sophisticated industries is crucial. Export orientation should be key to increasing the scale and scope of industries and invigorating international competition. Providing support to these industries, rather than to particular firms, with clear conditions and progress monitoring in place, would increase the likelihood of success.

First, for the state to intervene in the economy, the focus on sophisticated sectors is key because this is where market failures are the most acute. These are high R&D-intensive sectors, which are largely advanced manufacturing and scientific and information technology services, most of which are linked to manufacturing (Cherif and Hasanov 2019a, 2019b). These sectors are riddled with market failures, and without state intervention, these sectors either do not exist or have low investment, R&D, and production. These sophisticated industries need to be selected. Various strategies such as quick wins and transformative strategies like leapfrogging and moonshots need to be pursued (Cherif, Hasanov, and Sarsenbayev 2024). Seizing opportunities in the existing industries such as automotive, aerospace, machinery, electronics, pharmaceuticals, and renewables could be quick wins with a focus on the short-term horizon, while the industries of the future like quantum computing, artificial intelligence (AI), and advanced cleantech and electronics would require leapfrogging and moonshot approaches, implying a longer horizon with substantial innovation and production support. This support does not imply protecting incumbent firms or outdated technologies like the internal combustion engine; rather, it is about providing support to build on new and emerging technologies like EVs.10

Second, export performance with a focus on global markets should be an important goal, and one at the heart of the accountability framework for firms receiving state support. This is a key insight from the Asian miracles, and the experience of European economies, and a defining difference between their successful industrial policies and the doomed import-substitution industrialization attempts of the 1970s and 1980s elsewhere (Cherif and Hasanov 2024). Competing with the best in the international markets requires improving cost competitiveness and efficiency and investing in product development and innovation from the onset. Competition in external markets provides the right incentives for firms to step up their game fast.11 At the state level, export orientation would naturally entail exploring the European market, especially for periphery economies. It could be accomplished by supplying producers of sophisticated products or producing finished products. The European value chain network has supported the income convergence and could still be the key vehicle driving growth in the periphery. Yet one of the difficulties for the European periphery, especially in the eurozone, is the potential return of the “Dutch disease,” as it is difficult to entice firms in the periphery to compete with firms in the core economies in sophisticated sectors when low-skilled service jobs are available (e.g., tourism), the dominant pattern before the 2008 GFC.

Third, the state support should only be provided with clear accountability signals. Export market performance serves as one of these market signals, as gaining global market shares allows the state to gauge performance and progress, as was the case in the Asian miracles. Domestic competition is another important element of the accountability framework. Supporting industries as a whole, rather than individual firms, is crucial because it is unclear which specific firm will succeed (Aghion 2016). Moreover, the industry support allows the state to redirect resources from laggards to frontier firms, thus ensuring the survival of the industry rather than propping up a failing firm. As firms fail, human and capital resources would not disappear, but rather would most likely move to other firms in the same industry, raising the chances of success (Ali-Yrkko et al. 2021). Supporting firm entry rather than only directing resources to incumbents is as important to the development of the industry in the global arena.

Europe already has in place most of the tools implemented in the Asian miracles, including business support and competition rules, skill training, financing, R&D support, and research and industry clusters, to be used for the creation and growth of sophisticated sectors. The single market provides technology standards, common rules, and favourable business environment as more work is underway to improve its workings (IMF 2024a, 2024b; Letta 2024; and Arnold, Claveres, and Frie 2024). Tackling market failures in sophisticated sectors, where firms may hesitate to enter or may underinvest, requires redirecting existing support tools toward these industries. Many countries already offer R&D grants and tax credits, while top research universities and public research institutes engage in a range of basic and applied research. Industry clusters further promote applied research and production. Commercialization of the technology is an important stage of TIP, and financing is key. Various investment and innovation schemes exist either via European institutions like the European Investment Bank (EIB) or the European Innovation Fund (EIF) or national development banks like Germany’s KfW. There are ongoing discussions about creating breakthrough innovation initiatives similar to the US’s Defense Advanced Research Projects Agency (DARPA).

Correcting market failures that prevent the development of sophisticated sectors must be at the top of government priorities:12 this involves identifying or creating an adequate institutional apparatus where the highest levels of the government frequently monitor the progress and coordination of all stakeholders. This should be done through a high-level representation of all relevant stakeholders for the sophisticated sector(s) targeted (e.g., education, infrastructure, regulation, trade).13 Following in the footsteps of the Asian miracles, it would also require acquiring (or often reacquiring) technical capabilities within government institutions to be able to collaborate, monitor, and receive feedback from the firms in a way that is impartial and independent from political interference—that is, “embedded autonomy” as outlined by Evans (1995). In addition, on the European level, an agency like the European Commission (EC) needs to coordinate policies and support across all countries, ensuring the flow of information, knowledge, and supporting tools. This approach, as exemplified by the EU Chips Act for the semiconductor industry, aims to tackle coordination and information failures.

All-in-all, at the European level, there are several ways to apply the principles of TIP. European policies and regulations could distinguish between the periphery and core, allowing for adjustments to competition and regulation policies that take into account the need for the periphery to catch up, especially in terms of exports of sophisticated products. Given the technological gap between core and periphery and the long time required to catch up, such a distinction is unlikely to alter or “distort” the single market and would eventually reinforce it. A particular emphasis could be placed on creating or extending value chains connecting the periphery to the core in sophisticated/complex industries. In parallel, as argued earlier, core Europe is facing the challenge of accelerated disruptions, including in industries where they have had a dominant position for decades, such as automotive and renewables. Far from trying to protect dying industries, policies applying existing business support tools could help incumbents pivot to more innovative products or industries while encouraging the creation and growth of new entrants. In other words, policies should also aim to create new firms in sophisticated industries—similar to the emergence of Tesla, challenging established auto firms back in the 2010s.

In practice, the following broad economic issues could be considered for a TIP in Europe:

First, a redeployment of European support tools toward the development of sophisticated industries,14 not only for innovation but also for production and diffusion to reach economies of scale and support knowledge spillovers, is in order. This implies spending differently and potentially spending more. For example, since its inception and until 2023, agricultural subsidies represented the largest share of the European budget (about a third on average), and it is more unequally distributed to favour large firms over small farmers (Aghion, Cherif, and Hasanov 2022). Meanwhile, agriculture represents a small fraction of employment, on average about 1%, and contributes marginally to R&D expenditure and productivity gains, which potentially redirected financing could support, promoting innovation and technology deployment and diffusion, solving market failures of inadequate access to finance and technological uncertainties. While increased spending may lead to a rising deficit and public debt in the short run—a potential challenge when these are already relatively high—the potential for higher productivity growth in the medium to long run, driven by sophisticated sectors and their spillover effects on other industries, could make this a worthwhile trade-off. Growth is one of the most significant drivers of public debt dynamics (Cherif and Hasanov 2018). In addition, the accountability framework and governance structure of the state support to industries and firms are key to the successful implementation of the policy and need to be designed correctly with the emphasis on a few critical elements: “embedded autonomy” of the institution, clear market signals from firms receiving support (e.g., exports, innovation, and global market shares), strong domestic competition, and the withdrawal of support if market signal criteria are not met.

The redeployment of resources could not only involve fiscal policy but also use various public investment vehicles to catalyze private finance. EIB, EIF, national development banks, and other institutions are key to derisking private investment and innovation spending (Mazzucato 2013). Funds of funds are needed to provide more directed funding to venture capitalists (VCs), enabling them to invest in these sophisticated sectors to create and grow startups. Next, commercial banks, pension funds, insurance companies, and other financial intermediaries could be given incentives to provide necessary funding for scaleups (Arnold, Claveres, and Frie 2024). In brief, the whole innovation chain needs to be provided with adequate financing to succeed.

What is important for productivity gains and growth is not only innovation but also manufacturing with a focus on the portfolio approach, which we call “the state as a venture capitalist”. This approach implies that the state programs have to take a portfolio view in providing support to industries and firms just like VCs take a portfolio view in their investments. For instance, a financing program acting as a catalyst alongside traditional private investors for scaleups would be evaluated at a program or portfolio level. This evaluation would compare the benefits obtained from loans to successful companies like Tesla with losses of failed ventures like Solyndra. In addition, as innovation produces designs and prototypes and employs highly skilled workers, it may not be sufficient for a broad-based inclusive growth, reaching out to many regions and different types of workers. Manufacturing of these newly developed advanced goods and products is important for spillovers and feedback loops in and across industries. This approach is part of a broader competition policy needed to create a flow of new entrants into the markets that innovate and produce, a key feature of the Schumpeterian growth paradigm. Whether for innovation or manufacturing, as support is given to firms, flexible rather than rigid accountability frameworks focused on principles rather than prescribed rules for all possibilities would allow adaptation and pivoting as circumstances change. It is “the state as a venture capitalist” approach to supporting industries that allows flexibility with a focus on an industry or a set of industries with various policy tools, including financing programs, skill training, regulatory and legal overhaul, and the provision of purpose-specific infrastructure. While it is impossible to identify ex ante which specific firms will succeed, it is feasible to select winning sophisticated industries as a portfolio (Adler 2021). This can be achieved by implementing the right set of policy tools and accountability frameworks.

Second, a better coordination of policy tools and stakeholders, including financing vehicles, universities, and public research institutes, across countries would facilitate the formulation of a coherent strategy. Drawing from the experience of Nokia in the 1980s and 1990s, a coordination of European policies would help identify technologies of the future, create European technology standards (such as GSM), ensure close collaboration with the private sector when setting up standards, and finally leverage procurement to spur innovation. This approach could be spearheaded by the EC at the European level while national agencies or ministries could be focused on the country’s progress.

Third, while the European market is one of the largest in the world, and the benefit of geographic proximity gives a natural advantage to intra-European trade, the experience of the last decade (e.g., chips, Nokia, and EVs) has shown that for sophisticated industries, the markets are global. In other words, policies should aim at achieving international competitiveness rather than protecting incumbents in their domestic or regional markets. Tariffs, for example, do not necessarily provide an incentive to attain cost competitiveness and may only delay the inevitable demise of the industry (Cherif and Hasanov 2024). Rather, the focus on exports and global markets to compete with the best, continuously innovating on a product level and manufacturing processes, is the path to success.

7.5 Concluding Remarks

The European integration showed broadly impressive results up to the 2008 GFC, with the periphery catching up rapidly with the core, while the core was catching up with the US. However, the initial growth models, with relatively low levels of exports of sophisticated products in the periphery and low R&D investment in most of Europe, showed their limits in the post-GFC era. The rate of convergence of the periphery slowed down dramatically, while some large core economies stagnated. Moreover, in the core economies, the spectre of disruption from international competitors looms large. The cases of Nokia, the semiconductor industry in Europe, or the EV industry in the 2020s illustrate this challenge well. This is confirmed by the secular decline in the number of European firms appearing in the top rankings of global firms, especially in sophisticated and high-tech industries.

One can distil lessons from the growth experience of the Asian miracles and the European growth experience to explore growth strategies in Europe. It comprises following three simple principles: steering resources toward correcting market failures to support the development of sophisticated industries; emphasizing exports and global markets; and enforcing competition and accountability. In practice, it means a reappraisal of the approach toward sophisticated sectors to help spur more technology creation in the periphery and the core, produce newly developed goods and services, and connect supply chains in sophisticated industries. Far from the caricatural “hard” industrial policy tools of the past (e.g., tariffs and unconditional subsidies), this effort requires policy tailored to correcting market failures, as part of a holistic approach (e.g., purpose-specific investment and regulation), a continuous market feedback, flexibility, and a tolerance for risk-taking. This approach should lead to an increase in R&D expenditure, which ultimately produces more innovation and advanced manufacturing, resulting in higher productivity and income growth.

At this critical juncture, Europe would benefit from a strong coordination among states and a reorientation of policy tools to spur dynamism and competition in sophisticated industries to keep creating new champions, capable of competing internationally and reaching the list of top global firms.

References

Adler, D. (2021) “Inside Operation Warp Speed: A New Model for Industrial Policy”, American Affairs V(2): 3–32, https://americanaffairsjournal.org/2021/05/inside-operation-warp-speed-a-new-model-for-industrial-policy/

Aghion, P. (2016) “Growth Policy Design for Middle-Income Countries”, in R. Cherif, F. Hasanov, and M. Zhu (eds), Breaking the Oil Spell: The Gulf Falcons’ Path to Diversification. Washington, DC: International Monetary Fund, pp. 117–130.

Aghion, P., R. Cherif, and F. Hasanov (2022) “Competition and Innovation”, in V. Cerra, B. Eichengreen, A. El-Ganainy, and M. Schindler (eds), How To Achieve Inclusive Growth. Oxford: Oxford University Press, pp. 212–237.

Arnold, N., G. Claveres, and J. Frie (2024) “Stepping Up Venture Capital to Finance Innovation in Europe”, IMF Working Paper 24/146.

Atlas of Economic Complexity, The (2024) Harvard University, Growth Lab, https://atlas.cid.harvard.edu.

Bergeaud, A. (2024) “The Past, Present, and Future of European Productivity”, Working Paper, ECB Forum on Central Banking, July 1–3, https://www.ecb.europa.eu/pub/pdf/

sintra/ecb.forumcentbankpub2024_Bergeaud_paper.en.pdf

Ali-Yrkkö, J., R. Cherif, F. Hasanov, N. Kuosmanen, and M. Pajarinen (2021) “Knowledge Spillovers from Superstar Tech-Firms: The Case of Nokia”, IMF Working Paper 2021/258, https://www.imf.org/en/Publications/WP/Issues/2021/10/29/Knowledge-Spillovers-From-Superstar-Tech-Firms-The-Case-of-Nokia-501347

Cherif, R., and F. Hasanov (2018) “Public Debt Dynamics: The Effects of Austerity, Inflation, and Growth Shocks”, Empirical Economics 54(3): 1087–1105.

Cherif, R., and F. Hasanov (2019a) “Return of the Policy That Shall Not Be Named: Principles of Industrial Policy”, IMF Working Paper 2019/74, https://www.imf.org/en/Publications/WP/Issues/2019/03/26/The-Return-of-the-Policy-That-Shall-Not-Be-Named-Principles-of-Industrial-Policy-46710

Cherif, R., and F. Hasanov (2019b) “Principles of True Industrial Policy”, Journal of Globalization and Development 10(1): 1–22.

Cherif, R., and F. Hasanov (2019c) “The Leap of the Tiger: Escaping the Middle‐income Trap to the Technological Frontier”, Global Policy 10(4): 497–511.

Cherif, R., and F. Hasanov (2024) “The Pitfalls of Protectionism: Import Substitution vs. Export-Oriented Industrial Policy”, Journal of Industry, Competition and Trade 24(1): 1–34.

Cherif, R., F. Hasanov, and A. Pande (2017) “Riding the Energy Transition: Oil Beyond 2040”, IMF Working Paper 2017/120, https://www.imf.org/en/Publications/WP/Issues/2017/05/22/Riding-the-Energy-Transition-Oil-Beyond-2040-44932

Cherif, R., F. Hasanov, and A. Pande (2021) “Riding the Energy Transition: Oil beyond 2040”, Asian Economic Policy Review 16(1): 117–137.

Cherif, R., F. Hasanov, and M. Sarsenbayev (2024) “Call of Duty: Industrial Policy for Post-Oil Era”, IMF Working Paper 2024/74. https://www.imf.org/en/Publications/WP/Issues/2024/03/29/Call-of-Duty-Industrial-Policy-for-the-Post-Oil-Era-546941

Cherif, R., F. Hasanov, and P. Aghion (2023) “Fair and Inclusive Markets: Why Dynamism Matters”, IMF Working Paper 2021/29, https://www.imf.org/en/Publications/WP/Issues/2021/02/06/Fair-and-Inclusive-Markets-Why-Dynamism-Matters-50052

Cherif, R., F. Hasanov, and M. Zhu (2021) “The Electric Vehicle Revolution Goes Global”, August 30, Project Syndicate, https://www.project-syndicate.org/commentary/electirc-vehicles-in-developing-and-emerging-economies-by-reda-cherif-et-al-2021-08

Draghi, M. (2024a) “Radical Change—Is What Is Needed”, Speech at the High-level Conference on the European Pillar of Social Rights, Brussels, April 16, https://geopolitique.eu/en/2024/04/16/radical-change-is-what-is-needed/

Draghi, M. (2024b) The Future of European Competitiveness. Brussels: European Commission, https://commission.europa.eu/document/download/97e481fd-2dc3-412d-be4c-f152a8232961_en

Duchatel, M. (2022) “Semiconductors in Europe: The Return of Industrial Policy” Institut Montaigne, Policy Paper, https://www.institutmontaigne.org/ressources/pdfs/publications/europe-new-geopolitics-technology-1.pdf

European Commission (2024) “Euro Area Competitiveness: Opportunities and Value Added of a European Industrial Policy. A Note to the Eurogroup for June 20, 2024 Meeting”, https://www.consilium.europa.eu/media/dfcjg0yd/com-note-ea-competitiveness-industrial-policy.pdf

Evans, P. (1995) Embedded Autonomy: States and Industrial Transformation. Princeton, NJ: Princeton University Press.

Fortune (1998) “The World’s Largest Corporations”, 138(3): F1–F10.

Fortune (2010) “Global 500”, 162(2): 153–F7.

Fortune (2015) “Global 500”, 172(2): F1–F6.

Fuest, C., D. Gros, P. Mengel, G. Presidente, and J. Tirole (2024) “How to Escape the Middle Technology Trap”, EconPol Policy Report, April, https://www.econpol.eu/publications/policy_report/eu-innovation-policy-how-to-escape-the-middle-technology-trap

Heimer, M. (2019) “The List”, Fortune 180(2): 122–118.

Heimer, M. (2023) “The List”, Fortune 188(1): F1–F6.

Hjelt, P. (2004) “The Fortune Global 500”, Fortune 150(2): 159–186.

Hodge, A., R. Piazza, F. Hasanov, X. Li, M. Vaziri, A. Weller, and Y. C. Wong (forthcoming) “Industrial Policy in Europe: A Single Market Perspective”, IMF Working Paper.

Huggins, R., A. Johnston, M. Munday, and C. Xu (2023) “Competition, Open Innovation, and Growth Challenges in the Semiconductor Industry: The Case of Europe’s Clusters”, Science and Public Policy 50: 531–547.

IMF (2024a) “Euro Area Policies—2024 Annual Consultation”, IMF Country Report 24/248, https://www.imf.org/en/Publications/CR/Issues/2024/07/29/Euro-Area-Policies-2024-Annual-Consultation-Press-Release-Staff-Report-and-Statement-by-the-552578

IMF (2024b) “Soft Landing in Crosswinds for a Lasting Recovery”, IMF Regional Economic Outlook, April, https://www.imf.org/en/Publications/REO/EU/Issues/2024/04/05/regional-economic-outlook-europe-april-2024

Kleinhans, J.-P. (2024) “The Missing Strategy in Europe’s Chip Ambitions”, July, interface, https://www.interface-eu.org/publications/europe-semiconductor-strategy

Kleinhans, J.-P., and N. Baisakova (2020) “The Global Semiconductor Value Chain: A Technology Primer for Policymakers”, October, Stiftung Neue Verantwortung Policy Paper.

Letta, E. (2024) Much More Than a Market, https://www.consilium.europa.eu/media/ny3j24sm/much-more-than-a-market-report-by-enrico-letta.pdf

Mazzucato, M. (2013) The Entrepreneurial State: Debunking Public vs. Private Sector Myths. New York: Public Affairs.

Pisano, G., and W. Shih (2012) Producing Prosperity: Why America Needs a Manufacturing Renaissance. Cambridge, MA: Harvard Business Review Press.

SIA (2024) “Semiconductor Industry Association Factbook”, SIA, https://www.semiconductors.org/resources/factbook/

Stiglitz, J. E., and B. C. Greenwald (2014) Creating a Learning Society: A New Approach to Growth, Development, and Social Progress. New York: Columbia University Press. https://doi.org/10.7312/stig15214

1 The views expressed are those of the authors and do not necessarily represent the views of the International Monetary Fund (IMF), its Executive Board, or IMF management. We would like to thank the editors Floriana Cerniglia and Francesco Saraceno and IMF colleagues at the European Department, in particular, Helge Berger, Luis Brandao Marques, Stephan Danninger, Manuela Goretti, Gavin Gray, Andrew Hodge, Malhar Nabar, Roberto Piazza, and Hasan Toprak as well as Riccardo Ercoli and Annalisa Korinthios for helpful comments and suggestions. All errors are our own.

2 IMF, Bennett Institute for Public Policy (University of Cambridge), and Technology and Industrialization for Development Centre (University of Oxford).

3 IMF, Georgetown University, Bennett Institute for Public Policy (University of Cambridge), and Technology and Industrialization for Development Centre (University of Oxford).

4 IMF.

5 See Stiglitz and Greenwald (2014).

6 By doing so, the government addressed the market failure of inadequate financing for innovation.

7 See Cherif and Hasanov (2019c) for a discussion of the middle-income trap and the income thresholds.

8 The TFP data for the euro area and the UK through 2022 suggest that the gap with the US has not improved (Bergeaud 2024).

9 Total investment is a bit above 20% of GDP on average in both European core and periphery.

10 See Cherif and Hasanov (2024) on the pitfalls of protectionism, who argue that protectionist policies may not help industries survive in the long run.

11 As economic pie is not fixed and trade is not necessarily a zero-sum game, a focus on exports without protectionism should not create a beggar-thy-neighbour environment and retaliation (Cherif and Hasanov 2024).

12 The lack or underdevelopment of sophisticated sectors stems from a myriad of market failures, requiring policy tools to address them.

13 For example, biotech would require coordinating with the Ministry of Health.

14 See footnote 13.